GE 2012 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2012 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

management’s discussion and analsis

54 GE 2012 ANNUAL REPORT

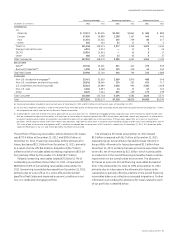

CONSUMER—U.S. INSTALLMENT AND REVOLVING CREDIT.

Nonearning receivables of $1.0 billion represented 13.6% of

total nonearning receivables at December 31, 2012. The ratio of

allowance for losses as a percent of nonearning receivables

increased from 202.8% at December 31, 2011, to 222.4% at

December 31, 2012, reflecting an increase in the allowance for

losses primarily due to the use of a more granular portfolio seg-

mentation approach, by loss type, in determining the incurred

loss period, partially offset by an increase in the nonearning

receivables balance. The ratio of nonearning receivables as a

percentage of financing receivables decreased from 2.1% at

December 31, 2011 to 2.0% at December 31, 2012, primarily due

to a higher financing receivables balance, partially offset by an

increase in the nonearning receivables balance.

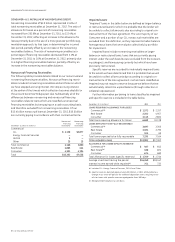

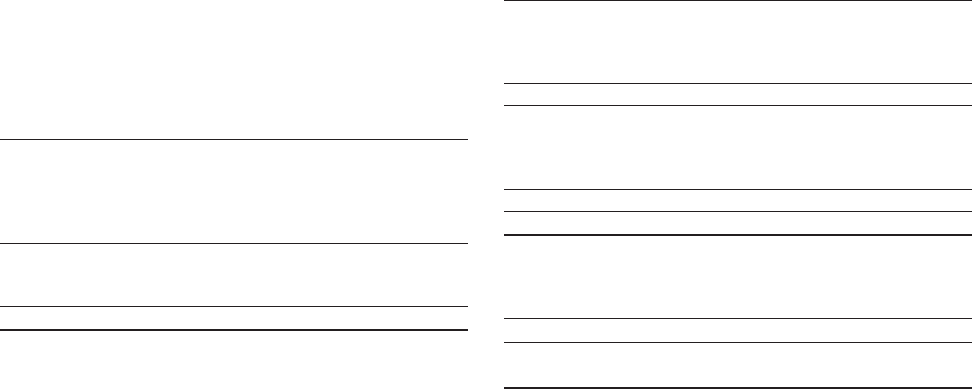

Nonaccrual Financing Receivables

The following table provides details related to our nonaccrual and

nonearning financing receivables. Nonaccrual financing receiv-

ables include all nonearning receivables and are those on which

we have stopped accruing interest. We stop accruing interest

at the earlier of the time at which collection becomes doubtful or

the account becomes 90 days past due. Substantially all of the

differences between nonearning and nonaccrual financing

receivables relate to loans which are classified as nonaccrual

financing receivables but are paying on a cash accounting basis,

and therefore excluded from nonearning receivables. Of our

$13.4 billion nonaccrual loans at December 31, 2012, $10.5 billion

are currently paying in accordance with their contractual terms.

December 31, 2012 (In millions)

Nonaccrual

financing

receivables

Nonearning

financing

receivables

Commercial

CLL $ 4,138 $2,877

Energy Financial Services — —

GECAS 3 —

Other 25 13

Total Commercial 4,166 2,890

Real Estate 4,885 444

Consumer 4,301 4,194

Total $13,352 $7,528

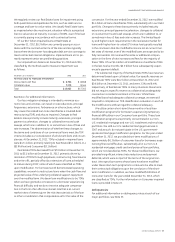

Impaired Loans

“Impaired” loans in the table below are defined as larger-balance

or restructured loans for which it is probable that the lender will

be unable to collect all amounts due according to original con-

tractual terms of the loan agreement. The vast majority of our

Consumer and a portion of our CLL nonaccrual receivables are

excluded from this definition, as they represent smaller-balance

homogeneous loans that we evaluate collectively by portfolio

for impairment.

Impaired loans include nonearning receivables on larger-

balance or restructured loans, loans that are currently paying

interest under the cash basis (but are excluded from the nonearn-

ing category), and loans paying currently but which have been

previously restructured.

Specific reserves are recorded for individually impaired loans

to the extent we have determined that it is probable that we will

be unable to collect all amounts due according to original con-

tractual terms of the loan agreement. Certain loans classified as

impaired may not require a reserve because we believe that we

will ultimately collect the unpaid balance (through collection or

collateral repossession).

Further information pertaining to loans classified as impaired

and specific reserves is included in the table below.

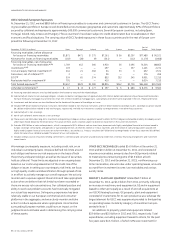

December 31 (In millions) 2012 2011

LOANS REQUIRING ALLOWANCE FOR LOSSES

Commercial (a) $ 1,372 $ 2,357

Real Estate 2,202 4,957

Consumer 3,115 2,824

Total loans requiring allowance for losses 6,689 10,138

LOANS EXPECTED TO BE FULLY RECOVERABLE

Commercial (a) 3,697 3,305

Real Estate 3,491 3,790

Consumer 105 69

Total loans expected to be fully recoverable 7,293 7,164

TOTAL IMPAIRED LOANS $13,982 $17,302

ALLOWANCE FOR LOSSES (SPECIFIC RESERVES)

Commercial (a) $ 487 $ 812

Real Estate (b) 188 822

Consumer 674 680

Total allowance for losses (specific reserves) $ 1,349 $ 2,314

Average investment during the period $16,269 $18,167

Interest income earned while impaired (c) 751 733

(a) Includes CLL, Energy Financial Services, GECAS and Other.

(b) Specific reserves declined approximately $0.3 billion in 2012 attributable to a

change in our write-off policies for collateral dependent loans, requiring write-

offs for loans with specific reserves aged greater than 360 days.

(c) Recognized principally on a cash basis.