GE 2012 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2012 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

124 GE 2012 ANNUAL REPORT

notes to consolidated financial statements

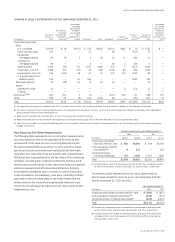

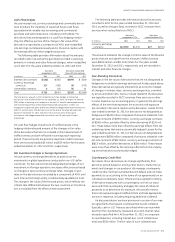

$10,352 million, of which $5,125 million was cash and $5,227 mil-

lion was in the form of securities held by a custodian for our

benefit. Under certain of these same agreements, we post col-

lateral to our counterparties for our derivative obligations, the fair

value of which was $391 million at December 31, 2012.

Additionally, our master agreements typically contain

mutual downgrade provisions that provide the ability of each

party to require termination if the long-term credit rating of the

counterparty were to fall below A-/A3. In certain of these master

agreements, each party also has the ability to require termina-

tion if the short-term rating of the counterparty were to fall below

A-1/P-1. The net amount relating to our derivative liability sub-

ject to these provisions, after consideration of collateral posted

by us, and outstanding interest payments, was $337 million at

December 31, 2012.

Note 23.

Supplemental Information about the Credit Quality

of Financing Receivables and Allowance for Losses on

Financing Receivables

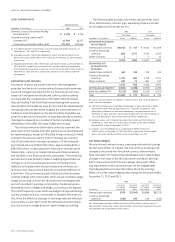

We provide further detailed information about the credit

quality of our Commercial, Real Estate and Consumer financing

receivables portfolios. For each portfolio, we describe the char-

acteristics of the financing receivables and provide information

about collateral, payment performance, credit quality indicators,

and impairment. We manage these portfolios using delinquency

and nonearning data as key performance indicators. The cat-

egories used within this section such as impaired loans, TDR and

nonaccrual financing receivables are defined by the authoritative

guidance and we base our categorization on the related scope

and definitions contained in the related standards. The categories

of nonearning and delinquent are defined by us and are used in

our process for managing our financing receivables. Definitions

of these categories are provided in Note 1.

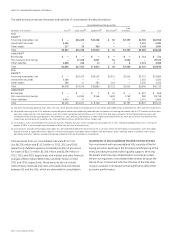

Commercial

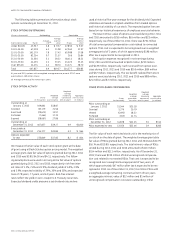

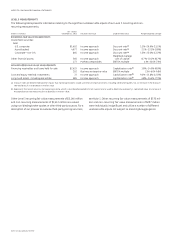

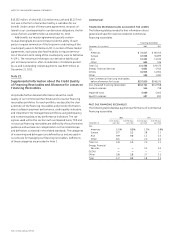

FINANCING RECEIVABLES AND ALLOWANCE FOR LOSSES

The following table provides further information about

general and specific reserves related to Commercial

financing receivables.

Financing receivables

December 31 (In millions) 2012 2011

CLL

Americas $ 72,517 $ 80,505

Europe 37,035 36,899

Asia 11,401 11,635

Other 605 436

Total CLL 121,558 129,475

Energy Financial Services 4,851 5,912

GECAS 10,915 11,901

Other 486 1,282

Total Commercial financing receivables,

before allowance for losses $137,810 $148,570

Non-impaired financing receivables $132,741 $142,908

General reserves 554 718

Impaired loans 5,069 5,662

Specific reserves 487 812

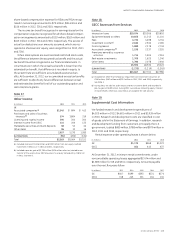

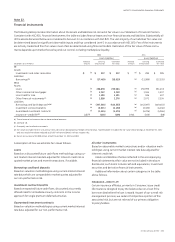

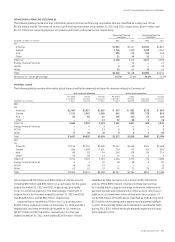

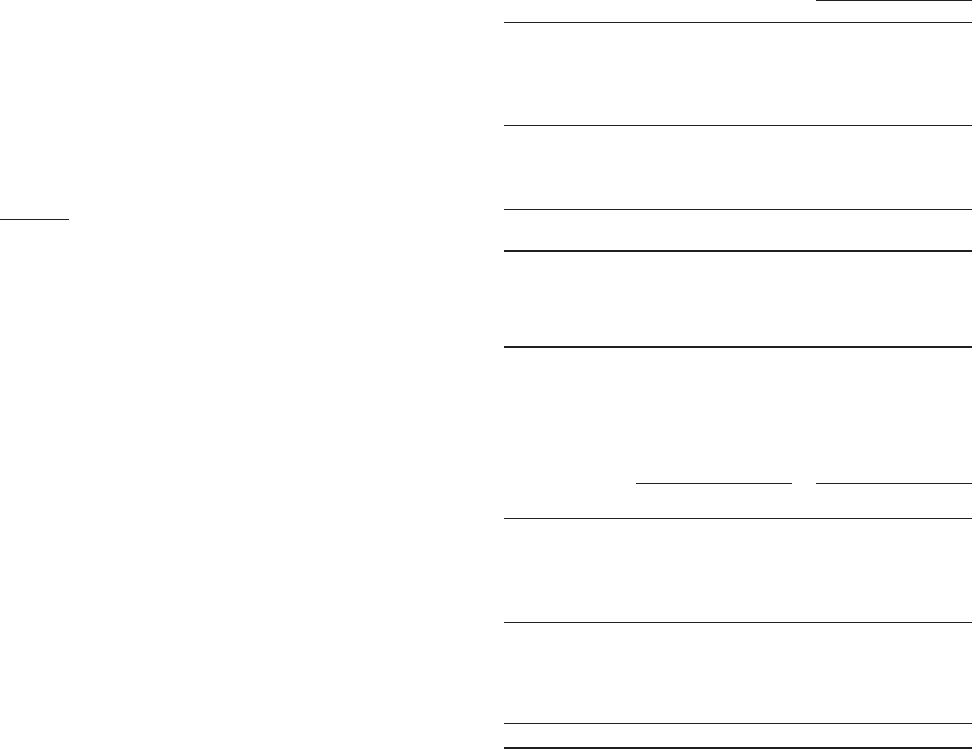

PAST DUE FINANCING RECEIVABLES

The following table displays payment performance of Commercial

financing receivables.

2012 2011

December 31

Over 30 days

past due

Over 90 days

past due

Over 30 days

past due

Over 90 days

past due

CLL

Americas 1.1% 0.5% 1.3% 0.8%

Europe 3.7 2.1 3.8 2.1

Asia 0.9 0.6 1.3 1.0

Other 0.1 — 2.0 0.1

Total CLL 1.9 1.0 2.0 1.2

Energy Financial

Services ——0.3 0.3

GECAS ————

Other 2.8 2.8 3.7 3.5

Total 1.7 0.9 1.8 1.1