GE 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256

|

|

GE 2014 FORM 10-K 59

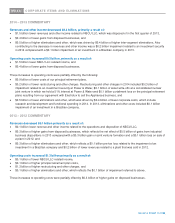

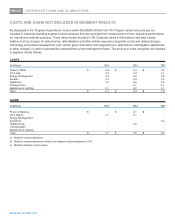

MD&A CORPORATE ITEMS AND ELIMINATIONS

2014 – 2013 COMMENTARY

Revenues and other income decreased $2.4 billion, primarily a result of:

x $1.5 billion lower revenues and other income related to NBCU LLC, which was disposed of in the first quarter of 2013,

x $0.4 billion of lower gains from disposed businesses, and

x $0.5 billion of higher eliminations and other, which was driven by $0.4 billion of higher inter-segment eliminations. Also

contributing to the decrease in revenues and other income was a $0.2 billion impairment related to an investment security

in 2014 compared with a $0.1 billion impairment of an investment in a Brazilian company in 2013.

Operating costs increased $0.2 billion, primarily as a result of:

x $1.5 billion lower NBCU LLC related income, and

x $0.4 billion of lower gains from disposed businesses.

These increases to operating costs were partially offset by the following:

x $0.9 billion of lower costs of our principal retirement plans,

x $0.2 billion of lower restructuring and other charges. Restructuring and other charges in 2014 included $0.2 billion of

impairment related to an investment security at Power & Water, $0.1 billion of asset write-offs at a consolidated nuclear

joint venture in which we hold a 51% interest at Power & Water and $0.1 billion curtailment loss on the principal retirement

plans resulting from our agreement with Electrolux to sell the Appliances business, and

x $0.5 billion of lower eliminations and other, which was driven by $0.4 billion of lower corporate costs, which include

research and development and functional spending in 2014. In 2013, eliminations and other costs included $0.1 billion

impairment of an investment in a Brazilian company.

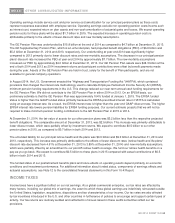

2013 – 2012 COMMENTARY

Revenues decreased $0.1 billion primarily as a result of:

x $0.1 billion lower revenue and other income related to the operations and disposition of NBCU LLC,

x $0.3 billion of higher gains from disposed businesses, which reflects the net effect of $0.5 billion of gains from industrial

business dispositions in 2013 compared with a $0.3 billion gain on joint venture formation and a $0.1 billion loss on sale of

a plant in 2012, and

x $0.3 billion of higher eliminations and other, which reflects a $0.1 billion pre-tax loss related to the impairment of an

investment in a Brazilian company and $0.2 billion of lower revenues related to a plant that was sold in 2012.

Operating costs increased $1.3 billion primarily as a result of:

x $0.1 billion of lower NBCU LLC related income,

x $0.1 billion of higher principal retirement plan costs,

x $1.3 billion of higher restructuring and other charges, and

x $0.1 billion of higher eliminations and other, which reflects the $0.1 billion of impairment referred to above.

These increases to operating costs were partially offset by $0.3 billion of higher gains on disposed businesses.