GE 2014 Annual Report Download - page 233

Download and view the complete annual report

Please find page 233 of the 2014 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GE 2014 FORM 10-K 213

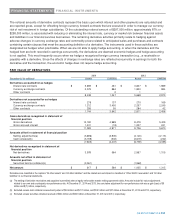

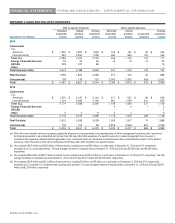

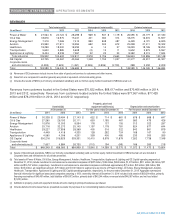

FINANCIAL STATEMENTS FINANCING RECEIVABLES – SUPPLEMENTAL INFORMATION

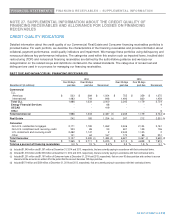

NOTE 27. SUPPLEMENTAL INFORMATION ABOUT THE CREDIT QUALITY OF

FINANCING RECEIVABLES AND ALLOWANCE FOR LOSSES ON FINANCING

RECEIVABLES

CREDIT QUALITY INDICATORS

Detailed information about the credit quality of our Commercial, Real Estate and Consumer financing receivables portfolios is

provided below. For each portfolio, we describe the characteristics of the financing receivables and provide information about

collateral, payment performance, credit quality indicators and impairment. We manage these portfolios using delinquency and

nonaccrual data as key performance indicators. The categories used within this section such as impaired loans, troubled debt

restructuring (TDR) and nonaccrual financing receivables are defined by the authoritative guidance and we base our

categorization on the related scope and definitions contained in the related standards. The categories of nonaccrual and

delinquent are used in our process for managing our financing receivables.

PAST DUE AND NONACCRUAL FINANCING RECEIVABLES

2014 2013

Over 30 days Over 90 days Over 30 days Over 90 days

December 31 (In millions) past due past due Nonaccrual past due past due Nonaccrual

Commercial

CLL

Americas $ 503 $ 284

$ 1,054

$ 755

$ 359

$ 1,275

International 1,483

749

946

1,490

820

1,459

Total CLL 1,986

1,033

2,000

2,245

1,179 2,734

Energy Financial Services -

- 68

-

- 4

GECAS -

- 419

-

- -

Other -

- -

-

- 6

Total Commercial 1,986

1,033

2,487 (a) 2,245

1,179 2,744

(a)

Real Estate 242

183

1,254 (b) 247

212 2,551

(b)

Consumer

Non-U.S. residential mortgages 2,171

1,195

1,262

3,406

2,104

2,161

Non-U.S. installment and revolving credit 333

89 53

601

159

106

U.S. installment and revolving credit 2,492

1,147

2

2,442

1,105

2

Other 141

64 167

172

99 351

Total Consumer 5,137

2,495

(c) 1,484

(d) 6,621

3,467 (c) 2,620

(d)

Total $ 7,365

$ 3,711

$ 5,225

$ 9,113 $ 4,858

$ 7,915

Total as a percent of financing receivables 3.0 % 1.5 % 2.2

% 3.5 % 1.9 % 3.1 %

(a) Included $1,549 million and $1,397 million at December 31, 2014 and 2013, respectively, that are currently paying in accordance with their contractual terms.

(b) Included $1,018 million and $2,308 million at December 31, 2014 and 2013, respectively, that are currently paying in accordance with their contractual terms.

(c) Included $1,231 million and $1,197 million of Consumer loans at December 31, 2014 and 2013, respectively, that are over 90 days past due and continue to accrue

interest until the accounts are written off in the period that the account becomes 180 days past due.

(d) Included $179 million and $324 million at December 31, 2014 and 2013, respectively, that are currently paying in accordance with their contractual terms.