GE 2012 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2012 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

management’s discussion and analsis

46 GE 2012 ANNUAL REPORT

Energy Financial Services 2012 revenues increased 23% and

net earnings decreased 2% compared with 2011. Revenues

increased primarily as a result of organic revenue growth

($0.3 billion), including the consolidation of an entity involved in

power generating activities and asset sales by investees, and

higher gains.

Energy Financial Services 2011 revenues decreased 38%

and net earnings increased 20% compared with 2010. Revenues

decreased primarily as a result of the deconsolidation of Regency

Energy Partners L.P. (Regency) ($0.7 billion) and organic revenue

declines ($0.3 billion), primarily from an asset sale in 2010 by an

investee. These decreases were partially offset by higher gains

($0.2 billion). The increase in net earnings resulted primarily from

higher gains ($0.2 billion), partially offset by the deconsolidation

of Regency ($0.1 billion) and core decreases, primarily from an

asset sale in 2010 by an investee.

GECAS 2012 revenues increased 1% and net earnings

increased 6% compared with 2011. Revenues increased as a

result of organic revenue growth ($0.2 billion) and higher gains,

partially offset by higher impairments ($0.2 billion). The increase

in net earnings resulted primarily from core increases ($0.1 bil-

lion) and higher gains, partially offset by higher impairments

($0.1 billion).

GECAS 2011 revenues increased 3% and net earnings

decreased 4% compared with 2010. Revenues for 2011 increased

compared with 2010 as a result of organic revenue growth

($0.1 billion). The decrease in net earnings resulted primarily from

core decreases ($0.1 billion), reflecting the 2010 benefit from

resolution of the 2003-2005 IRS audit, partially offset by lower

impairments ($0.1 billion).

CORPORATE ITEMS AND ELIMINATIONS

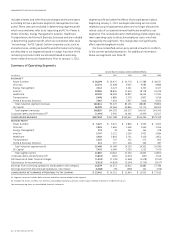

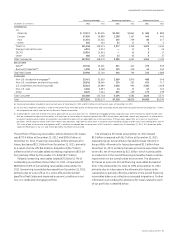

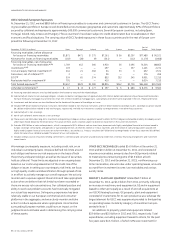

(In millions) 2012 2011 2010

REVENUES

NBCU/NBCU LLC $ 1,615 $ 5,686 $16,901

Gains (losses) on disposed or

held for sale businesses 186 — 105

Eliminations and other (3,292) (2,691) (2,511)

Total $(1,491) $ 2,995 $14,495

OPERATING PROFIT (COST)

NBCU/NBCU LLC $ 1,615 $ 4,535 $ 2,261

Gains (losses) on disposed or

held for sale businesses 186 — 105

Principal retirement plans (a) (3,098) (1,898) (493)

Unallocated corporate and

other costs (3,545) (2,924) (2,886)

Total $(4,842) $ (287) $ (1,013)

(a) Included non-operating pension income (cost) for our principal pension plans

(non-GAAP) of $(2.1) billion, $(1.1) billion and $0.3 billion in 2012, 2011 and 2010,

respectively, which includes expected return on plan assets, interest costs and

non-cash amortization of actuarial gains and losses.

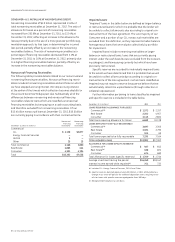

Revenues of $(1.5) billion decreased $4.5 billion in 2012 as

$4.1 billion of lower NBCU/NBCU LLC related revenues (primarily

due to the non-repeat of the pre-tax gain on the NBCU transac-

tion and the deconsolidation of NBCU in 2011, partially offset by

higher earnings at NBCU LLC due to a gain on disposition in 2012)

and $0.1 billion of pre-tax losses related to the sale of a plant in

the U.K. were partially offset by $0.3 billion of gains on the forma-

tion of a joint venture at Aviation. Operating costs of $4.8 billion

increased $4.6 billion in 2012 as $2.9 billion of lower NBCU/NBCU

LLC related earnings (primarily due to the non-repeat of the 2011

gain related to the NBCU transaction, partially offset by earnings

at NBCU LLC due to a gain on disposition in 2012), $1.2 billion of

higher costs of our principal retirement plans and $0.4 billion of

higher research and development spending and global corporate

costs were partially offset by $0.2 billion of lower restructuring

and other charges.

Revenues of $3.0 billion decreased $11.5 billion in 2011 as a

$14.9 billion reduction in revenues from NBCU LLC operations

resulting from the deconsolidation of NBCU effective January 28,

2011 and $0.1 billion of lower revenues from other disposed

businesses were partially offset by a $3.7 billion pre-tax gain

related to the NBCU transaction. Operating costs of $0.3 billion

decreased by $0.7 billion in 2011 as $3.6 billion of higher gains

from disposed businesses, primarily the NBCU transaction, and a

$0.6 billion decrease in restructuring, rationalization, acquisition-

related and other charges were partially offset by $1.4 billion

of higher costs of our principal retirement plans, $1.4 billion of

lower earnings from NBCU/NBCU LLC operations and a $0.6 bil-

lion increase in research and development spending and global

corporate costs.

Certain amounts included in Corporate items and eliminations

cost are not allocated to GE operating segments because they are

excluded from the measurement of their operating performance

for internal purposes. For 2012, these included $0.3 billion of gain

related to formation of a joint venture at Aviation and $0.5 billion

of costs at Healthcare, $0.3 billion of costs at Aviation, $0.2 bil-

lion of costs at each of Power & Water and Energy Management,

and $0.1 billion of costs at each of Oil & Gas, Home & Business

Solutions and Transportation, primarily for technology and prod-

uct development costs and restructuring, rationalization and

other charges.

For 2011, these included $0.3 billion at Oil & Gas and $0.1 bil-

lion at Energy Management for acquisition-related costs and

$0.4 billion at Healthcare, $0.2 billion at Power & Water, $0.2 bil-

lion at Aviation and $0.1 billion at each of Energy Management, Oil

& Gas, Home & Business Solutions and Transportation, primarily

for technology and product development costs and restructur-

ing, rationalization and other charges. For 2010, these included

$0.4 billion at Healthcare, $0.2 billion at Home & Business

Solutions, and $0.1 billion at each of Energy Management,

Power & Water and Aviation, primarily for technology and prod-

uct development costs and restructuring, rationalization and

other charges.