GE 2014 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2014 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

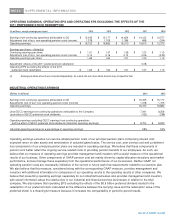

GE 2014 FORM 10-K 85

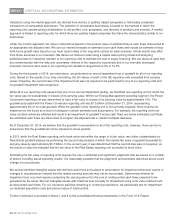

MD&A CRITICAL ACCOUNTING ESTIMATES

CRITICAL ACCOUNTING ESTIMATES

Accounting estimates and assumptions discussed in this section are those that we consider to be the most critical to an

understanding of our financial statements because they involve significant judgments and uncertainties. Many of these

estimates include determining fair value. All of these estimates reflect our best judgment about current, and for some

estimates future, economic and market conditions and their potential effects based on information available as of the date of

these financial statements. If these conditions change from those expected, it is reasonably possible that the judgments and

estimates described below could change, which may result in future impairments of investment securities, goodwill, intangibles

and long-lived assets, incremental losses on financing receivables, increases in reserves for contingencies, establishment of

valuation allowances on deferred tax assets and increased tax liabilities, among other effects. Also see Note 1 to the

consolidated financial statements in this Form 10-K Report, which discusses our most significant accounting policies.

LOSSES ON FINANCING RECEIVABLES

Losses on financing receivables are recognized when they are incurred, which requires us to make our best estimate of

probable losses inherent in the portfolio. The method for calculating the best estimate of losses depends on the size, type and

risk characteristics of the related financing receivable. Such an estimate requires consideration of historical loss experience,

adjusted for current conditions, and judgments about the probable effects of relevant observable data, including present

economic conditions such as delinquency rates, financial health of specific customers and market sectors, collateral values

(including housing price indices, as applicable), and the present and expected future levels of interest rates. The underlying

assumptions, estimates and assessments we use to provide for losses are updated to reflect our view of current conditions

and are subject to the regulatory examination process, which can result in changes to our assumptions. Changes in such

estimates can significantly affect the allowance and provision for losses. It is possible that we will experience credit losses that

are different from our current estimates. Write-offs in both our consumer and commercial portfolios can also reflect both losses

that are incurred subsequent to the beginning of a fiscal year and information becoming available during that fiscal year that

may identify further deterioration on exposures existing prior to the beginning of that fiscal year, and for which reserves could

not have been previously recognized. Our risk management process includes standards and policies for reviewing major risk

exposures and concentrations, and evaluates relevant data either for individual loans or financing leases, or on a portfolio

basis, as appropriate.

Further information is provided in the Global Risk Management section and Statement of Financial Position – Financing

Receivables section within the MD&A of this Form 10-K, the Asset Impairment section that follows and in Notes 1 and 6 to the

consolidated financial statements in this Form 10-K Report.

REVENUE RECOGNITION ON LONG-TERM PRODUCT SERVICES AGREEMENTS

Revenue recognition on long-term product services agreements requires estimates of profits over the multiple-year terms of

such agreements, considering factors such as the frequency and extent of future monitoring, maintenance and overhaul

events; the amount of personnel, spare parts and other resources required to perform the services; and future billing rate, cost

changes and customers’ utilization of assets. We routinely review estimates under product services agreements and regularly

revise them to adjust for changes in outlook.