GE 2014 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2014 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70 GE 2014 FORM 10-K

MD&A STATEMENT OF FINANCIAL POSITION

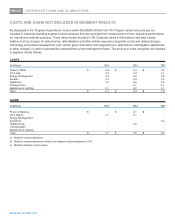

STATEMENT OF FINANCIAL POSITION

Because GE and GECC share certain significant elements of their Statements of Financial Position, the following discussion

addresses significant captions in the consolidated statement. Within the following discussions, however, we distinguish

between GE and GECC activities in order to permit meaningful analysis of each individual consolidating statement.

MAJOR CHANGES IN OUR FINANCIAL POSITION DURING 2014

x GE Cash increased $2.2 billion driven by the following:

- $15.2 billion of GE cash flows from operating activities

- $3.0 billion senior unsecured debt issuance

- $0.6 billion from business dispositions

- $(8.9) billion dividends to shareowners

- $(2.2) billion used to buyback treasury stock under our share repurchase program

- $(2.1) billion used to acquire businesses

For additional information on GE Cash, see the Statement of Cash Flows section within the MD&A of this Form 10-K.

x Investment securities increased $3.9 billion reflecting purchases of U.S. government and federal agency securities at

Synchrony Financial and higher net unrealized gains in U.S. Corporate and State and Municipal securities driven by lower

interest rates in the U.S. See Note 3 to the consolidated financial statements in this Form 10-K Report.

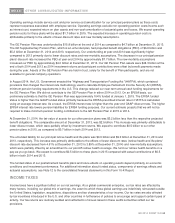

- Pre-tax, other-than-temporary impairment losses (OTTI) recognized in earnings were $0.4 billion and $0.8 billion in

2014 and 2013, respectively. The 2014 amount primarily relates to other-than temporary impairments on equity

securities, corporate debt securities, commercial and residential mortgage-backed securities (CMBS), residential

mortgage-backed securities (RMBS) and asset-backed securities (ABS). The 2013 amount primarily related to credit

losses on corporate debt securities and other-than-temporary impairment on equity securities.

- Pre-tax, OTTI recognized in accumulated other comprehensive income were insignificant amounts in both 2014 and

2013.

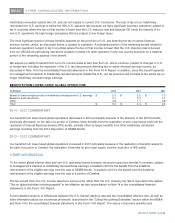

x GECC Financing receivables-net decreased $16.0 billion. See the following Financing Receivables section for

additional information.

x GE All other assets increased $1.0 billion primarily due to an increase in contract costs and estimated earnings at our

Power & Water and Aviation businesses of $1.5 billion, partially offset by the reclassification of Appliances and Signaling

balances to assets of businesses held for sale of $0.5 billion.

x GECC All other assets decreased $3.5 billion as a result of sales of certain real estate investments of $3.4 billion, a net

decrease in equity and cost method investments of $1.5 billion and a net decrease in advances to suppliers of $0.9 billion,

partially offset by a net increase in assets held for sale of $2.3 billion.

x Deferred income taxes increased $2.3 billion primarily due to an increased deferred tax asset as a result of the

increased postretirement benefit liabilities, partially offset by the impact of the adoption of a new accounting standard,

which reduced our deferred tax asset balance. See Note 1 to the consolidated financial statements in this Form 10-K

Report.

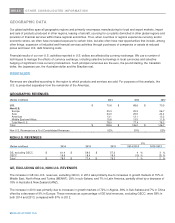

x GE borrowings increased $3.0 billion. GE completed issuances of $3.0 billion of senior unsecured debt with maturities

up to 30 years and reclassified $2.0 billion of long-term borrowings to short-term borrowings during the year.

x GECC borrowings decreased $31.0 billion. GECC had net repayments on these borrowings of $24.9 billion during the

year, along with a net $9.1 billion reduction in the balances driven by the strengthening of the U.S. dollar against all major

currencies.

x Bank deposits increased $9.5 billion primarily due to increases at our banks of $12.6 billion, including Synchrony

Financial of $9.2 billion, partially offset by the reclassification of Budapest Bank deposits to liabilities of businesses held

for sale of $1.9 billion.