GE 2012 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2012 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104 GE 2012 ANNUAL REPORT

notes to consolidated financial statements

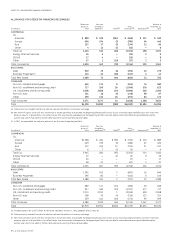

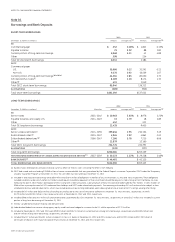

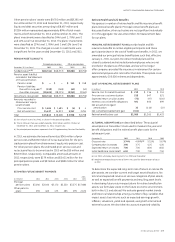

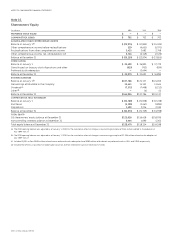

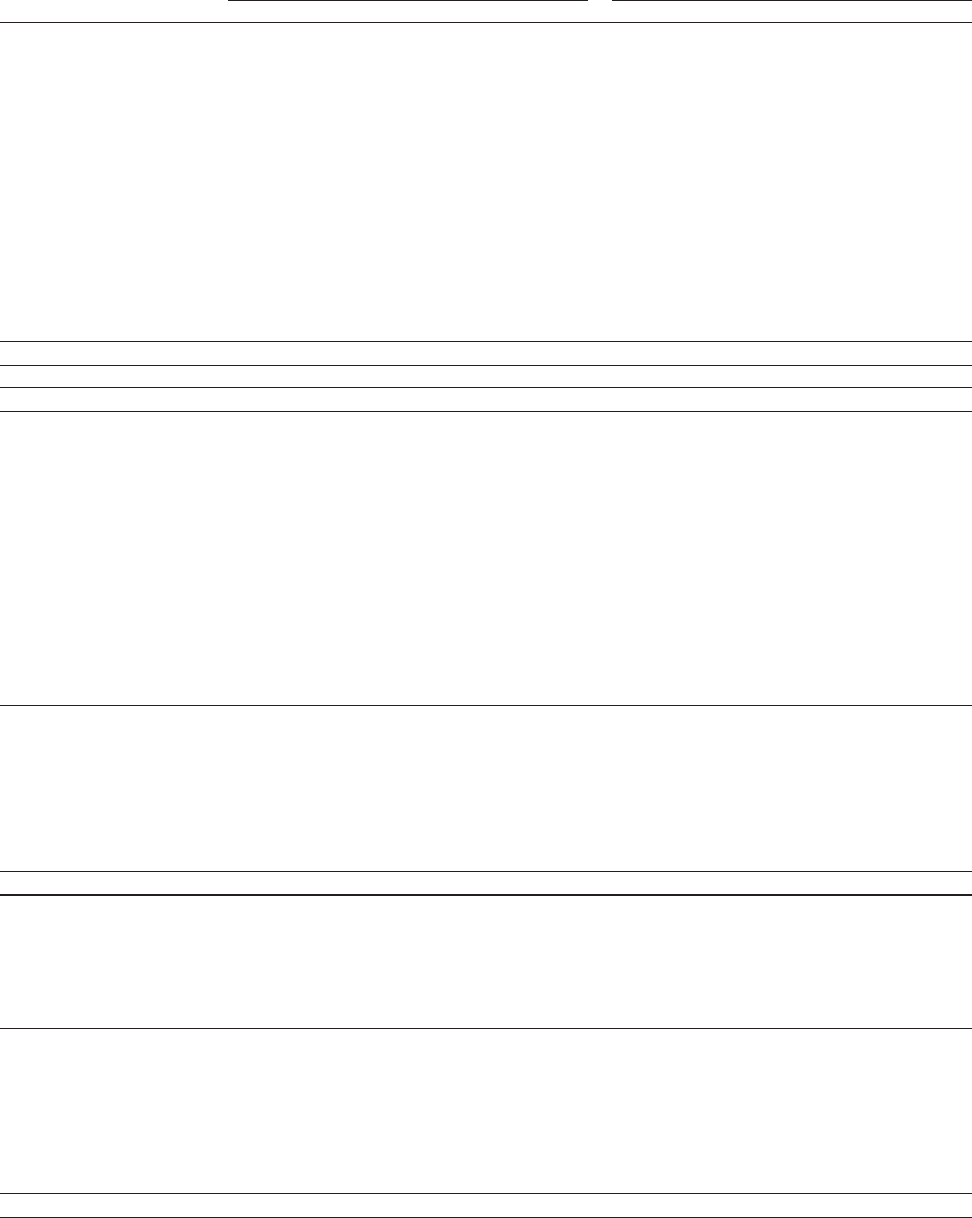

The following table presents GE Pension Plan investments measured at fair value.

