GE 2012 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2012 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112 GE 2012 ANNUAL REPORT

notes to consolidated financial statements

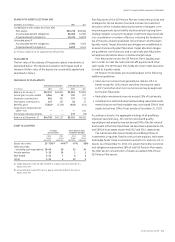

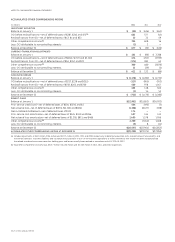

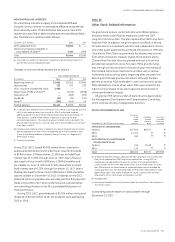

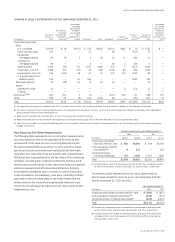

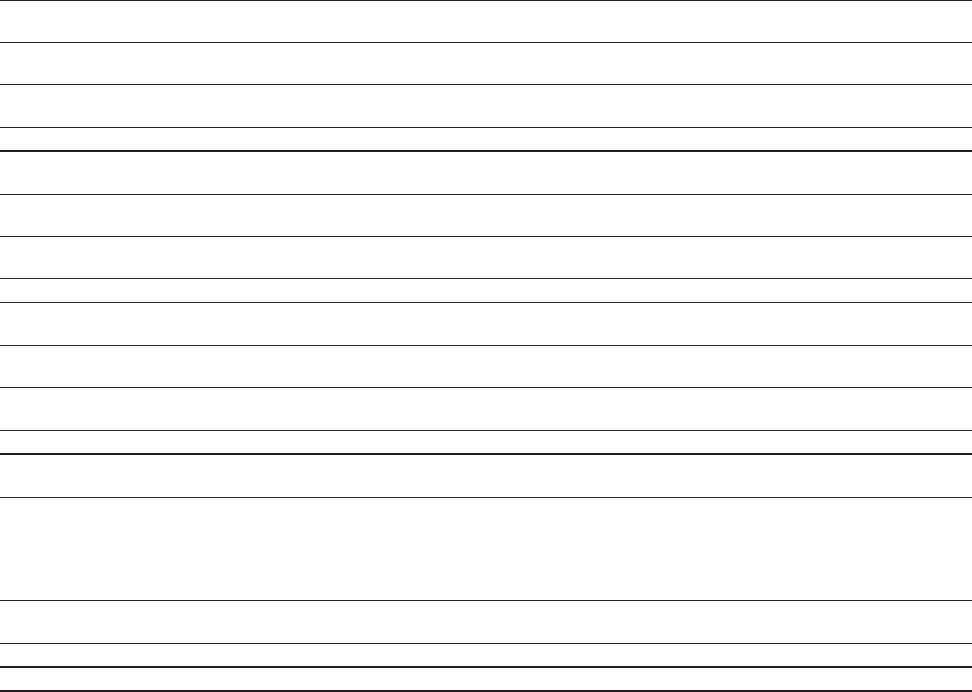

ACCUMULATED OTHER COMPREHENSIVE INCOME

(In millions) 2012 2011 2010

INVESTMENT SECURITIES

Balance at January 1 $ (30) $ (636) $ (652)

OCI before reclassifications—net of deferred taxes of $387, $341 and $72 (a) 683 577 (43)

Reclassifications from OCI—net of deferred taxes of $13, $1 and $32 22 31 59

Other comprehensive income (b) 705 608 16

Less: OCI attributable to noncontrolling interests (2) 2—

Balance at December 31 $ 677 $ (30) $ (636)

CURRENCY TRANSLATION ADJUSTMENTS

Balance at January 1 $ 133 $ (86) $ 3,788

OCI before reclassifications—net of deferred taxes of $(266), $(717) and $3,208 474 (201) (3,939)

Reclassifications from OCI—net of deferred taxes of $54, $357 and $22 (174) 381 63

Other comprehensive income (b) 300 180 (3,876)

Less: OCI attributable to noncontrolling interests 21 (39) (2)

Balance at December 31 $ 412 $ 133 $ (86)

CASH FLOW HEDGES

Balance at January 1 $ (1,176) $ (1,280) $ (1,734)

OCI before reclassifications—net of deferred taxes of $217, $238 and $(515) (127) (860) (552)

Reclassifications from OCI—net of deferred taxes of $(70), $202 and $706 580 978 1,057

Other comprehensive income (b) 453 118 505

Less: OCI attributable to noncontrolling interests (1) 14 51

Balance at December 31 $ (722) $ (1,176) $ (1,280)

BENEFIT PLANS

Balance at January 1 $(22,901) $(15,853) $(16,932)

Prior service credit (cost)—net of deferred taxes of $304, $(276) and $1 534 (495) (3)

Net actuarial loss—net of deferred taxes of $(574), $(4,746) and $(261) (1,396) (8,637) (498)

Net curtailment/settlement—net of deferred taxes of $123 174 ——

Prior service cost amortization—net of deferred taxes of $326, $341 and $346 497 514 513

Net actuarial loss amortization—net of deferred taxes of $1,278, $811 and $486 2,490 1,578 1,056

Other comprehensive income (b) 2,299 (7,040) 1,068

Less: OCI attributable to noncontrolling interests (5) 8(11)

Balance at December 31 $(20,597) $(22,901) $(15,853)

ACCUMULATED OTHER COMPREHENSIVE INCOME AT DECEMBER 31 $(20,230) $(23,974) $(17,855)

(a) Includes adjustments of $527 million, $786 million and $1,171 million in 2012, 2011 and 2010, respectively, to deferred acquisition costs, present value of future profits, and

investment contracts, insurance liabilities and insurance annuity benefits in our run-off insurance operations to reflect the effects that would have been recognized had

the related unrealized investment securities holding gains and losses actually been realized in accordance with ASC 320-10-S99-2.

(b) Total other comprehensive income was $3,757 million, $(6,134) million and $(2,287) million in 2012, 2011 and 2010, respectively.