GE 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

management’s discussion and analsis

GE 2012 ANNUAL REPORT 55

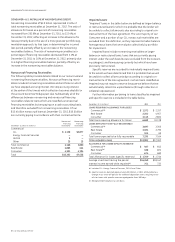

We regularly review our Real Estate loans for impairment using

both quantitative and qualitative factors, such as debt service

coverage and loan-to-value ratios. We classify Real Estate loans

as impaired when the most recent valuation reflects a projected

loan-to-value ratio at maturity in excess of 100%, even if the loan

is currently paying in accordance with contractual terms.

Of our $5.7 billion impaired loans at Real Estate at

December 31, 2012, $5.3 billion are currently paying in accor-

dance with the contractual terms of the loan and are typically

loans where the borrower has adequate debt service coverage to

meet contractual interest obligations. Impaired loans at CLL pri-

marily represent senior secured lending positions.

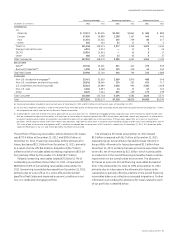

Our impaired loan balance at December 31, 2012 and 2011,

classified by the method used to measure impairment was

as follows.

December 31 (In millions) 2012 2011

METHOD USED TO MEASURE IMPAIRMENT

Discounted cash flow $ 6,704 $ 8,858

Collateral value 7,278 8,444

Total $13,982 $17,302

See Note 1 for additional information.

Our loss mitigation strategy is intended to minimize eco-

nomic loss and, at times, can result in rate reductions, principal

forgiveness, extensions, forbearance or other actions, which

may cause the related loan to be classified as a troubled debt

restructuring (TDR), and also as impaired. Changes to Real

Estate’s loans primarily include maturity extensions, principal

payment acceleration, changes to collateral terms and cash

sweeps, which are in addition to, or sometimes in lieu of, fees and

rate increases. The determination of whether these changes to

the terms and conditions of our commercial loans meet the TDR

criteria includes our consideration of all relevant facts and circum-

stances. At December 31, 2012, TDRs included in impaired loans

were $12.1 billion, primarily relating to Real Estate ($5.1 billion), CLL

($3.9 billion) and Consumer ($3.1 billion).

Real Estate TDRs decreased from $7.0 billion at December 31,

2011 to $5.1 billion at December 31, 2012, primarily driven by

resolution of TDRs through paydowns, restructuring, foreclosures

and write-offs, partially offset by extensions of loans scheduled

to mature during 2012, some of which were classified as TDRs

upon modification. For borrowers with demonstrated operating

capabilities, we work to restructure loans when the cash flow and

projected value of the underlying collateral support repayment

over the modified term. We deem loan modifications to be TDRs

when we have granted a concession to a borrower experiencing

financial difficulty and we do not receive adequate compensa-

tion in the form of an effective interest rate that is at current

market rates of interest given the risk characteristics of the loan

or other consideration that compensates us for the value of the

concession. For the year ended December 31, 2012, we modified

$4.4 billion of loans classified as TDRs, substantially all in our Debt

portfolio. Changes to these loans primarily included maturity

extensions, principal payment acceleration, changes to collateral

or covenant terms and cash sweeps, which are in addition to, or

sometimes in lieu of, fees and rate increases. The limited liquid-

ity and higher return requirements in the real estate market for

loans with higher loan-to-value (LTV) ratios has typically resulted

in the conclusion that the modified terms are not at current mar-

ket rates of interest, even if the modified loans are expected to be

fully recoverable. We received the same or additional compen-

sation in the form of rate increases and fees for the majority of

these TDRs. Of our $4.4 billion of modifications classified as TDRs

in the last twelve months, $0.2 billion have subsequently experi-

enced a payment default.

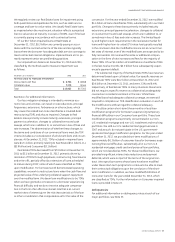

The substantial majority of the Real Estate TDRs have reserves

determined based upon collateral value. Our specific reserves on

Real Estate TDRs were $0.2 billion at December 31, 2012 and

$0.6 billion at December 31, 2011, and were 3.1% and 8.4%,

respectively, of Real Estate TDRs. In many situations these loans

did not require a specific reserve as collateral value adequately

covered our recorded investment in the loan. While these

modified loans had adequate collateral coverage, we were still

required to complete our TDR classification evaluation on each of

the modifications without regard to collateral adequacy.

We utilize certain short-term (three months or less) loan

modification programs for borrowers experiencing temporary

financial difficulties in our Consumer loan portfolio. These loan

modification programs are primarily concentrated in our non-

U.S. residential mortgage and non-U.S. installment and revolving

portfolios. We sold our U.S. residential mortgage business in

2007 and as such, do not participate in the U.S. government-

sponsored mortgage modification programs. For the year ended

December 31, 2012, we provided short-term modifications of

approximately $0.3 billion of consumer loans for borrowers expe-

riencing financial difficulties, substantially all in our non-U.S.

residential mortgage, credit card and personal loan portfolios,

which are not classified as TDRs. For these modified loans, we

provided insignificant interest rate reductions and payment

deferrals, which were not part of the terms of the original con-

tract. We expect borrowers whose loans have been modified

under these short-term programs to continue to be able to meet

their contractual obligations upon the conclusion of the short-

term modification. In addition, we have modified $1.8 billion of

Consumer loans for the year ended December 31, 2012, which

are classified as TDRs. Further information on Consumer impaired

loans is provided in Note 23.

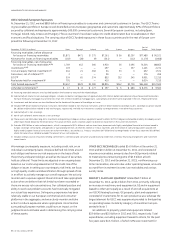

Delinquencies

For additional information on delinquency rates at each of our

major portfolios, see Note 23.