GE 2012 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2012 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

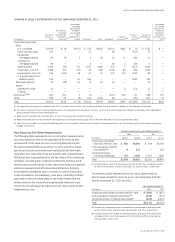

114 GE 2012 ANNUAL REPORT

notes to consolidated financial statements

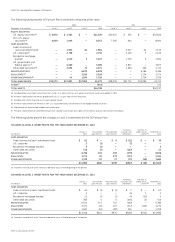

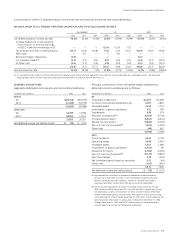

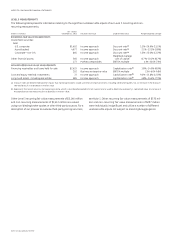

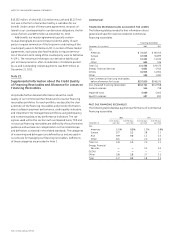

The following table summarizes information about stock

options outstanding at December 31, 2012.

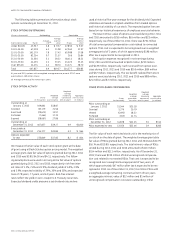

STOCK OPTIONS OUTSTANDING

(Shares in thousands) Outstanding Exercisable

Exercise price range Shares

Average

life (a)

Average

exercise

price Shares

Average

exercise

price

Under $10.00 45,957 5.8 $ 9.57 27,855 $ 9.57

10.01–15.00 67,018 6.1 11.98 42,963 11.97

15.01–20.00 191,179 7.8 17.43 65,988 17.08

20.01–25.00 83,204 9.7 21.57 266 20.84

25.01–30.00 21,550 5.1 28.22 18,411 28.21

30.01–35.00 44,455 2.2 33.25 44,420 33.25

Over $35.00 14,474 4.2 38.70 14,474 38.70

Total 467,837 6.9 $19.27 214,377 $20.85

At year-end 2011, options with a weighted average exercise price of $22.47 were

exercisable on 189 million shares.

(a) Average contractual life remaining in years.

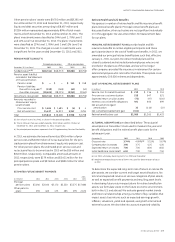

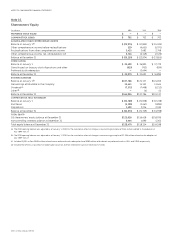

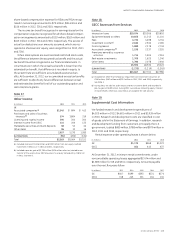

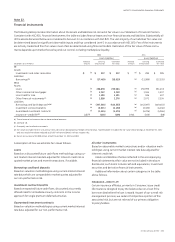

STOCK OPTION ACTIVITY

Shares

(In thousands)

Weighted

average

exercise price

Weighted

average

remaining

contractual

term (In years)

Aggregate

intrinsic value

(In millions)

Outstanding at

January 1, 2012 449,861 $18.87

Granted 83,179 21.56

Exercised (29,672) 11.97

Forfeited (7,464) 17.31

Expired (28,067) 27.86

Outstanding at

December 31, 2012 467,837 $19.27 6.9 $1,810

Exercisable at

December 31, 2012 214,377 $20.85 5.3 $ 964

Options expected

to vest 235,849 $17.82 8.2 $ 814

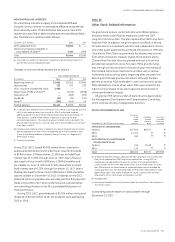

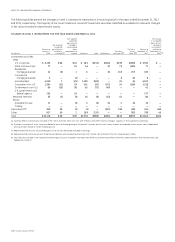

We measure the fair value of each stock option grant at the date

of grant using a Black-Scholes option pricing model. The weighted

average grant-date fair value of options granted during 2012, 2011

and 2010 was $3.80, $4.00 and $4.11, respectively. The follow-

ing assumptions were used in arriving at the fair value of options

granted during 2012, 2011 and 2010, respectively: risk-free inter-

est rates of 1.3%, 2.6% and 2.9%; dividend yields of 4.0%, 3.9%

and 3.9%; expected volatility of 29%, 30% and 35%; and expected

lives of 7.8 years, 7.7 years, and 6.9 years. Risk-free interest

rates reflect the yield on zero-coupon U.S. Treasury securities.

Expected dividend yields presume a set dividend rate and we

used a historical five-year average for the dividend yield. Expected

volatilities are based on implied volatilities from traded options

and historical volatility of our stock. The expected option lives are

based on our historical experience of employee exercise behavior.

