GE 2012 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2012 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GE 2012 ANNUAL REPORT 91

notes to consolidated financial statements

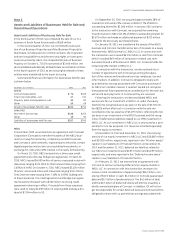

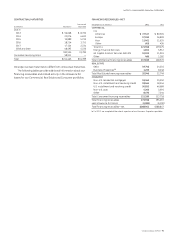

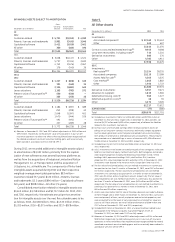

CONTRACTUAL MATURITIES OF INVESTMENT IN AVAILABLE-

FOR-SALE DEBT SECURITIES (EXCLUDING MORTGAGE-BACKED

AND ASSET-BACKED SECURITIES)

(In millions)

Amortized

cost

Estimated

fair value

Due in

2013 $ 1,937 $ 1,960

2014–2017 7,191 7,204

2018–2022 4,803 5,304

2023 and later 17,901 21,998

We expect actual maturities to differ from contractual

maturities because borrowers have the right to call or prepay

certain obligations.

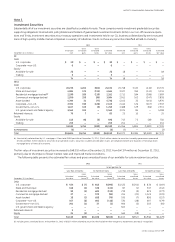

Supplemental information about gross realized gains and

losses on available-for-sale investment securities follows.

(In millions) 2012 2011 2010

GE

Gains $ — $ — $ —

Losses, including impairments (1) ——

Net (1) ——

GECC

Gains 177 205 190

Losses, including impairments (211) (402) (281)

Net (34) (197) (91)

Total $ (35) $(197) $ (91)

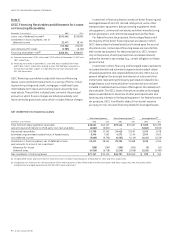

Although we generally do not have the intent to sell any specific

securities at the end of the period, in the ordinary course of

managing our investment securities portfolio, we may sell securi-

ties prior to their maturities for a variety of reasons, including

diversification, credit quality, yield and liquidity requirements and

the funding of claims and obligations to policyholders. In some

of our bank subsidiaries, we maintain a certain level of purchases

and sales volume principally of non-U.S. government debt securi-

ties. In these situations, fair value approximates carrying value for

these securities.

Proceeds from investment securities sales and early redemp-

tions by issuers totaled $12,745 million, $15,606 million and

$16,238 million in 2012, 2011 and 2010, respectively, principally

from the sales of short-term securities in our bank subsidiaries

and treasury operations.

We recognized pre-tax gains (losses) on trading securities of

$20 million, $22 million and $(7) million in 2012, 2011 and 2010,

respectively.

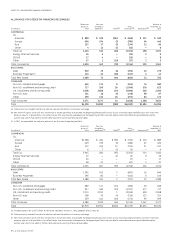

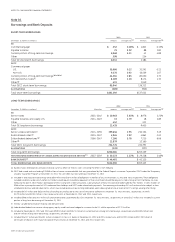

Note 4.

Current Receivables

Consolidated (a) GE (b)

December 31 (In millions) 2012 2011 2012 2011

Power & Water $ 3,809 $ 4,240 $ 2,532 $ 3,498

Oil & Gas 5,421 4,224 2,637 2,269

Energy Management 1,600 1,484 800 791

Aviation 4,756 4,355 2,493 2,658

Healthcare 4,253 4,306 2,012 1,943

Transportation 485 441 324 347

Home & Business Solutions 1,286 1,330 186 184

Corporate items and

eliminations 352 550 344 563

21,962 20,930 11,328 12,253

Less allowance for losses (462) (452) (456) (446)

Total $21,500 $20,478 $10,872 $11,807

(a) Included GE industrial customer receivables factored through a GECC affiliate

and reported as financing receivables by GECC. See Note 27.

(b) GE current receivables balances at December 31, 2012 and 2011, before allowance

for losses, included $7,881 million and $8,994 million, respectively, from sales of

goods and services to customers, and $70 million and $65 million at December 31,

2012 and 2011, respectively, from transactions with associated companies.

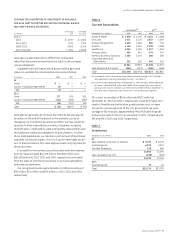

GE current receivables of $114 million and $112 million at

December 31, 2012 and 2011, respectively, arose from sales, prin-

cipally of Healthcare and Aviation goods and services, on open

account to various agencies of the U.S. government. As a per-

centage of GE revenues, approximately 4% of GE sales of goods

and services were to the U.S. government in 2012, compared with

4% and 5% in 2011 and 2010, respectively.

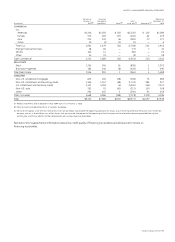

Note 5.

Inventories

December 31 (In millions) 2012 2011

GE

Raw materials and work in process $ 9,295 $ 8,735

Finished goods 6,020 4,971

Unbilled shipments 378 485

15,693 14,191

Less revaluation to LIFO (398) (450)

15,295 13,741

GECC

Finished goods 79 51

Total $15,374 $13,792