GE 2012 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2012 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

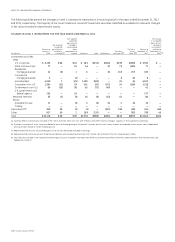

116 GE 2012 ANNUAL REPORT

notes to consolidated financial statements

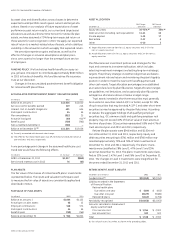

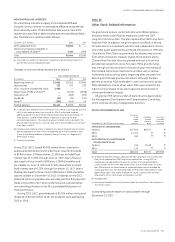

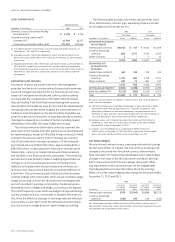

GE’s selling, general and administrative expenses totaled

$17,672 million in 2012, $17,556 million in 2011 and $16,340 mil-

lion in 2010. The increase in 2012 is primarily due to increased

acquisition-related costs, offset by the effects of global cost

reduction initiatives. The increase in 2011 is primarily due to

higher pension costs, increased acquisition-related costs and

increased costs to support global growth, partially offset by the

disposition of NBCU and lower restructuring and other charges.

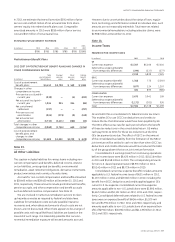

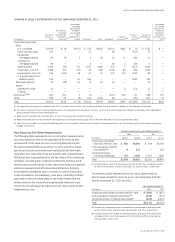

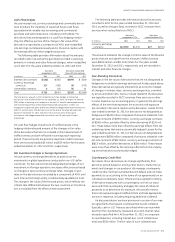

Our Aviation segment enters into collaborative arrange-

ments with manufacturers and suppliers of components used to

build and maintain certain engines, under which GE and these

participants share in risks and rewards of these product pro-

grams. Under these arrangements, participation fees earned and

recorded as other income totaled $35 million, $12 million and

$4 million for the years 2012, 2011 and 2010, respectively. GE’s

payments to participants are recorded as cost of services sold

($593 million, $612 million and $563 million for the years 2012,

2011 and 2010, respectively) or as cost of goods sold ($2,506 mil-

lion, $1,996 million and $1,751 million for the years 2012, 2011 and

2010, respectively).

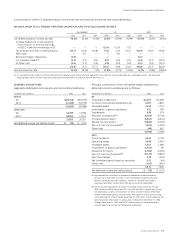

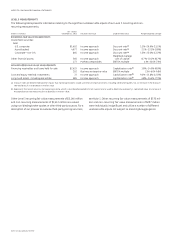

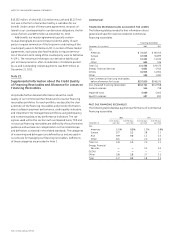

Note 20.

Earnings Per Share Information

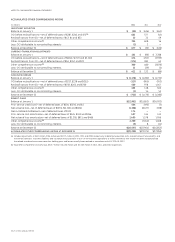

2012 2011 2010

(In millions; per-share amounts in dollars) Diluted Basic Diluted Basic Diluted Basic

AMOUNTS ATTRIBUTABLE TO THE COMPANY:

CONSOLIDATED

Earnings from continuing operations for per-share calculation (a) (b) $14,659 $14,659 $14,206 $14,205 $12,588 $12,588

Preferred stock dividends declared (c) ——(1,031) (1,031) (300) (300)

Earnings from continuing operations attributable to common

shareowners for per-share calculation (a) (b) 14,659 14,659 13,174 13,174 12,288 12,288

Earnings (loss) from discontinued operations for per-share calculation (a) (b) (1,035) (1,036) (74) (75) (964) (965)

Net earnings attributable to GE common shareowners for per-share

calculation (a) (b) $13,623 $13,622 $13,098 $13,098 $11,322 $11,322

AVERAGE EQUIVALENT SHARES

Shares of GE common stock outstanding 10,523 10,523 10,591 10,591 10,661 10,661

Employee compensation-related shares, including stock options 41 — 29 — 17 —

Total average equivalent shares 10,564 10,523 10,620 10,591 10,678 10,661

PER-SHARE AMOUNTS

Earnings from continuing operations $ 1.39 $ 1.39 $ 1.24 $ 1.24 $ 1.15 $ 1.15

Earnings (loss) from discontinued operations (0.10) (0.10) (0.01) (0.01) (0.09) (0.09)

Net earnings 1.29 1.29 1.23 1.24 1.06 1.06

Our unvested restricted stock unit awards that contain non-forfeitable rights to dividends or dividend equivalents are considered participating securities and, therefore, are

included in the computation of earnings per share pursuant to the two-class method. Application of this treatment has an insignificant effect.

(a) Included an insignificant amount of dividend equivalents in each of the three years presented.

(b) Included an insignificant amount related to accretion of redeemable securities in 2010.

(c) Included $806 million related to the redemption of our 10% cumulative preferred stock in 2011. See Note 15.

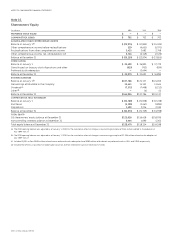

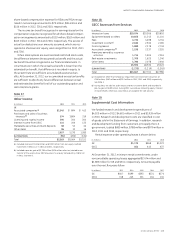

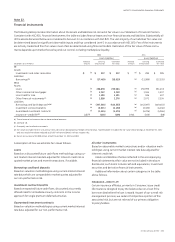

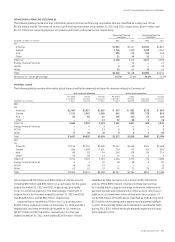

For the years ended December 31, 2012, 2011 and 2010, there

were approximately 292 million, 321 million and 325 million,

respectively, of outstanding stock awards that were not included

in the computation of diluted earnings per share because their

effect was antidilutive.

Earnings-per-share amounts are computed independently

for earnings from continuing operations, earnings (loss) from

discontinued operations and net earnings. As a result, the sum

of per-share amounts from continuing operations and discon-

tinued operations may not equal the total per-share amounts for

net earnings.