GE 2012 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2012 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.management’s discussion and analsis

GE 2012 ANNUAL REPORT 45

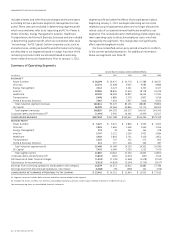

GE Capital revenues decreased 6% and net earnings increased

12% in 2012 as compared with 2011. Revenues for 2012 included

$0.1 billion from acquisitions and were reduced by $0.6 billion as

a result of dispositions. Revenues also decreased as a result of

organic revenues declines, primarily due to lower ENI, the stron-

ger U.S. dollar, and the absence of the 2011 gain on sale of a

substantial portion of our Garanti Bank equity investment (the

Garanti Bank transaction). Net earnings increased by $0.8 billion

in 2012, primarily due to lower impairments and core increases,

including higher tax benefits, partially offset by the absence of

the 2011 gain on the Garanti Bank transaction and operations.

GE Capital net earnings in 2012 also included restructuring,

rationalization and other charges of $0.1 billion and net losses

of $0.2 billion related to our Treasury operations. GE Capital

net earnings excluded $0.1 billion of preferred stock dividends

declared in 2012.

GE Capital revenues decreased 2% and net earnings

increased favorably in 2011 as compared with 2010. Revenues

for 2011 and 2010 included $0.3 billion and $0.2 billion, respec-

tively, from acquisitions and were reduced by $1.1 billion and

$2.3 billion, respectively, as a result of dispositions. Revenues also

increased as a result of the gain on the Garanti Bank transaction,

the weaker U.S. dollar and higher gains and investment income,

partially offset by reduced revenues from lower ENI. Net earnings

increased by $3.5 billion in 2011, primarily due to lower provi-

sions for losses on financing receivables, the gain on the Garanti

Bank transaction and lower impairments. GE Capital net earn-

ings in 2011 also included restructuring, rationalization and other

charges of $0.1 billion and net losses of $0.2 billion related to our

Treasury operations.

Additional information about certain GE Capital busi -

nesses follows.

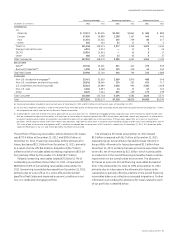

CLL 2012 revenues decreased 7% and net earnings decreased

11% compared with 2011. Revenues were reduced by $0.4 billion

as a result of dispositions. Revenues also decreased as a result

of organic revenue declines ($0.6 billion), primarily due to lower

ENI ($0.6 billion), and the stronger U.S. dollar ($0.3 billion). Net

earnings decreased reflecting core decreases ($0.2 billion) and

dispositions ($0.1 billion).

CLL 2011 revenues decreased 1% and net earnings increased

75% compared with 2010. Revenues decreased as a result of

organic revenue declines ($1.1 billion), primarily due to lower

ENI, partially offset by the weaker U.S. dollar ($0.5 billion) and

higher gains and investment income ($0.4 billion). Net earnings

increased in 2011, reflecting lower provisions for losses on financ-

ing receivables ($0.6 billion), higher gains and investment income

($0.3 billion), core increases ($0.2 billion) and lower impairments

($0.1 billion).

Consumer 2012 revenues decreased 7% and net earnings

decreased 13% compared with 2011. Revenues included $0.1 bil-

lion from acquisitions and were reduced by $0.1 billion as a result

of dispositions. Revenues in 2012 also decreased as a result of

the absence of the 2011 gain on the Garanti Bank transaction

($0.7 billion), the stronger U.S. dollar ($0.4 billion) and organic rev-

enue declines ($0.2 billion). The decrease in net earnings resulted

primarily from the absence of the 2011 gain on the Garanti Bank

transaction and operations ($0.4 billion), dispositions ($0.1 billion)

and core decreases, which included higher provisions for losses

on financing receivables ($0.2 billion). The higher provisions for

losses on financing receivables reflected the use of a more granu-

lar portfolio segmentation approach, by loss type, in determining

the incurred loss period in our U.S. Installment and Revolving

Credit portfolio.

Consumer 2011 revenues decreased 2% and net earnings

increased 41% compared with 2010. Revenues included $0.3 bil-

lion from acquisitions and were reduced by $0.4 billion as a result

of dispositions. Revenues in 2011 also decreased $0.3 billion as a

result of organic revenue declines ($1.4 billion), primarily due to

lower ENI, and higher impairments ($0.1 billion), partially offset by

the gain on the Garanti Bank transaction ($0.7 billion), the weaker

U.S. dollar ($0.5 billion) and higher gains ($0.1 billion). The increase

in net earnings resulted primarily from lower provisions for losses

on financing receivables ($1.0 billion), the gain on the Garanti

Bank transaction ($0.3 billion), acquisitions ($0.1 billion) and the

weaker U.S. dollar ($0.1 billion), partially offset by lower Garanti

results ($0.2 billion), and core decreases ($0.2 billion).

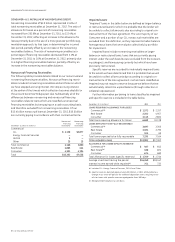

Real Estate 2012 revenues decreased 2% and net earnings

were favorable compared with 2011. Revenues decreased as a

result of organic revenue declines ($0.2 billion), primarily due to

lower ENI, and the stronger U.S. dollar ($0.1 billion), partially off-

set by increases in net gains on property sales ($0.2 billion). Real

Estate net earnings increased as a result of lower impairments

($0.7 billion), core increases ($0.7 billion) including higher tax

benefits of $0.5 billion, lower provisions for losses on financing

receivables ($0.2 billion) and increases in net gains on property

sales ($0.1 billion). Depreciation expense on real estate equity

investments totaled $0.8 billion and $0.9 billion in 2012 and

2011, respectively.

Real Estate 2011 revenues decreased 1% and net earnings

increased 47% compared with 2010. Revenues decreased as

organic revenue declines ($0.4 billion), primarily due to lower

ENI, were partially offset by increases in net gains on property

sales ($0.2 billion) and the weaker U.S. dollar ($0.1 billion). Real

Estate net earnings increased compared with 2010, as lower

impairments ($0.7 billion), a decrease in provisions for losses

on financing receivables ($0.4 billion) and increases in net gains

on property sales ($0.2 billion) were partially offset by core

declines ($0.4 billion). Depreciation expense on real estate equity

investments totaled $0.9 billion and $1.0 billion in 2011 and

2010, respectively.