The total intrinsic value of options exercised during 2012, 2011

and 2010 amounted to $265 million, $65 million and $23 million,

respectively. As of December 31, 2012, there was $734 million

of total unrecognized compensation cost related to nonvested

options. That cost is expected to be recognized over a weighted

average period of 2 years, of which approximately $198 million

after tax is expected to be recognized in 2013.

Stock option expense recognized in net earnings during

2012, 2011 and 2010 amounted to $220 million, $230 million

and $178 million, respectively. Cash received from option exer-

cises during 2012, 2011 and 2010 was $355 million, $89 million

and $37 million, respectively. The tax benefit realized from stock

options exercised during 2012, 2011 and 2010 was $88 million,

$21 million and $7 million, respectively.

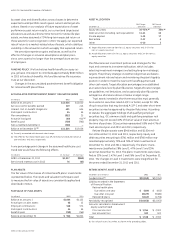

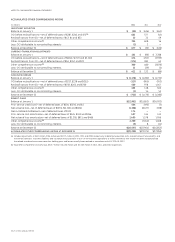

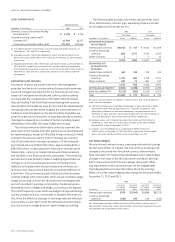

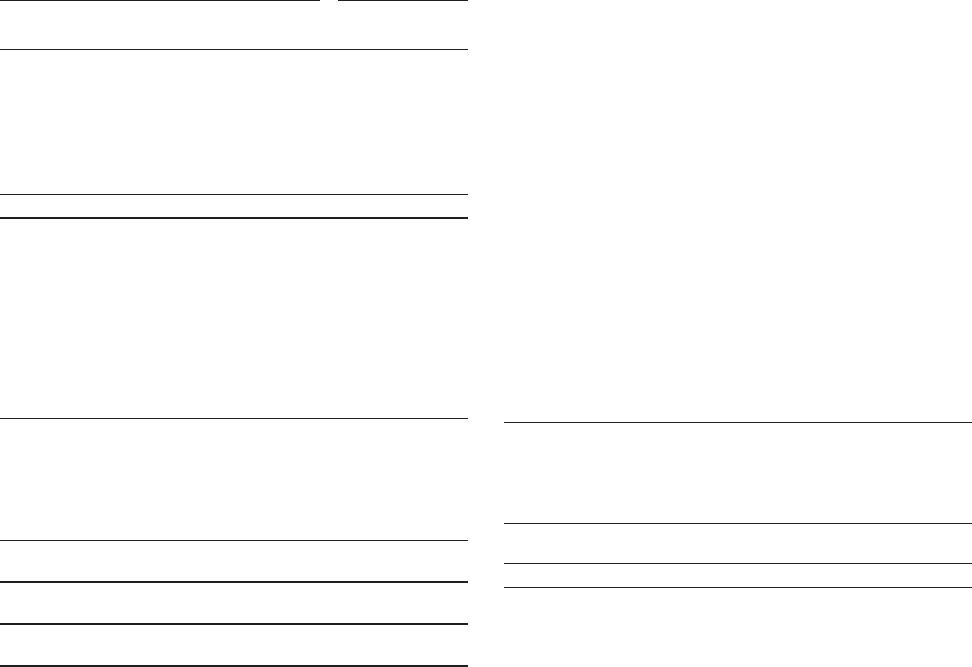

OTHER STOCK-BASED COMPENSATION

Shares

(In thousands)

Weighted

average

grant date

fair value

Weighted

average

remaining

contractual

term (In years)

Aggregate

intrinsic value

(In millions)

RSUs outstanding at

January 1, 2012 15,544 $25.18

Granted 5,379 20.79

Vested (5,692) 28.32

Forfeited (353) 22.74

RSUs outstanding at

December 31, 2012 14,878 $22.45 3.0 $312

RSUs expected to vest 13,556 $22.46 2.9 $285

The fair value of each restricted stock unit is the market price of

our stock on the date of grant. The weighted average grant date

fair value of RSUs granted during 2012, 2011 and 2010 was $20.79,

$16.74 and $15.89, respectively. The total intrinsic value of RSUs

vested during 2012, 2011 and 2010 amounted to $116 million,

$154 million and $111 million, respectively. As of December 31,

2012, there was $190 million of total unrecognized compensa-

tion cost related to nonvested RSUs. That cost is expected to be

recognized over a weighted average period of two years, of

which approximately $47 million after tax is expected to be rec-

ognized in 2013. As of December 31, 2012, 0.6 million PSUs with

a weighted average remaining contractual term of two years,

an aggregate intrinsic value of $12 million and $1 million of

unrecognized compensation cost were outstanding. Other