GE 2014 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2014 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

184 GE 2014 FORM 10-K

FINANCIAL STATEMENTS INCOME TAXES

The balance of unrecognized tax benefits, the amount of related interest and penalties we have provided and what we believe

to be the range of reasonably possible changes in the next 12 months were:

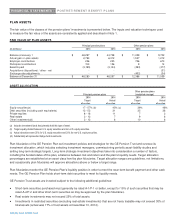

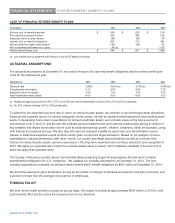

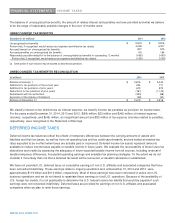

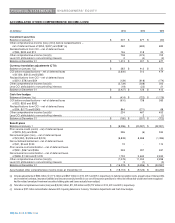

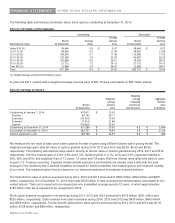

UNRECOGNIZED TAX BENEFITS

December 31 (In millions) 2014 2013

Unrecognized tax benefits $ 5,619 $ 5,816

Portion that, if recognized, would reduce tax expense and effective tax rate(a) 4,059 4,307

Accrued interest on unrecognized tax benefits 807 975

Accrued penalties on unrecognized tax benefits 103 164

Reasonably possible reduction to the balance of unrecognized tax benefits in succeeding 12 months 0-900 0-900

Portion that, if recognized, would reduce tax expense and effective tax rate(a) 0-300 0-350

(a) Some portion of such reduction may be reported as discontinued operations.

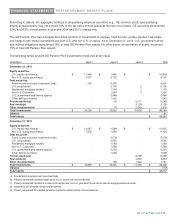

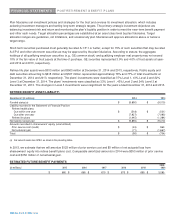

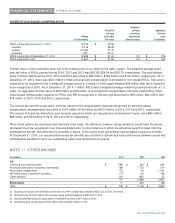

UNRECOGNIZED TAX BENEFITS RECONCILIATION

(In millions) 2014

2013

Balance at January 1, $ 5,816 $ 5,445

Additions for tax positions of the current year 234 771

Additions for tax positions of prior years 673 872

Reductions for tax positions of prior years (761) (1,140)

Settlements with tax authorities (305) (98)

Expiration of the statute of limitations (38) (34)

Balance at December 31 $ 5,619 $ 5,816

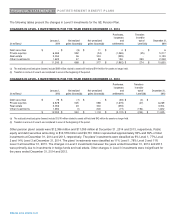

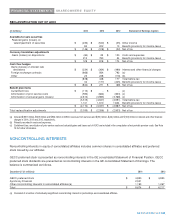

We classify interest on tax deficiencies as interest expense; we classify income tax penalties as provision for income taxes.

For the years ended December 31, 2014, 2013 and 2012, $(68) million, $22 million and $(45) million of interest expense

(income), respectively, and $(45) million, an insignificant amount and $33 million of tax expense (income) related to penalties,

respectively, were recognized in the Statement of Earnings.

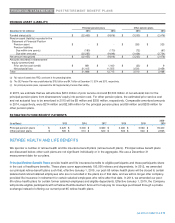

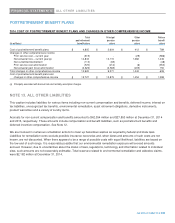

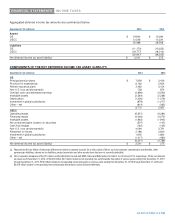

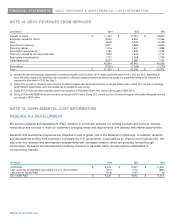

DEFERRED INCOME TAXES

Deferred income tax balances reflect the effects of temporary differences between the carrying amounts of assets and

liabilities and their tax bases, as well as from net operating loss and tax credit carryforwards, and are stated at enacted tax

rates expected to be in effect when taxes are actually paid or recovered. Deferred income tax assets represent amounts

available to reduce income taxes payable on taxable income in future years. We evaluate the recoverability of these future tax

deductions and credits by assessing the adequacy of future expected taxable income from all sources, including reversal of

taxable temporary differences, forecasted operating earnings and available tax planning strategies. To the extent we do not

consider it more likely than not that a deferred tax asset will be recovered, a valuation allowance is established.

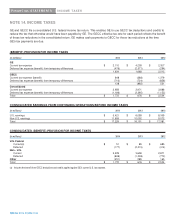

We have not provided U.S. deferred taxes on cumulative earnings of non-U.S. affiliates and associated companies that have

been reinvested indefinitely. These earnings relate to ongoing operations and, at December 31, 2014 and 2013, were

approximately $119 billion and $110 billion, respectively. Most of these earnings have been reinvested in active non-U.S.

business operations and we do not intend to repatriate these earnings to fund U.S. operations. Because of the availability of

U.S. foreign tax credits, it is not practicable to determine the U.S. federal income tax liability that would be payable if such

earnings were not reinvested indefinitely. Deferred taxes are provided for earnings of non-U.S. affiliates and associated

companies when we plan to remit those earnings.