GE 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96 GE 2012 ANNUAL REPORT

notes to consolidated financial statements

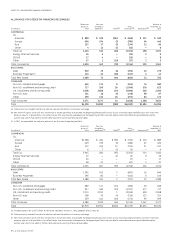

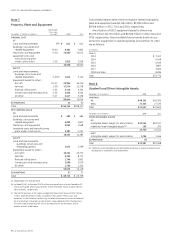

Note 7.

Property, Plant and Equipment

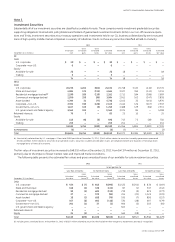

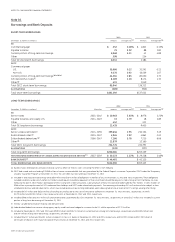

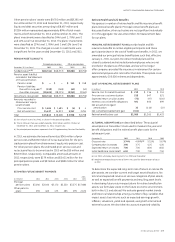

December 31 (Dollars in millions)

Depreciable

lives—new

(in years) 2012 2011

ORIGINAL COST

GE

Land and improvements 8 (a) $ 612 $ 611

Buildings, structures and

related equipment 8–40 8,361 7,823

Machinery and equipment 4–20 24,090 22,071

Leasehold costs and

manufacturing plant

under construction 1–10 2,815 2,538

35,878 33,043

GECC (b)

Land and improvements,

buildings, structures and

related equipment 1–36 (a) 2,624 3,110

Equipment leased to others

Aircraft 19–21 49,954 46,240

Vehicles 1–28 17,574 15,278

Railroad rolling stock 4–50 4,210 4,324

Construction and manufacturing 1–30 3,055 2,644

All other 3–27 3,427 3,438

80,844 75,034

ELIMINATIONS 41 40

Total $116,763 $108,117

NET CARRYING VALUE

GE

Land and improvements $ 582 $ 584

Buildings, structures and

related equipment 4,003 3,827

Machinery and equipment 9,061 7,648

Leasehold costs and manufacturing

plant under construction 2,387 2,224

16,033 14,283

GECC (b)

Land and improvements,

buildings, structures and

related equipment 1,074 1,499

Equipment leased to others

Aircraft

(c) 36,231 34,271

Vehicles 9,263 8,772

Railroad rolling stock 2,746 2,853

Construction and manufacturing 2,069 1,670

All other 2,290 2,354

53,673 51,419

ELIMINATIONS 37 37

Total $ 69,743 $ 65,739

(a) Depreciable lives exclude land.

(b) Included $1,467 million and $1,570 million of original cost of assets leased to GE

with accumulated amortization of $452 million and $445 million at December 31,

2012 and 2011, respectively.

(c) The GECAS business of GE Capital recognized impairment losses of $242 million

in 2012 and $301 million in 2011 recorded in the caption “Other costs and

expenses” in the Statement of Earnings to reflect adjustments to fair value based

on an evaluation of average current market values (obtained from third parties)

of similar type and age aircraft, which are adjusted for the attributes of the

specific aircraft under lease.

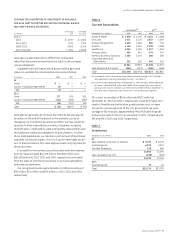

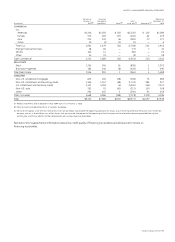

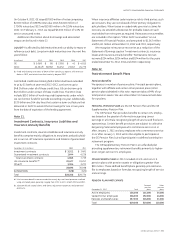

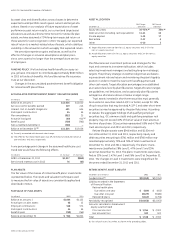

Consolidated depreciation and amortization related to property,

plant and equipment was $9,346 million, $9,185 million and

$9,786 million in 2012, 2011 and 2010, respectively.

Amortization of GECC equipment leased to others was

$6,243 million, $6,253 million and $6,786 million in 2012, 2011 and

2010, respectively. Noncancellable future rentals due from cus-

tomers for equipment on operating leases at December 31, 2012,

are as follows:

(In millions)

Due in

2013 $ 7,507

2014 6,168

2015 4,946

2016 3,863

2017 3,000

2018 and later 8,286

Total $33,770

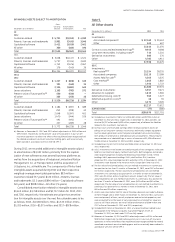

Note 8.

Goodwill and Other Intangible Assets

December 31 (In millions) 2012 2011

GOODWILL

GE $46,143 $45,395

GECC 27,304 27,230

Total $73,447 $72,625

December 31 (In millions) 2012 2011

OTHER INTANGIBLE ASSETS

GE

Intangible assets subject to amortization $10,541 $10,317

Indefinite-lived intangible assets (a) 159 205

10,700 10,522

GECC

Intangible assets subject to amortization 1,294 1,546

ELIMINATIONS (7) —

Total $11,987 $12,068

(a) Indefinite-lived intangible assets principally comprised in-process research and

development, trademarks and tradenames.