GE 2012 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2012 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.management’s discussion and analsis

58 GE 2012 ANNUAL REPORT

through issuance of long-term debt and reissuance of com-

mercial paper, cash on hand, collections of financing receivables

exceeding originations, dispositions, asset sales, and deposits

and other alternative sources of funding. Long-term maturities

and early redemptions were $88 billion in 2012. Interest on bor-

rowings is primarily repaid through interest earned on existing

financing receivables. During 2012, GECC earned interest income

on financing receivables of $21.0 billion, which more than offset

interest expense of $11.7 billion.

We maintain a detailed liquidity policy for GECC which

includes a requirement to maintain a contingency funding plan.

The liquidity policy defines GECC’s liquidity risk tolerance under

different stress scenarios based on its liquidity sources and also

establishes procedures to escalate potential issues. We actively

monitor GECC’s access to funding markets and its liquidity profile

through tracking external indicators and testing various stress

scenarios. The contingency funding plan provides a framework

for handling market disruptions and establishes escalation proce-

dures in the event that such events or circumstances arise.

GECC is a savings and loan holding company under U.S. law

and became subject to Federal Reserve Board (FRB) supervision

on July 21, 2011, the one-year anniversary of the Dodd-Frank

Wall Street Reform and Consumer Protection Act (DFA). The FRB

has recently finalized a regulation that requires certain organi-

zations it supervises to submit annual capital plans for review,

including institutions’ plans to make capital distributions, such

as dividend payments. The applicability and timing of this pro-

posed regulation to GECC is not yet determined; however, the

FRB has indicated that it expects to extend these requirements

to large savings and loan holding companies through separate

rulemaking or by order. While GECC is not yet subject to this

regulation, GECC’s capital allocation planning is still subject to

FRB review. The FRB recently proposed regulations to revise and

replace its current rules on capital adequacy and we have taken

the proposed regulations into consideration in our current capi-

tal planning. The proposed regulations would apply to savings

and loan holding companies like GECC. The transition period for

achieving compliance with the proposed regulations following

final adoption is unclear. As expected, the U.S. Financial Stability

Oversight Council (FSOC) recently notified GECC that it is under

consideration for a proposed determination as a nonbank sys-

temically important financial institution (nonbank SIFI) under the

DFA. While not final, such a determination would subject GECC to

proposed enhanced supervisory standards.

Actions taken to strengthen and maintain our liquidity are

described in the following sections.

Liquidity Sources

We maintain liquidity sources that consist of cash and equiva-

lents and a portfolio of high-quality, liquid investments and

committed unused credit lines.

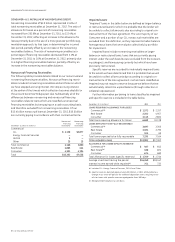

We have consolidated cash and equivalents of $77.4 billion at

December 31, 2012, which is available to meet our needs. Of this,

approximately $16 billion is held at GE and approximately $62 bil-

lion is held at GECC.

In addition to our $77.4 billion of cash and equivalents, we

have a centrally managed portfolio of high-quality, liquid invest-

ments at GECC with a fair value of $3.1 billion at December 31,

2012. This portfolio is used to manage liquidity and meet the

operating needs of GECC under both normal and stress scenarios.

The investments consist of unencumbered U.S. government

securities, U.S. agency securities, securities guaranteed by the

government, supranational securities, and a select group of non-

U.S. government securities. We believe that we can readily obtain

cash for these securities, even in stressed market conditions.

We have committed, unused credit lines totaling $48.2 billion

that have been extended to us by 51 financial institutions at

December 31, 2012. GECC can borrow up to $48.2 billion under all

of these credit lines. GE can borrow up to $12.0 billion under

certain of these credit lines. These lines include $30.3 billion of

revolving credit agreements under which we can borrow funds

for periods exceeding one year. Additionally, $17.9 billion are 364-

day lines that contain a term-out feature that allows us to extend

borrowings for one or two years from the date of expiration of

the lending agreement.

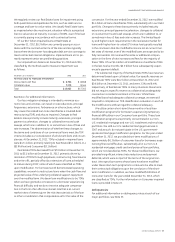

Cash and equivalents of $53.2 billion at December 31, 2012 are

held outside of the U.S. Of this amount at year-end, $14.4 billion is

indefinitely reinvested. Indefinitely reinvested cash held outside

of the U.S. is available to fund operations and other growth of

non-U.S. subsidiaries; it is also used to fund our needs in the U.S.

on a short-term basis through short-term loans, without being

subject to U.S. tax. Under the Internal Revenue Code, these loans

are permitted to be outstanding for 30 days or less and the total

of all such loans are required to be outstanding for less than 60

days during the year.

$1.8 billion of GE cash and equivalents is held in countries

with currency controls that may restrict the transfer of funds to

the U.S. or limit our ability to transfer funds to the U.S. without

incurring substantial costs. These funds are available to fund

operations and growth in these countries and we do not currently

anticipate a need to transfer these funds to the U.S.

At GECC, about $10 billion of cash and equivalents are in

regulated banks and insurance entities and are subject to

regulatory restrictions.

If we were to repatriate indefinitely reinvested cash held out-

side the U.S., we would be subject to additional U.S. income taxes

and foreign withholding taxes.

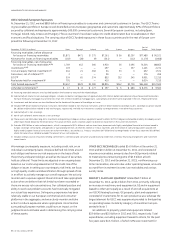

Funding Plan

We have reduced our GE Capital ending net investment, exclud-

ing cash and equivalents, from $513 billion at January 1, 2009 to

$419 billion at December 31, 2012.

During 2012, GE completed issuances of $7.0 billion of senior

unsecured debt with maturities up to 30 years. GECC issued

$33.9 billion of senior unsecured debt and $1.7 billion of secured

debt (excluding securitizations described below) with maturi-

ties up to 40 years (and subsequent to December 31, 2012, an

additional $13.1 billion). Average commercial paper borrowings

for GECC and GE during the fourth quarter were $40.4 billion

and $10.2 billion, respectively, and the maximum amounts of

commercial paper borrowings outstanding for GECC and GE

during the fourth quarter were $43.1 billion and $14.8 billion,