GE 2014 Annual Report Download - page 238

Download and view the complete annual report

Please find page 238 of the 2014 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

218 GE 2014 FORM 10-K

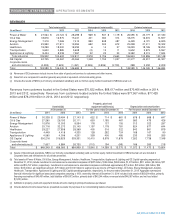

FINANCIAL STATEMENTS FINANCING RECEIVABLES – SUPPLEMENTAL INFORMATION

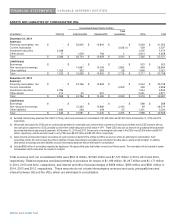

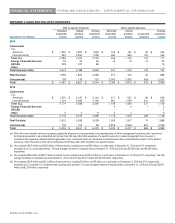

COMMERCIAL FINANCING RECEIVABLES BY RISK CATEGORY

Secured

December 31 (In millions) A B C Total

2014

CLL

Americas $ 63,754 $ 1,549 $ 1,443 $ 66,746

International 41,476 474 891 42,841

Total CLL 105,230 2,023 2,334 109,587

Energy Financial Services 2,479 60 16 2,555

GECAS 7,908 237 118 8,263

Other 130 - - 130

Total $ 115,747 $ 2,320 $ 2,468 $ 120,535

2013

CLL

Americas $ 65,545 $ 1,587 $ 1,554 $ 68,686

International 44,930 619 1,237 46,786

Total CLL 110,475 2,206 2,791 115,472

Energy Financial Services 2,969 9 - 2,978

GECAS 9,175 50 152 9,377

Other 318 - - 318

Total $ 122,937 $ 2,265 $ 2,943 $ 128,145

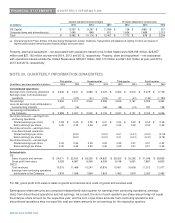

For our secured financing receivables portfolio, our collateral position and ability to work out problem accounts mitigate our

losses. Our asset managers have deep industry expertise that enables us to identify the optimum approach to default

situations. We price risk premiums for weaker credits at origination, closely monitor changes in creditworthiness through our

risk ratings and watch list process, and are engaged early with deteriorating credits to minimize economic loss. Secured

financing receivables within risk Category C are predominantly in our CLL businesses and are primarily composed of senior

term lending facilities and factoring programs secured by various asset types including inventory, accounts receivable, cash,

equipment and related business facilities as well as franchise finance activities secured by underlying equipment.

Loans within Category C are reviewed and monitored regularly, and classified as impaired when it is probable that they will not

pay in accordance with contractual terms. Our internal risk rating process identifies credits warranting closer monitoring; and

as such, these loans are not necessarily classified as nonaccrual or impaired.

Our unsecured Commercial financing receivables portfolio is primarily attributable to our Interbanca S.p.A. and GE Sanyo

Credit acquisitions in CLL International. At December 31, 2014 and 2013, these financing receivables included $332 million

and $313 million rated A, $408 million and $580 million rated B, and $201 million and $231 million rated C, respectively.

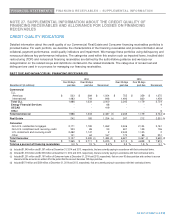

REAL ESTATE

Due to the primarily non-recourse nature of our Debt portfolio, loan-to-value ratios (the ratio of the outstanding debt on a

property to the re-indexed value of that property) provide the best indicators of the credit quality of the portfolio.

Loan-to-value ratio

2014 2013

Less than 80% to Greater than Less than 80% to Greater than

December 31 (In millions) 80% 95% 95% 80% 95% 95%

Debt $ 16,915 $ 1,175 $ 958 $ 15,576 $ 1,300 $ 2,111