GE 2014 Annual Report Download - page 231

Download and view the complete annual report

Please find page 231 of the 2014 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GE 2014 FORM 10-K 211

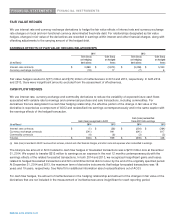

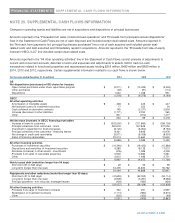

FINANCIAL STATEMENTS SUPPLEMENTAL CASH FLOWS INFORMATION

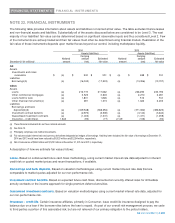

NOTE 25. SUPPLEMENTAL CASH FLOWS INFORMATION

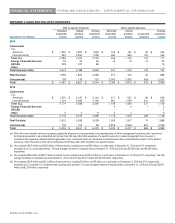

Changes in operating assets and liabilities are net of acquisitions and dispositions of principal businesses.

Amounts reported in the “Proceeds from sales of discontinued operations” and “Proceeds from principal business dispositions”

lines in the Statement of Cash Flows are net of cash disposed and included certain deal-related costs. Amounts reported in

the “Net cash from (payments for) principal businesses purchased” line is net of cash acquired and included certain deal-

related costs and debt assumed and immediately repaid in acquisitions. Amounts reported in the “Proceeds from sale of equity

interest in NBCU LLC” line included certain deal-related costs.

Amounts reported in the “All other operating activities” line in the Statement of Cash Flows consist primarily of adjustments to

current and noncurrent accruals, deferrals of costs and expenses and adjustments to assets. GECC had non-cash

transactions related to foreclosed properties and repossessed assets totaling $218 million, $482 million and $839 million in

2014, 2013 and 2012, respectively. Certain supplemental information related to our cash flows is shown below.

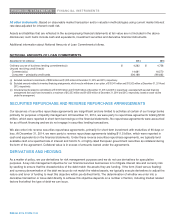

For the years ended December 31 (In millions) 2014 2013 2012

GE

Net dis

p

ositions (

p

urchases) of GE shares for treasur

y

O

p

en market

p

urchases under share re

p

urchase

p

ro

g

ram $

(

2,211

)

$

(

10,225

)

$

(

5,005

)

Other

p

urchases

(

49

)

(

91

)

(

110

)

Dis

p

ositions 1,042 1,038 951

$

(

1

,

218

)

$

(

9

,

278

)

$

(

4

,

164

)

GECC

All other o

p

eratin

g

activities

Amortization of intan

g

ible assets $ 408 $ 425 $ 447

Net realized losses on investment securities 17 523 34

Cash collateral on derivative contracts 745

(

2,271

)

2,900

Increase

(

decrease

)

in other liabilities

(

1,771

)

2,334 560

Other 841

(

912

)

1,477

$ 240 $ 99 $ 5

,

418

Net decrease

(

increase

)

in GECC financin

g

receivables

Increase in loans to customers $

(

323,050

)

$

(

311,860

)

$

(

308,156

)

Princi

p

al collections from customers - loans 302,618 307,849 307,250

Investment in e

q

ui

p

ment for financin

g

leases

(

8,120

)

(

8,652

)

(

9,192

)

Princi

p

al collections from customers - financin

g

leases 8,421 9,646 10,976

Net chan

g

e in credit card receivables

(

5,571

)

(

8,058

)

(

8,030

)

Sales of financin

g

receivables 20,013 14,664 12,642

$

(

5

,

689

)

$ 3

,

589 $ 5

,

490

All other investin

g

activities

Purchases of investment securities $

(

10,346

)

$

(

16,422

)

$

(

15,666

)

Dis

p

ositions and maturities of investment securities 9,289 18,139 17,010

Decrease

(

increase

)

in other assets - investments

(

476

)

1,089 4,338

Proceeds from sales of real estate

p

ro

p

erties 5,920 10,680 3,381

Other 2,610 1,486 2,731

$ 6

,

997 $ 14

,

972 $ 11

,

794

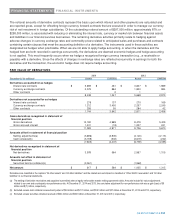

Newl

y

issued debt

(

maturities lon

g

er than 90 da

y

s

)

Short-term

(

91 to 365 da

y

s

)

$ 29 $ 55 $ 59

Lon

g

-term

(

lon

g

er than one

y

ear

)

34,435 44,833 55,782

$ 34

,

464 $ 44

,

888 $ 55

,

841

Re

p

a

y

ments and other reductions

(

maturities lon

g

er than 90 da

y

s

)

Short-term

(

91 to 365 da

y

s

)

$

(

47,694

)

$

(

52,553

)

$

(

94,114

)

Lon

g

-term

(

lon

g

er than one

y

ear

)

(

4,909

)

(

3,291

)

(

9,368

)

Princi

p

al

p

a

y

ments - non-recourse, levera

g

ed leases

(

454

)

(

585

)

(

426

)

$

(

53

,

057

)

$

(

56

,

429

)

$

(

103

,

908

)

All other financin

g

activities

Proceeds from sales of investment contracts $ 322 $ 491 $ 2,697

Redem

p

tion of investment contracts

(

1,113

)

(

980

)

(

5,515

)

Other

(

300

)

(

420

)

(

49

)

$

(

1

,

091

)

$

(

909

)

$

(

2

,

867

)