GE 2012 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2012 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

128 GE 2012 ANNUAL REPORT

notes to consolidated financial statements

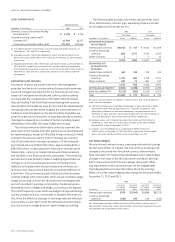

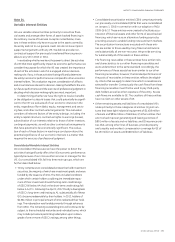

We recognized $329 million and $399 million of interest income,

including $237 million and $339 million on a cash basis, for the

years ended December 31, 2012 and 2011, respectively, principally

in our Real Estate—Debt portfolio. The total average investment in

impaired loans for the years ended December 31, 2012 and 2011

was $7,525 million and $9,678 million, respectively.

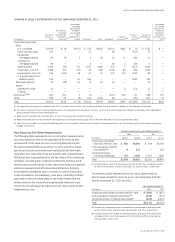

Real Estate TDRs decreased from $7,006 million at

December 31, 2011 to $5,146 million at December 31, 2012,

primarily driven by resolution of TDRs through paydowns,

restructurings, foreclosures and write-offs, partially offset by

extensions of loans scheduled to mature during 2012, some of

which were classified as TDRs upon modification. We deem loan

modifications to be TDRs when we have granted a concession to

a borrower experiencing financial difficulty and we do not receive

adequate compensation in the form of an effective interest rate

that is at current market rates of interest given the risk charac-

teristics of the loan or other consideration that compensates us

for the value of the concession. The limited liquidity and higher

return requirements in the real estate market for loans with

higher loan-to-value (LTV) ratios has typically resulted in the con-

clusion that the modified terms are not at current market rates

of interest, even if the modified loans are expected to be fully

recoverable. For the year ended December 31, 2012, we modi-

fied $4,351 million of loans classified as TDRs, substantially all

in our Debt portfolio. Changes to these loans primarily included

maturity extensions, principal payment acceleration, changes to

collateral or covenant terms and cash sweeps, which are in addi-

tion to, or sometimes in lieu of, fees and rate increases. Of our

$4,351 million of modifications classified as TDRs during 2012,

$210 million have subsequently experienced a payment default

in 2012. Of our $3,965 million of modifications classified as TDRs

during 2011, $140 million have subsequently experienced a pay-

ment default in 2011.

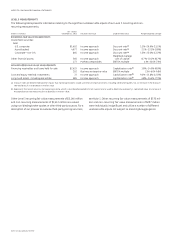

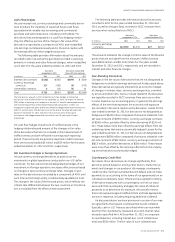

CREDIT QUALITY INDICATORS

Due to the primarily non-recourse nature of our Debt portfolio,

loan-to-value ratios provide the best indicators of the credit qual-

ity of the portfolio. By contrast, the credit quality of the Business

Properties portfolio is primarily influenced by the strength of the

borrower’s general credit quality, which is reflected in our internal

risk rating process, consistent with the process we use for our

Commercial portfolio.

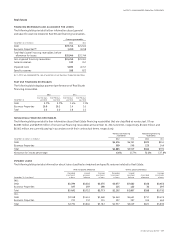

Loan-to-value ratio

December 31 (In millions)

Less than

80%

80% to

95%

Greater than

95%

2012

Debt $13,570 $2,572 $3,604

2011

Debt $14,454 $4,593 $5,454

At December 31, 2012, Business Properties receivables of

$956 million, $25 million and $219 million were rated A, B and C,

respectively. At December 31, 2011, Business Properties receiv-

ables of $7,628 million, $110 million and $510 million were rated A,

B and C, respectively.

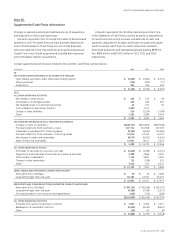

Within Real Estate—Debt, these financing receivables are

primarily concentrated in our North American and European

Lending platforms and are secured by various property types. A

substantial majority of the Real Estate—Debt financing receiv-

ables with loan-to-value ratios greater than 95% are paying in

accordance with contractual terms. Substantially all of these

loans and the majority of the Real Estate—Business Properties

financing receivables included in Category C are impaired loans

which are subject to the specific reserve evaluation process

described in Note 1. The ultimate recoverability of impaired loans

is driven by collection strategies that do not necessarily depend

on the sale of the underlying collateral and include full or partial

repayments through third-party refinancing and restructurings.

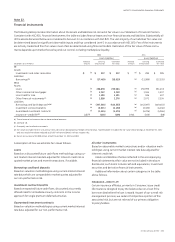

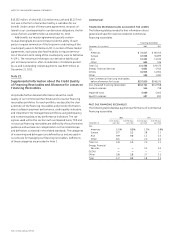

Consumer

At December 31, 2012, our U.S. consumer financing receivables

included private label credit card and sales financing for approxi-

mately 57 million customers across the U.S. with no metropolitan

area accounting for more than 6% of the portfolio. Of the total

U.S. consumer financing receivables, approximately 66% relate

to credit card loans, which are often subject to profit and loss-

sharing arrangements with the retailer (which are recorded in

revenues), and the remaining 34% are sales finance receivables,

which provide financing to customers in areas such as electron-

ics, recreation, medical and home improvement.

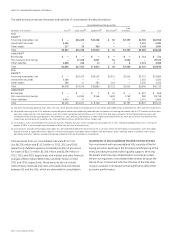

FINANCING RECEIVABLES AND ALLOWANCE FOR LOSSES

The following table provides further information about general

and specific reserves related to Consumer financing receivables.

Financing receivables

December 31 (In millions) 2012 2011

Non-U.S. residential mortgages $ 33,451 $ 35,550

Non-U.S. installment and revolving credit 18,546 18,544

U.S. installment and revolving credit 50,853 46,689

Non-U.S. auto 4,260 5,691

Other 8,070 7,244

Total Consumer financing receivables,

before allowance for losses $115,180 $113,718

Non-impaired financing receivables $111,960 $110,825

General reserves 2,950 2,891

Impaired loans 3,220 2,893

Specific reserves 674 680