GE 2012 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2012 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.34 GE 2012 ANNUAL REPORT

management’s discussion and analsis

Operations

The consolidated financial statements of General Electric

Company (the Company) combine the industrial manufactur-

ing and services businesses of General Electric Company (GE)

with the financial services businesses of General Electric Capital

Corporation (GECC or financial services). Unless otherwise indi-

cated by the context, we use the terms “GE” and “GECC” on the

basis of consolidation described in Note 1.

In the accompanying analysis of financial information, we

sometimes use information derived from consolidated finan-

cial information but not presented in our financial statements

prepared in accordance with U.S. generally accepted account-

ing principles (GAAP). Certain of these data are considered

“non-GAAP financial measures” under the U.S. Securities and

Exchange Commission (SEC) rules. For such measures, we have

provided supplemental explanations and reconciliations in the

Supplemental Information section.

We present Management’s Discussion of Operations in five

parts: Overview of Our Earnings from 2010 through 2012, Global

Risk Management, Segment Operations, Geographic Operations

and Environmental Matters. Unless otherwise indicated, we refer

to captions such as revenues and other income and earnings

from continuing operations attributable to the Company simply

as “revenues” and “earnings” throughout this Management’s

Discussion and Analysis. Similarly, discussion of other matters in

our consolidated financial statements relates to continuing oper-

ations unless otherwise indicated.

On February 22, 2012, we merged our wholly-owned sub-

sidiary, General Electric Capital Services, Inc. (GECS), with and

into GECS’ wholly-owned subsidiary, GECC. The merger simpli-

fied our financial services’ corporate structure by consolidating

financial services entities and assets within our organization

and simplifying SEC and regulatory reporting. Upon the merger,

GECC became the surviving corporation and assumed all of GECS’

rights and obligations and became wholly-owned directly by

General Electric Company. Our financial services segment, GE

Capital, continues to comprise the continuing operations of GECC,

which now include the run-off insurance operations previously

held and managed in GECS. Unless otherwise indicated, refer-

ences to GECC and the GE Capital segment in this Management’s

Discussion and Analysis relate to the entity or segment as they

exist subsequent to the February 22, 2012 merger.

Effective October 1, 2012, we reorganized the former Energy

Infrastructure segment into three segments—Power & Water,

Oil & Gas and Energy Management. We also reorganized our

Home & Business Solutions segment by transferring our

Intelligent Platforms business to Energy Management. Results for

2012 and prior periods are reported on this basis.

We supplement our GAAP net earnings and earnings per share

(EPS) reporting by also reporting operating earnings and operat-

ing EPS (non-GAAP measures). Operating earnings and operating

EPS include service costs and plan amendment amortization for

our principal pension plans as these costs represent expenses

associated with employee benefits earned. Operating earnings

and operating EPS exclude non-operating pension cost/income

such as interest costs, expected return on plan assets and non-

cash amortization of actuarial gains and losses. We believe that

this reporting provides better transparency to the employee

benefit costs of our principal pension plans and Company

operating results.

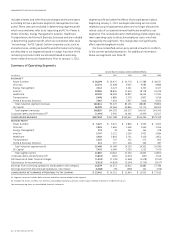

Overview of Our Earnings from 2010 through 2012

Earnings from continuing operations attributable to the Company

increased 3% to $14.7 billion in 2012 and 13% to $14.2 billion in

2011, reflecting the relative stabilization of overall economic condi-

tions during the last two years. Operating earnings (non-GAAP

measure) which exclude non-operating pension costs increased

8% to $16.1 billion in 2012 compared with a 20% increase to

$14.9 billion in 2011. Earnings per share from continuing operations

increased 12% to $1.39 in 2012 compared with an 8% increase to

$1.24 in 2011. Operating EPS (non-GAAP measure) increased 16%

to $1.52 in 2012 compared with a 16% increase to $1.31 in 2011.

Operating EPS excluding the effects of our 2011 preferred stock

redemption (non-GAAP measure) increased 10% to $1.52 in 2012

compared with $1.38 in 2011. We believe that we are seeing con-

tinued signs of stabilization in much of the global economy,

including in financial services, as GECC earnings from continuing

operations attributable to the Company increased 12% in 2012 and

111% in 2011. Net earnings attributable to the Company decreased

4% in 2012 reflecting an increase of losses from discontinued

operations partially offset by a 3% increase in earnings from

continuing operations. Net earnings attributable to the Company

increased 22% in 2011, as losses from discontinued operations in

2011 decreased and earnings from continuing operations

increased 13%. We begin 2013 with a record backlog of $210 bil-

lion, continue to invest in market-leading technology and services

and expect to continue our trend of revenue and earnings growth.

Power & Water (18% and 27% of consolidated three-year rev-

enues and total segment profit, respectively) revenues increased

10% in 2012 primarily as a result of higher volume mainly driven

by an increase in equipment sales at the Wind business after

increasing 4% in 2011 primarily as a result of higher volume.

Segment profit increased 8% in 2012 primarily driven by higher

volume. Segment profit decreased 13% in 2011 primarily due to

lower productivity and lower prices in the wind turbines business.

Oil & Gas (9% and 8% of consolidated three-year revenues

and total segment profit, respectively) revenues increased 12% in

2012 primarily as a result of higher volume driven by acquisitions

and higher sales of both equipment and services, after increas-

ing 44% in 2011 as a result of acquisitions and higher volume.

Segment profit increased 16% in 2012 primarily on higher volume

and increased productivity reflecting increased equipment mar-

gins. Segment profit increased 18% in 2011 primarily driven by

higher volume.