GE 2012 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2012 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.management’s discussion and analsis

36 GE 2012 ANNUAL REPORT

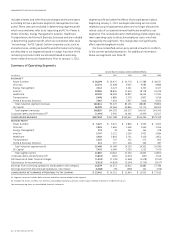

Significant matters relating to our Statement of Earnings are

explained below.

GE SALES OF PRODUCT SERVICES were $43.4 billion in 2012, an

increase of 4% compared with 2011, and operating profit from

product services was $12.5 billion in 2012, an increase of 6%

compared with 2011. Both the sales and operating profit of prod-

uct services increases were at Power & Water, Oil & Gas,

Transportation and Energy Management. GE sales of product

services were $41.9 billion in 2011, an increase of 14% compared

with 2010, and operating profit from product services was

$11.8 billion in 2011, an increase of 15% compared with 2010.

Both the sales and operating profit of product services increases

were at Oil & Gas, Energy Management, Aviation, Transportation

and Healthcare.

POSTRETIREMENT BENEFIT PLANS costs were $5.5 billion, $4.1 bil-

lion and $3.0 billion in 2012, 2011 and 2010, respectively. Costs

increased in 2012 primarily due to the continued amortization of

2008 investment losses and the effects of lower discount rates

(principal pension plans discount rate decreased from 5.28% at

December 31, 2010 to 4.21% at December 31, 2011). Costs

increased in 2011 primarily due to the continued amortization of

2008 investment losses and the effects of lower discount rates

(principal pension plans discount rate decreased from 5.78% at

December 31, 2009 to 5.28% at December 31, 2010).

Our discount rate for our principal pension plans at

December 31, 2012 was 3.96%, which reflected current histori-

cally low interest rates. Considering the current and target asset

allocations, as well as historical and expected returns on various

categories of assets in which our plans are invested, we have

assumed that long-term returns on our principal pension plan

assets will be 8.0% for cost recognition in 2013, compared to

8.0% in both 2012 and 2011 and 8.5% in 2010. GAAP provides for

recognition of differences between assumed and actual returns

over a period no longer than the average future service of

employees. See the Critical Accounting Estimates section for

additional information.

We expect the costs of our postretirement benefits to

increase in 2013 by approximately $0.4 billion as compared to

2012, primarily because of the effects of additional 2008 invest-

ment loss amortization and lower discount rates. Based on our

current assumptions, we expect that loss amortization related to

our principal pension plans will peak in 2013 and, as a result, our

postretirement benefits costs should decline in 2014.

Pension expense for our principal pension plans on a GAAP

basis was $3.8 billion, $2.4 billion and $1.1 billion in 2012, 2011

and 2010, respectively. Operating pension costs (non-GAAP) for

these plans were $1.7 billion in 2012 and $1.4 billion in both 2011

and 2010. Operating earnings include service cost and prior ser-

vice cost amortization for our principal pension plans as these

costs represent expenses associated with employee service.

Operating earnings exclude non-operating pension costs/

income such as interest cost, expected return on plan assets and

non-cash amortization of actuarial gains and losses. Operating

pension costs increased in 2012 primarily due to the effects of

lower discount rates and additional prior service cost amortiza-

tion resulting from 2011 union negotiations. We expect operating

pension costs for these plans will be about $1.7 billion in 2013.

The GE Pension Plan was underfunded by $13.3 billion at the

end of 2012 as compared to $13.2 billion at December 31, 2011.

The GE Supplementary Pension Plan, which is an unfunded plan,

had projected benefit obligations of $5.5 billion and $5.2 billion

at December 31, 2012 and 2011, respectively. Our underfund-

ing at year-end 2012 was relatively consistent with 2011 as the

effects of lower discount rates and liability growth were primar-

ily offset by higher investment returns (11.7% return in 2012).

Our principal pension plans discount rate decreased from 4.21%

at December 31, 2011 to 3.96% at December 31, 2012, which

increased the pension benefit obligation at year-end 2012 by

approximately $2.0 billion. A 100 basis point increase in our pen-

sion discount rate would decrease the pension benefit obligation

at year-end by approximately $7.4 billion. Our GE Pension Plan

assets increased from $42.1 billion at the end of 2011 to $44.7 bil-

lion at December 31, 2012, primarily driven by higher investment

returns that were partially offset by benefit payments made dur-

ing the year. Assets of the GE Pension Plan are held in trust, solely

for the benefit of Plan participants, and are not available for gen-

eral company operations.

On July 6, 2012, the U.S. Government enacted the “Moving

Ahead for Progress in the 21st Century Act,” which contained

provisions that changed the interest rate methodology used

to calculate Employee Retirement Income Security Act (ERISA)

minimum pension funding requirements in the U.S. This change

reduced our near-term annual cash funding requirements for the

GE Pension Plan. We contributed $0.4 billion to the GE Pension

Plan in 2012. We are not required to contribute to the GE Pension

Plan in 2013.

On an ERISA basis, our preliminary estimate is that the GE

Pension Plan was approximately 100% funded at January 1, 2013.

Based on this, our current best estimate of the projected 2014 GE

Pension Plan required contribution is approximately $0.6 billion.

At December 31, 2012, the fair value of assets for our other

pension plans was $3.9 billion less than the respective projected

benefit obligations. The comparable amount at December 31,

2011, was $3.3 billion. This increase was primarily attributable to

lower discount rates. We expect to contribute $0.7 billion to our

other pension plans in 2013, the same as in both 2012 and 2011.

The unfunded liability for our principal retiree health and life

plans was $10.9 billion and $12.1 billion at December 31, 2012 and

2011, respectively. This decrease was primarily attributable to a

plan amendment that affected retiree health and life benefit eligi-

bility for certain salaried plan participants and lower cost trends

which were partially offset by the effects of lower discount rates