GE 2014 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2014 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

152 GE 2014 FORM 10-K

FINANCIAL STATEMENTS HELD FOR SALE & DISCONTINUED OPERATIONS

Reserves related to repurchase claims made against WMC were $809 million at December 31, 2014, reflecting a net increase

to reserves in the twelve months ended December 31, 2014 of $9 million due to incremental provisions offset by settlement

activity. The reserve estimate takes into account recent settlement activity and is based upon WMC’s evaluation of the

remaining exposures as a percentage of estimated lifetime mortgage loan losses within the pool of loans supporting each

securitization. Settlements in prior periods reduced WMC’s exposure on claims asserted in certain securitizations and the

claim amounts reported above give effect to these settlements.

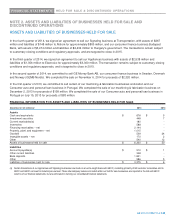

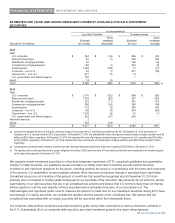

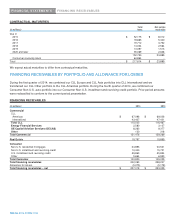

ROLLFORWARD OF THE RESERVE

December 31 (In millions) 2014 2013

Balance, beginning of period $ 800

$ 633

Provision 365

354

Claim resolutions / rescissions (356) (187)

Balance, end of period $ 809

$ 800

Given the significant litigation activity and WMC’s continuing efforts to resolve the lawsuits involving claims made against

WMC, it is difficult to assess whether future losses will be consistent with WMC’s past experience. Adverse changes to WMC’s

assumptions supporting the reserve may result in an increase to these reserves. Taking into account both recent settlement

activity and the potential variability of settlements, WMC estimates a range of reasonably possible loss from $0 to

approximately $500 million over its recorded reserve at December 31, 2014. This estimate excludes any possible loss

associated with an adverse court decision on the applicable statute of limitations, as WMC is unable at this time to develop

such a meaningful estimate.

At December 31, 2014, there were 15 lawsuits involving claims made against WMC arising from alleged breaches of

representations and warranties on mortgage loans included in 14 securitizations. The adverse parties in these cases are

securitization trustees or parties claiming to act on their behalf. Although the alleged claims for relief vary from case to case,

the complaints and counterclaims in these actions generally assert claims for breach of contract, indemnification, and/or

declaratory judgment, and seek specific performance (repurchase of defective mortgage loan) and/or money damages.

Adverse court decisions, including in cases not involving WMC (such as the New York Court of Appeals’ decision on statute of

limitations, expected in 2015), could result in new claims and lawsuits on additional loans. However, WMC continues to believe

that it has defenses to the claims asserted in litigation, including, for example, based on causation and materiality

requirements and applicable statutes of limitations. It is not possible to predict the outcome or impact of these defenses and

other factors, any of which could materially affect the amount of any loss ultimately incurred by WMC on these claims.

WMC has also received indemnification demands, nearly all of which are unspecified, from depositors/underwriters/sponsors

of RMBS in connection with lawsuits brought by RMBS investors concerning alleged misrepresentations in the securitization

offering documents to which WMC is not a party or, in two cases, involving mortgage loan repurchase claims made against

RMBS sponsors. WMC believes that it has defenses to these demands.

To the extent WMC is required to repurchase loans, WMC’s loss also would be affected by several factors, including pay

downs, accrued interest and fees, and the value of the underlying collateral. The reserve and estimate of possible loss reflect

judgment, based on currently available information, and a number of assumptions, including economic conditions, claim and

settlement activity, pending and threatened litigation, court decisions regarding WMC’s legal defenses, indemnification

demands, government activity, and other variables in the mortgage industry. Actual losses arising from claims against WMC

could exceed these amounts and additional claims and lawsuits could result if actual claim rates, governmental actions,

litigation and indemnification activity, adverse court decisions, actual settlement rates or losses WMC incurs on repurchased

loans differ from its assumptions.

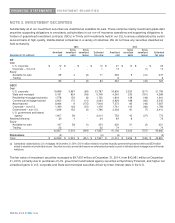

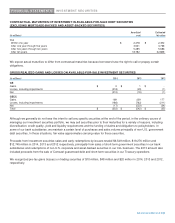

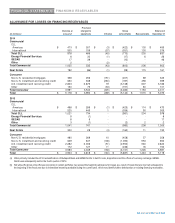

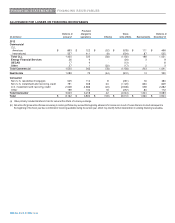

FINANCIAL INFORMATION FOR WMC

(In millions) 2014 2013 2012

Total revenues and other income (loss) $ (291) $ (346) $ (500)

Earnings (loss) from discontinued operations, net of taxes $ (199) $ (232) $ (337)