GE 2014 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2014 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256

|

|

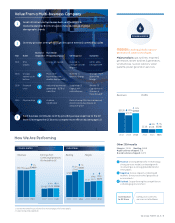

2016 OPERATING EPS GOAL

75%

INDUSTRIAL

How We’ve Made Purposeful Portfolio Moves

Over the past decade, we have repositioned GE as a more focused, high-value industrial company. This includes making

major investments to strengthen our infrastructure portfolio, substantially reducing our fi nancial services businesses & selling

businesses in which we lack competitive advantages.

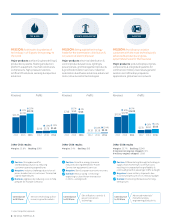

MAJOR PORTFOLIO CHANGES SINCE 2001

POWER & WATER

Rebuilt & diversifi ed business after the power

bubble to include Distributed Power, Water & Wind

• Enron wind assets

• Multiple water assets

• Jenbacher Gas Engines

• Alstom announced1

OIL & GAS

Built a competitive & diverse franchise

• Vetco Gray

• Hydril

• Dresser

• Wood Group Well Support

• Wellstream

• Lufkin

HEALTHCARE

Broadened Healthcare diagnostics franchise

beyond U.S. diagnostic imaging to include Life

Sciences & Healthcare IT

• Amersham

• Instrumentarium

• IDX/Healthcare IT

AVIATION

Expanded profi t pools for the business through

acquisitions focused on systems & supply chain

• Smiths Aerospace

• Avio

ENERGY MANAGEMENT

Added scale to the business

• Converteam

• Alstom announced1

STRONGER & SMALLER GE CAPITAL

MEDIA

Reposition NBC Universal & divest at

a good return

• Sold NBC Universal to Comcast

PLASTICS, SILICONES & SECURITY

Sell industrial businesses that do not fi t

GE’s core infrastructure platform

• Sold Plastics to Sabic

• Sold Silicones to Apollo

• Sold Security to United Technologies

APPLIANCES

Exit as it does not fi t GE’s core

infrastructure platform

• Announced sale of Appliances to Electrolux1

INSURANCE

Sell insurance before the storm to

reduce risk

• Completed staged exit of Genworth Financial

• Sold Reinsurance to Swiss Re

• Sold FGIC to Blackstone

CONSUMER FINANCE

Exit as it lacks GE competitive advantage

• Completed IPO of Synchrony Financial &

expect to split-off remaining interest1

• Exited Nordic & Swiss consumer fi nance

businesses & announced sale of Hungary

consumer fi nance business1

1

2

3

4

5

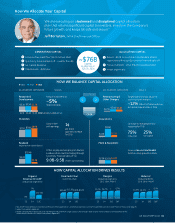

INVESTMENTS DISPOSITIONS

Ending net investment (ex. liquidity)2

Long-term debt outstanding

Commercial paper

Cash & liquidity

Tier 1 common ratio — Basel 1 (estimated)2

Adjusted debt:equity ratio2

1. Subject to regulatory approvals.

2. Non-GAAP Financial Measure. See Financial Measures That Supplement U.S. Generally Accepted Accounting Principles Measures (Non-GAAP Financial Measures) on page 94.

2008 2014

$513B

$381B

$72B

$37B

4.7%

8.95:1

$363B

$207B

$25B

$76B

12.7%

3.15:1

STRONGER

IN 2014

25%

FINANCIAL SERVICES

GE only in businesses

that connect to our core

competencies

14 GE 2014 FORM 10-K