GE 2012 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2012 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102 GE 2012 ANNUAL REPORT

notes to consolidated financial statements

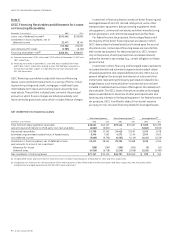

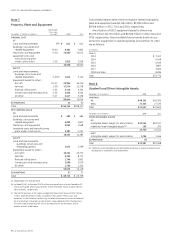

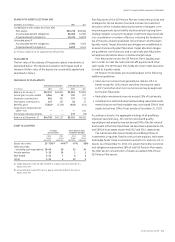

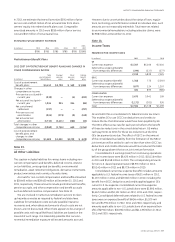

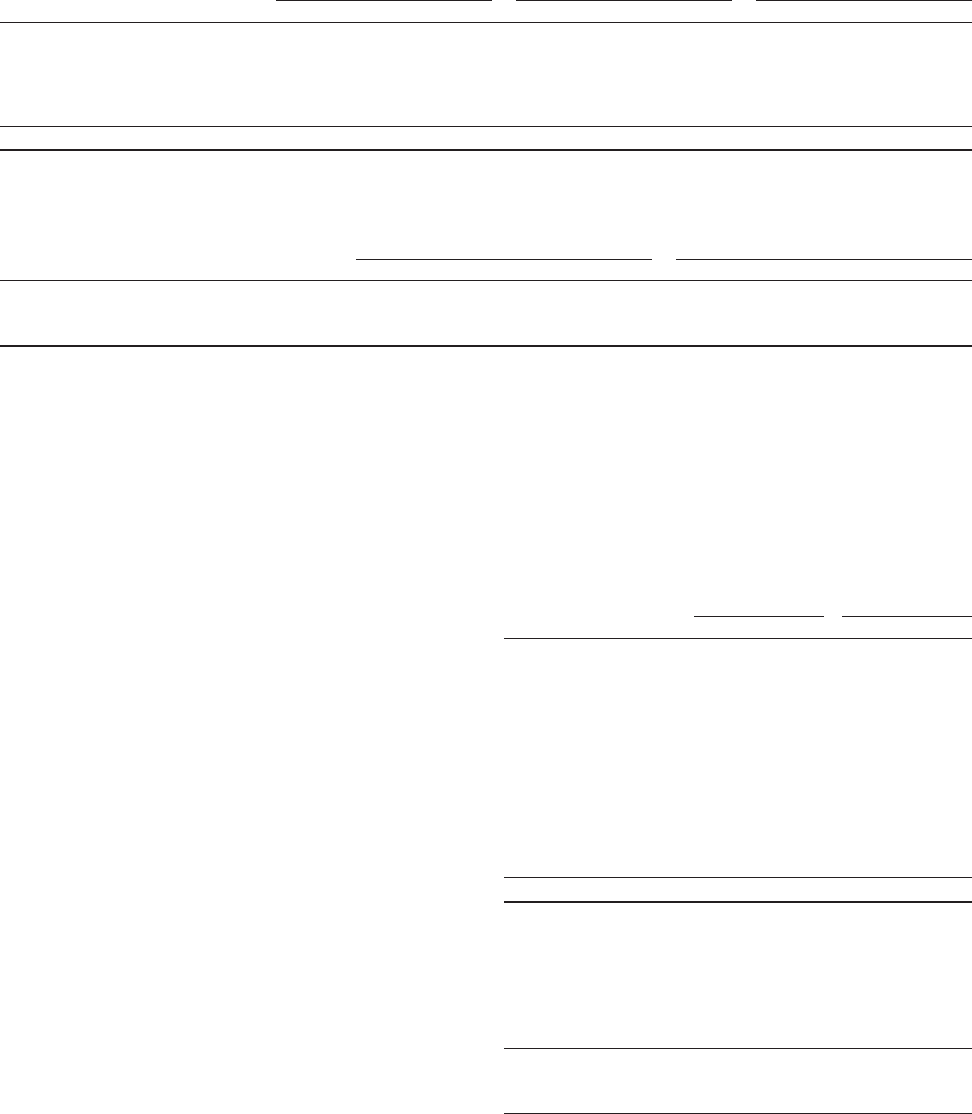

COST OF PENSION PLANS

Total Principal pension plans Other pension plans

(In millions) 2012 2011 2010 2012 2011 2010 2012 2011 2010

Service cost for benefits earned $ 1,779 $ 1,498 $ 1,426 $ 1,387 $ 1,195 $ 1,149 $ 392 $ 303 $ 277

Prior service cost amortization 287 207 252 279 194 238 813 14

Expected return on plan assets (4,394) (4,543) (4,857) (3,768) (3,940) (4,344) (626) (603) (513)

Interest cost on benefit obligations 2,993 3,176 3,179 2,479 2,662 2,693 514 514 486

Net actuarial loss amortization 3,701 2,486 1,546 3,421 2,335 1,336 280 151 210

Pension plans cost $ 4,366 $ 2,824 $ 1,546 $ 3,798 $ 2,446 $ 1,072 $ 568 $ 378 $ 474

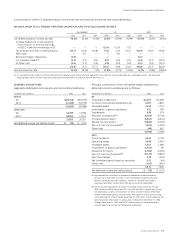

ACTUARIAL ASSUMPTIONS are described below. The actuarial assumptions at December 31 are used to measure the year-end benefit

obligations and the pension costs for the subsequent year.

