GE 2012 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2012 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

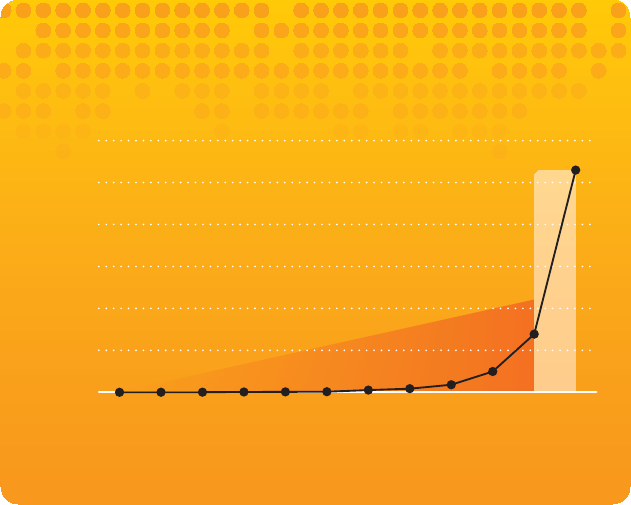

DIVIDEND HISTORY

TOTAL DOLLAR AMOUNT OF DIVIDENDS PAID TO SHAREHOLDERS

1892–1899

1900–1909

1910–1919

1920–1929

1930–1939

1940–1949

1950–1959

1960–1969

1970–1979

1980–1989

1990–1999

2000–2012

TOTAL DIVIDENDS 1892–1999: $45 BILLION

TOTAL DIVIDENDS 2000–2012: $106 BILLION

DOLLARS

IN BILLIONS

$0

$20

$40

$60

$80

$100

$120

At the same time, we are creating a

smaller, more focused financial ser-

vices company—one that has a lower

risk profile and adds value to our

industrial businesses. We will continue

to reduce the size of GE Capital from

the $600 billion of assets it was in 2008

to a goal of $300–$400 billion in the

future. GE Capital has a sound fiscal

position, with Tier 1 capital above 10%

and strong liquidity. We can generate

returns above our cost of capital. Over

the next few years, we plan for GE

Capital to return about $20 billion of

dividends back to the parent. We will

purposefully reallocate capital from

financial services to infrastructure and

grow it faster. Our goal is to have infra-

structure earnings reach 70% of our

total over time.

We have dramatically simplified GE

over the past decade. The last major

portfolio move we made was exit-

ing NBC Universal (NBCU). In the first

phase, we sold 51%, and reallocated

$11 billion from the proceeds to pur-

chase new platforms in Energy and

Oil & Gas. These businesses already

have generated $1 billion of earnings

and are growing 20% annually.

Recently, we announced an agreement

for the disposition of the remainder of

NBCU, and its real estate, for $18.1 bil-

lion. This creates additional cash

for value creation in the short term,

through increased share repurchase

and investment in growth.

Second, we are committed to allo-

cating capital in a balanced and

disciplined way, but with a clear

priority for dividend growth. GE will

generate $100 billion for allocation over

the next few years, including cash from

existing operations, dividends from GE

Capital and dispositions.

The top priority remains growing the

dividend. Since 2000, we have paid out

$106 billion in dividends, more than

any company except Shell, and more

than we paid out in the first 125 years

of the Company combined. We like

GE to have a high dividend yield,

which is appealing to the majority of

our investors.

We plan to buy back shares to get

below 10 billion, where we were before

the crisis. We will make significant

progress toward that goal in 2013 by

allocating a significant portion of the

NBCU cash to repurchase our shares.

In total, we plan to return $18 billion to

investors this year through dividend

and buyback.

We will continue to execute on focused

acquisitions, a capital-efficient way to

grow the Company. We will keep our

focus on acquiring specific capabilities

where GE can add substantial value.

We can execute on a few of these

each year.

Third, we have significantly increased

investment in organic growth, focus-

ing on R&D and global expansion.

In doing so, we have invested ahead

of our competition. We believe that

investing in technology and globaliza-

tion is key to gaining market share.

Annually, we invest more than $10 bil-

lion to launch new products and build

global capability. We make these

investments with the full benefit of

GE’s scale.

Over the past decade, we have

doubled our annual R&D investment,

increasing $2–$3 billion to 5%–6% of

revenue. Because of this investment,

we have progressed from a company

that can launch one new commercial

engine each decade to a company

that can launch one each year. We

will launch 10 new gas turbines this

decade, significantly more than in

previous times. We are a broader and

deeper technology leader than at any

time in our history.

We have built a company that has

high share in growth regions. In 2012,

we had $40 billion of orders in growth

regions, a 12% increase over the prior

year and a threefold increase in the

last decade.

GE 2012 ANNUAL REPORT 5