GE 2012 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2012 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

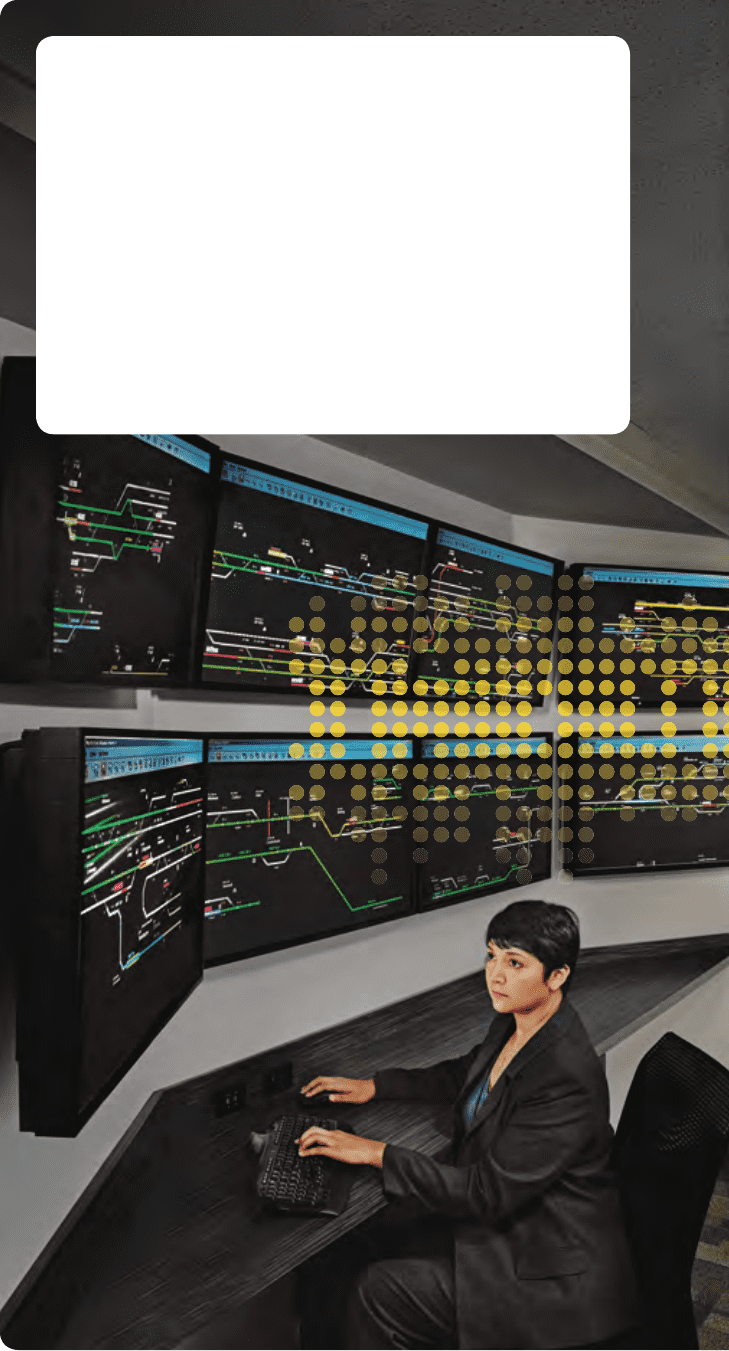

DRIVING THE INDUSTRIAL INTERNET Our Rail Optimization

Solutions help railroads move freight faster and more cost-

effectively. The RailConnect Transportation Management System

and Movement Planner System help railroads analyze critical

information in real time to plan and optimize business outcomes,

operations and asset utilization. These intelligent solutions deliver

real efficiencies: Norfolk Southern, a major Movement Planner

customer, estimates that every 1 mph increase in network speed

saves an estimated $200 million in annual capital and operating

expenses. In 2012, we expanded our Optimization Solutions portfolio

by acquiring RMI, a leading supplier of transportation management

systems used by railroads across North America to manage

operations, improve information flow, increase productivity

and reduce cost.

industrial segment organic revenue

growth was 8% and margins grew by

30 basis points, both metrics compar-

ing favorably to peers. Growth was

broad-based; all of our reported seg-

ments grew earnings for the first time

since 2006. We finished the year with

$210 billion of backlog, a record for

the Company.

We grow our industrial businesses

by pulling the same “levers.” We lead

with technology, invest in fast-growth

markets, drive value in the installed

base, invest in adjacencies and

grow margins.

Oil & Gas is our fastest-growing busi-

ness, with revenue of $15 billion and

earnings growing 16%. We compete

in high-growth markets. We are

investing to launch new products fully

utilizing our broad technical capabil-

ity. For instance, we launched the first

subsea compressor at Statoil, creat-

ing an industry-leading position. Our

orders grew by 16% in the year, and

we are winning new business around

the world.

Our Power & Water business grew

earnings by 8% in 2012, and we expect

to be about flat in 2013. We are well-

positioned for long-term growth in

natural gas power generation, distrib-

uted power, and services. However,

Wind power generation—where GE

leads—is more volatile. We had a very

strong year in 2012 but, due to U.S.

regulatory uncertainty, this year will

be difficult. Based on strong global

demand with expanding service,

we expect Power & Water growth to

resume in 2014.

Over the next few years, we see

earnings upside by improving

our performance in markets like

PICTURED: Rachna Pitts, Norfolk Southern

10 GE 2012 ANNUAL REPORT

LETTER TO SHAREOWNERS