GE 2014 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2014 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

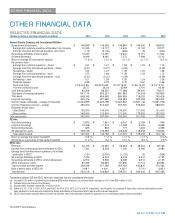

96 GE 2014 FORM 10-K

MD&A SUPPLEMENTAL INFORMATION

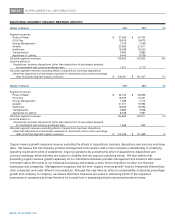

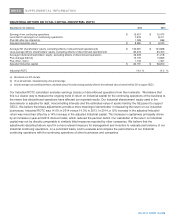

INDUSTRIAL SEGMENT ORGANIC REVENUE GROWTH

(Dollars in millions) 2014 2013 V%

Segment revenues:

Power & Water $ 27,564 $ 24,724

Oil & Gas 18,676 16,975

Energy Management 7,319 7,569

Aviation 23,990 21,911

Healthcare 18,299 18,200

Transportation 5,650 5,885

Appliances & Lighting 8,404 8,338

Industrial segment revenues 109,902 103,602 6%

Less the effects of:

Acquisitions, business dispositions (other than dispositions of businesses acquired

for investment) and currency exchange rates 1,871 2,175

Industrial segment revenues excluding effects of acquisitions, business dispositions

(other than dispositions of businesses acquired for investment) and currency exchange

rates (Industrial segment organic revenues) $ 108,031 $ 101,427 7%

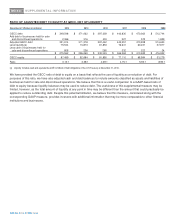

(Dollars in millions) 2013 2012 V%

Segment revenues:

Power & Water $ 24,724 $ 28,299

Oil & Gas 16,975 15,241

Energy Management 7,569 7,412

Aviation 21,911 19,994

Healthcare 18,200 18,290

Transportation 5,885 5,608

Appliances & Lighting 8,338 7,967

Industrial segment revenues 103,602 102,811 1%

Less the effects of:

Acquisitions, business dispositions (other than dispositions of businesses acquired

for investment) and currency exchange rates 1,566 842

Industrial segment revenues excluding effects of acquisitions, business dispositions

(other than dispositions of businesses acquired for investment) and currency exchange

rates (Industrial segment organic revenues) $ 102,036 $ 101,969 -%

Organic revenue growth measures revenue excluding the effects of acquisitions, business dispositions and currency exchange

rates. We believe that this measure provides management and investors with a more complete understanding of underlying

operating results and trends of established, ongoing operations by excluding the effect of acquisitions, dispositions and

currency exchange, which activities are subject to volatility and can obscure underlying trends. We also believe that

presenting organic revenue growth separately for our industrial businesses provides management and investors with useful

information about the trends of our industrial businesses and enables a more direct comparison to other non-financial

businesses and companies. Management recognizes that the term "organic revenue growth" may be interpreted differently by

other companies and under different circumstances. Although this may have an effect on comparability of absolute percentage

growth from company to company, we believe that these measures are useful in assessing trends of the respective

businesses or companies and may therefore be a useful tool in assessing period-to-period performance trends.