GE 2014 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2014 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

174 GE 2014 FORM 10-K

FINANCIAL STATEMENTS POSTRETIREMENT BENEFIT PLANS

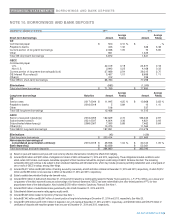

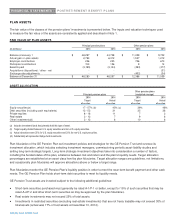

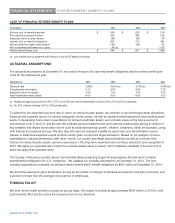

PLAN ASSETS

The fair value of the classes of the pension plans' investments is presented below. The inputs and valuation techniques used

to measure the fair value of the assets are consistently applied and described in Note 1.

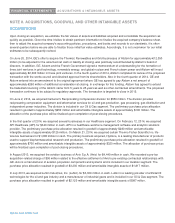

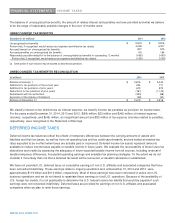

FAIR VALUE OF PLAN ASSETS

Principal pension plans Other pension plans

(In millions) 2014 2013 2014 2013

Balance at January 1 $ 48,297 $ 44,738 $ 11,059 $ 9,702

Actual gain on plan assets 2,793 6,312 1,537 1,212

Employer contributions 236 225 726 673

Participant contributions 153 156 9 14

Benefits paid (3,199) (3,134) (493) (477)

Acquisitions (dispositions) / other - net - - - (31)

Exchange rate adjustments - - (452) (34)

Balance at December 31 $ 48,280 $ 48,297 $ 12,386 $ 11,059

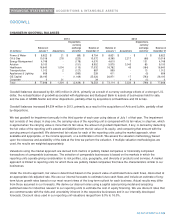

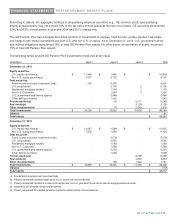

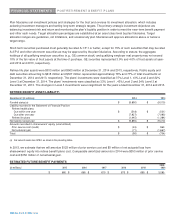

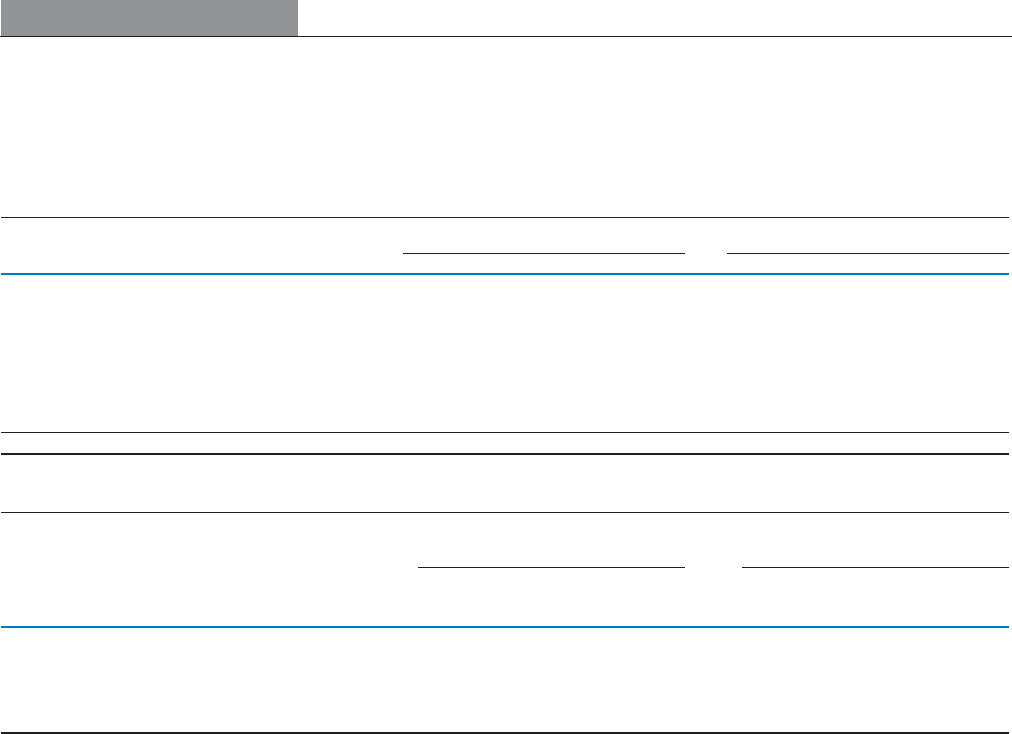

ASSET ALLOCATION

Other pension plans

Principal pension plans (weighted average)

201

4

201

4

2014 201

4

Targe

t

Actual Targe

t

Actual

allocation allocation allocation allocation

Equity securities(a) 17 - 57% (b) 45% (c) 39% 48%

Debt securities (including cash equivalents) 13 - 53 31 35 38

Private equities 8 - 18 11 7 2

Real estate 2 - 12 7 9 6

Other investments(d) 3 - 13 6 10 6

(a) Includes investment funds that primarily hold this type of asset.

(b) Target equally divided between U.S. equity securities and non-U.S. equity securities.

(c) Actual allocations were 25% for U.S. equity securities and 20% for non-U.S. equity securities.

(d) Substantially all represented hedge fund investments.

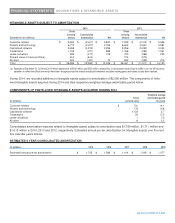

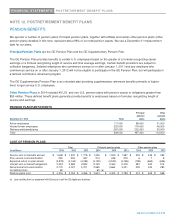

Plan fiduciaries of the GE Pension Plan set investment policies and strategies for the GE Pension Trust and oversee its

investment allocation, which includes selecting investment managers, commissioning periodic asset-liability studies and

setting long-term strategic targets. Long-term strategic investment objectives take into consideration a number of factors,

including the funded status of the plan, a balance between risk and return and the plan’s liquidity needs. Target allocation

percentages are established at an asset class level by plan fiduciaries. Target allocation ranges are guidelines, not limitations,

and occasionally plan fiduciaries will approve allocations above or below a target range.

Plan fiduciaries monitor the GE Pension Plan’s liquidity position in order to meet the near-term benefit payment and other cash

needs. The GE Pension Plan holds short-term debt securities to meet its liquidity needs.

GE Pension Trust assets are invested subject to the following additional guidelines:

x Short-term securities purchased must generally be rated A-1/P-1 or better, except for 15% of such securities that may be

rated A-2/P-2 and other short-term securities as may be approved by the plan fiduciaries.

x Real estate investments may not exceed 25% of total assets.

x Investments in restricted securities (excluding real estate investments) that are not freely tradable may not exceed 30% of

total assets (actual was 17% of trust assets at December 31, 2014).