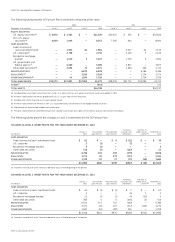

Principal pension plans Other pension plans (weighted average)

December 31 2012 2011 2010 2009 2012 2011 2010 2009

Discount rate 3.96% 4.21% 5.28% 5.78% 3.92% 4.42% 5.11% 5.31%

Compensation increases 3.90 3.75 4.25 4.20 3.30 4.31 4.44 4.56

Expected return on assets 8.00 8.00 8.00 8.50 6.82 7.09 7.25 7.29

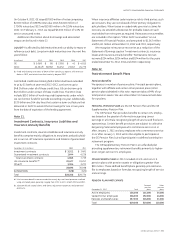

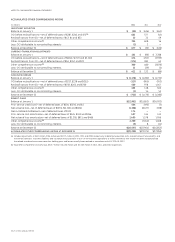

To determine the expected long-term rate of return on pension

plan assets, we consider current and target asset allocations,

as well as historical and expected returns on various categories

of plan assets. In developing future return expectations for our

principal pension plans’ assets, we formulate views on the future

economic environment, both in the U.S. and abroad. We evalu-

ate general market trends and historical relationships among a

number of key variables that impact asset class returns such as

expected earnings growth, inflation, valuations, yields and spreads,

using both internal and external sources. We also take into account

expected volatility by asset class and diversification across classes

to determine expected overall portfolio results given current and

target allocations. Based on our analysis of future expectations

of asset performance, past return results, and our current and

target asset allocations, we have assumed an 8.0% long-term

expected return on those assets for cost recognition in 2013. For

the principal pension plans, we apply our expected rate of return to

a market-related value of assets, which stabilizes variability in the

amounts to which we apply that expected return.

We amortize experience gains and losses, as well as the effects

of changes in actuarial assumptions and plan provisions, over a

period no longer than the average future service of employees.

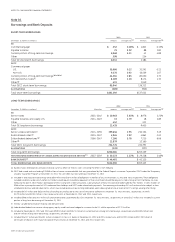

FUNDING POLICY for the GE Pension Plan is to contribute amounts

sufficient to meet minimum funding requirements as set forth in

employee benefit and tax laws plus such additional amounts as

we may determine to be appropriate. We contributed $433 mil-

lion to the GE Pension Plan in 2012. The ERISA minimum funding

requirements do not require a contribution in 2013. In addi-

tion, we expect to pay approximately $230 million for benefit

payments under our GE Supplementary Pension Plan and admin-

istrative expenses of our principal pension plans and expect to

contribute approximately $735 million to other pension plans

in 2013. In 2012, comparative amounts were $209 million and

$737 million, respectively.

BENEFIT OBLIGATIONS are described in the following tables.

Accumulated and projected benefit obligations (ABO and PBO)

represent the obligations of a pension plan for past service

as of the measurement date. ABO is the present value of ben-

efits earned to date with benefits computed based on current

compensation levels. PBO is ABO increased to reflect expected

future compensation.

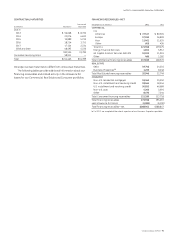

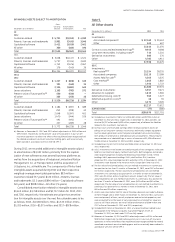

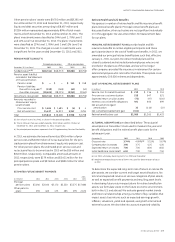

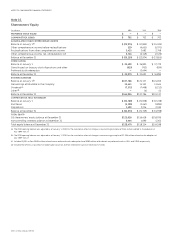

PROJECTED BENEFIT OBLIGATION

Principal pension plans Other pension plans

(In millions) 2012 2011 2012 2011

Balance at January 1 $60,510 $51,999 $11,637 $ 9,907

Service cost for benefits

earned 1,387 1,195 392 303

Interest cost on benefit

obligations 2,479 2,662 514 514

Participant contributions 157 167 16 37

Plan amendments —804 (6) (58)

Actuarial loss (a) 2,021 6,803 890 1,344

Benefits paid (3,052) (3,120) (425) (424)

Acquisitions (dispositions)/

other—net ——230 122

Exchange rate adjustments ——336 (108)

Balance at December 31 (b) $63,502 $60,510 $13,584 $11,637

(a) Principally associated with discount rate changes.

(b) The PBO for the GE Supplementary Pension Plan, which is an unfunded plan, was

$5,494 million and $5,203 million at year-end 2012 and 2011, respectively.

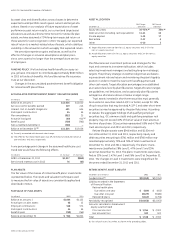

ACCUMULATED BENEFIT OBLIGATION

December 31 (In millions) 2012 2011

GE Pension Plan $55,664 $53,040

GE Supplementary Pension Plan 4,114 3,643

Other pension plans 12,687 10,722