GE 2012 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2012 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GE 2012 ANNUAL REPORT 111

notes to consolidated financial statements

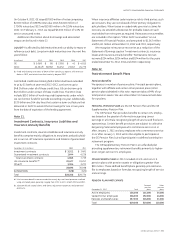

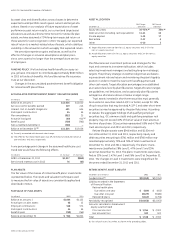

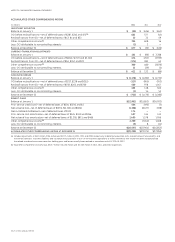

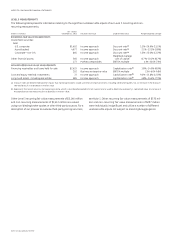

SHARES OF GE PREFERRED STOCK

On October 16, 2008, we issued 30,000 shares of 10% cumulative

perpetual preferred stock (par value $1.00 per share) having an

aggregate liquidation value of $3,000 million, and warrants to

purchase 134,831,460 shares of common stock (par value $0.06

per share) to Berkshire Hathaway Inc. (Berkshire Hathaway) for

net proceeds of $2,965 million in cash. The proceeds were allo-

cated to the preferred shares ($2,494 million) and the warrants

($471 million) on a relative fair value basis and recorded in other

capital. The warrants are exercisable through October 16, 2013,

at an exercise price of $22.25 per share of common stock and

were to be settled through physical share issuance. The terms

of the warrants were amended in January 2013 to allow for net

share settlement where the total number of issued shares is

based on the amount by which the average market price of GE

common stock over the 20 trading days preceding the date of

exercise exceeds the exercise price of $22.25.

The preferred stock was redeemable at our option three

years after issuance at a price of 110% of liquidation value plus

accrued and unpaid dividends. On September 13, 2011, we pro-

vided notice to Berkshire Hathaway that we would redeem the

shares for the stated redemption price of $3,300 million, plus

accrued and unpaid dividends. In connection with this notice,

we recognized a preferred dividend of $806 million (calculated

as the difference between the carrying value and redemption

value of the preferred stock), which was recorded as a reduction

to earnings attributable to common shareowners and common

shareowners’ equity. The preferred shares were redeemed on

October 17, 2011.

GE has 50 million authorized shares of preferred stock

($1.00 par value). No shares are issued and outstanding as of

December 31, 2012.

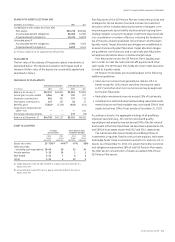

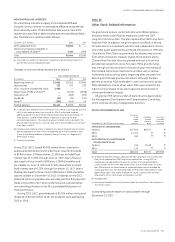

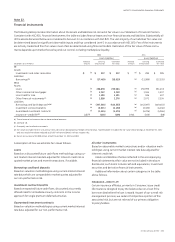

SHARES OF GE COMMON STOCK

On December 14, 2012, we increased the existing authorization

by $10 billion to $25 billion for our share repurchase program

and extended the program (which would have otherwise expired

on December 31, 2013) through 2015. Under this program, on

a book basis, we repurchased 248.6 million shares for a total of

$5,185 million during 2012 and 111.3 million shares for a total

of $1,968 million during 2011. On February 12, 2013, we increased

the existing authorization by an additional $10 billion resulting in

authorization to repurchase up to a total of $35 billion of our com-

mon stock through 2015.

GE has 13.2 billion authorized shares of common stock ($0.06

par value).

Common shares issued and outstanding are summarized in

the following table.

December 31 (In thousands) 2012 2011 2010

Issued 11,693,841 11,693,841 11,693,841

In treasury (1,288,216) (1,120,824) (1,078,465)

Outstanding 10,405,625 10,573,017 10,615,376