2012 2011

December 31 (In millions) Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3 Total

EQUITY SECURITIES

U.S. equity securities (a) $ 8,876 $ 2,462 $ — $11,338 $10,645 $ 191 $ — $10,836

Non-U.S. equity

securities (a) 6,699 1,644 — 8,343 7,360 644 — 8,004

DEBT SECURITIES

Fixed income and

cash investment funds — 1,931 50 1,981 — 2,057 62 2,119

U.S. corporate (b) — 2,758 — 2,758 — 2,126 3 2,129

Residential mortgage-

backed — 1,420 3 1,423 — 1,276 5 1,281

U.S. government and

federal agency (c) — 5,489 — 5,489 — 3,872 — 3,872

Other debt securities (d) — 2,053 22 2,075 — 1,566 146 1,712

PRIVATE EQUITIES

(a) — — 6,878 6,878 — — 6,786 6,786

REAL ESTATE

(a) — — 3,356 3,356 — — 3,274 3,274

OTHER INVESTMENTS

(e) — 44 1,694 1,738 — — 1,709 1,709

TOTAL INVESTMENTS $15,575 $17,801 $12,003 45,379 $18,005 $11,732 $11,985 41,722

OTHER (f) (641) 415

TOTAL ASSETS $44,738 $42,137

(a) Included direct investments and investment funds. U.S. equity and non-U.S. equity investment funds were added in 2012.

(b) Primarily represented investment grade bonds of U.S. issuers from diverse industries.

(c) Included short-term investments to meet liquidity needs.

(d) Primarily represented investments in non-U.S. corporate bonds and commercial mortgage-backed securities.

(e) Substantially all represented hedge fund investments.

(f) Primarily represented net unsettled transactions related to purchases and sales of investments and accrued income receivables.

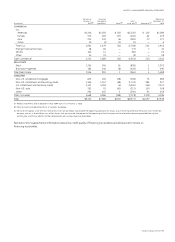

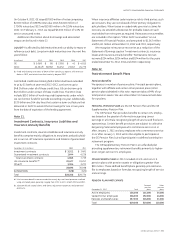

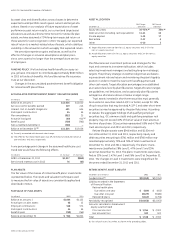

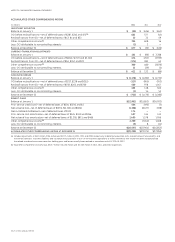

The following tables present the changes in Level 3 investments for the GE Pension Plan.

CHANGES IN LEVEL 3 INVESTMENTS FOR THE YEAR ENDED DECEMBER 31, 2012

(In millions)

January 1,

2012

Net realized

gains (losses)

Net unrealized

gains (losses)

Purchases,

issuances and

settlements

Transfers in

and/or out of

Level 3 (a) December 31,

2012

DEBT SECURITIES

Fixed income and cash investment funds $ 62 $ — $ 9 $ (21) $ — $ 50

U.S. corporate 3(1)—(2)——

Residential mortgage-backed 5 (2) — — — 3

Other debt securities 146 (2) — (122) — 22

PRIVATE EQUITIES 6,786 133 438 (479) — 6,878

REAL ESTATE 3,274 20 279 (217) — 3,356

OTHER INVESTMENTS 1,709 32 72 (71) (48) 1,694

$11,985 $180 $798 $(912) $ (48) $12,003

(a) Transfers in and out of Level 3 are considered to occur at the beginning of the period.

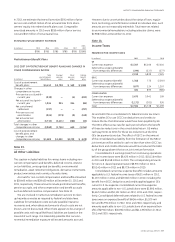

CHANGES IN LEVEL 3 INVESTMENTS FOR THE YEAR ENDED DECEMBER 31, 2011

(In millions)

January 1,

2011

Net realized

gains (losses)

Net unrealized

gains (losses)

Purchases,

issuances and

settlements

Transfers in

and/or out of

Level 3 (a) December 31,

2011

DEBT SECURITIES

Fixed income and cash investment funds $ 65 $ (1) $ (4) $ 2 $ — $ 62

U.S. corporate 5 — — (5) 3 3

Residential mortgage-backed 21 (1) (1) (4) (10) 5

Other debt securities 283 4 6 (145) (2) 146

PRIVATE EQUITIES 6,014 311 701 (240) — 6,786

REAL ESTATE 3,373 (70) 320 (217) (132) 3,274

OTHER INVESTMENTS 1,687 (41) (87) 150 — 1,709

$11,448 $202 $935 $(459) $(141) $11,985

(a) Transfers in and out of Level 3 are considered to occur at the beginning of the period.