GE 2012 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2012 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GE 2012 ANNUAL REPORT 131

notes to consolidated financial statements

Note 24.

Variable Interest Entities

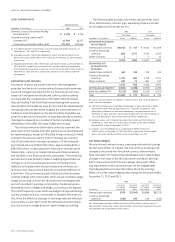

We use variable interest entities primarily to securitize finan-

cial assets and arrange other forms of asset-backed financing in

the ordinary course of business. Except as noted below, inves-

tors in these entities only have recourse to the assets owned by

the entity and not to our general credit. We do not have implicit

support arrangements with any VIE. We did not provide non-

contractual support for previously transferred financing receiv-

ables to any VIE in 2012 or 2011.

In evaluating whether we have the power to direct the activities

of a VIE that most significantly impact its economic performance, we

consider the purpose for which the VIE was created, the importance

of each of the activities in which it is engaged and our decision-

making role, if any, in those activities that significantly determine

the entity’s economic performance as compared to other economic

interest holders. This evaluation requires consideration of all facts

and circumstances relevant to decision-making that affects the enti-

ty’s future performance and the exercise of professional judgment in

deciding which decision-making rights are most important.

In determining whether we have the right to receive benefits

or the obligation to absorb losses that could potentially be signifi-

cant to the VIE, we evaluate all of our economic interests in the

entity, regardless of form (debt, equity, management and servic-

ing fees, and other contractual arrangements). This evaluation

considers all relevant factors of the entity’s design, including: the

entity’s capital structure, contractual rights to earnings (losses),

subordination of our interests relative to those of other investors,

contingent payments, as well as other contractual arrangements

that have potential to be economically significant. The evalua-

tion of each of these factors in reaching a conclusion about the

potential significance of our economic interests is a matter that

requires the exercise of professional judgment.

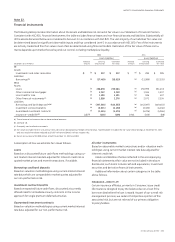

Consolidated Variable Interest Entities

We consolidate VIEs because we have the power to direct the

activities that significantly affect the VIEs economic performance,

typically because of our role as either servicer or manager for the

VIE. Our consolidated VIEs fall into three main groups, which are

further described below:

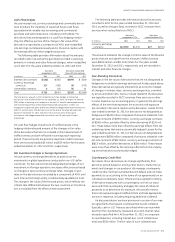

Þ Trinity comprises two consolidated entities that hold investment

securities, the majority of which are investment grade, and were

funded by the issuance of GICs. The GICs included conditions

under which certain holders could require immediate repay-

ment of their investment should the long-term credit ratings

of GECC fall below AA-/Aa3 or the short-term credit ratings fall

below A-1+/P-1. Following the April 3, 2012 Moody’s downgrade

of GECC’s long-term credit rating to A1, substantially all of these

GICs became redeemable by their holders. In 2012, holders of

$1,981 million in principal amount of GICs redeemed their hold-

ings. The redemption was funded primarily through advances

from GECC. The remaining outstanding GICs will continue to be

subject to their scheduled maturities and individual terms, which

may include provisions permitting redemption upon a down-

grade of one or more of GECC’s ratings, among other things.

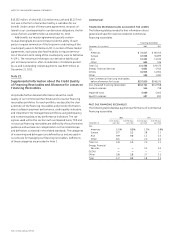

Þ Consolidated securitization entities (CSEs) comprise primarily

our previously unconsolidated QSPEs that were consolidated

on January 1, 2010 in connection with our adoption of ASU

2009-16 & 17. These entities were created to facilitate secu-

ritization of financial assets and other forms of asset-backed

financing, which serve as an alternative funding source by

providing access to variable funding notes and term markets.

The securitization transactions executed with these enti-

ties are similar to those used by many financial institutions

and substantially all are non-recourse. We provide servicing

for substantially all of the assets in these entities.

The financing receivables in these entities have similar risks

and characteristics to our other financing receivables and

were underwritten to the same standard. Accordingly, the

performance of these assets has been similar to our other

financing receivables; however, the blended performance of

the pools of receivables in these entities reflects the eligibil-

ity criteria that we apply to determine which receivables are

selected for transfer. Contractually the cash flows from these

financing receivables must first be used to pay third-party

debt holders as well as other expenses of the entity. Excess

cash flows are available to GE. The creditors of these entities

have no claim on other assets of GE.

Þ Other remaining assets and liabilities of consolidated VIEs

relate primarily to three categories of entities: (1) joint ven-

tures that lease light industrial equipment of $1,438 million

of assets and $836 million of liabilities; (2) other entities that

are involved in power generating and leasing activities of

$891 million of assets and no liabilities; and (3) insurance enti-

ties that, among other lines of business, provide property

and casualty and workers’ compensation coverage for GE of

$1,193 million of assets and $588 million of liabilities.