GE 2012 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2012 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94 GE 2012 ANNUAL REPORT

notes to consolidated financial statements

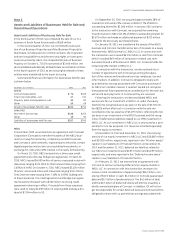

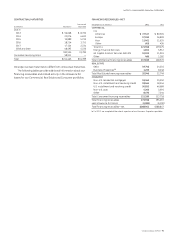

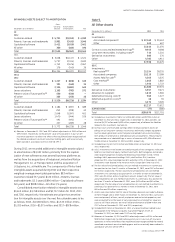

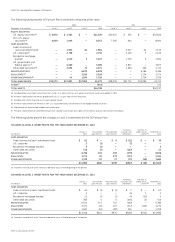

ALLOWANCE FOR LOSSES ON FINANCING RECEIVABLES

(In millions)

Balance at

January 1,

2012

Provision

charged to

operations Other (a) Gross

write-offs (b) Recoveries (b)

Balance at

December 31,

2012

COMMERCIAL

CLL

Americas $ 889 $ 109 $(51) $ (568) $ 111 $ 490

Europe 400 374 (3) (390) 64 445

Asia 157 37 (3) (134) 23 80

Other 4 13 (1) (10) — 6

Total CLL 1,450 533 (58) (1,102) 198 1,021

Energy Financial Services 26 4 — (24) 3 9

GECAS 17 4 — (13) — 8

Other 37 1 (20) (17) 2 3

Total Commercial 1,530 542 (78) (1,156) 203 1,041

REAL ESTATE

Debt 949 29 (6) (703) 10 279

Business Properties (c) 140 43 (38) (107) 3 41

Total Real Estate 1,089 72 (44) (810) 13 320

CONSUMER

Non-U.S. residential mortgages 546 111 8 (261) 76 480

Non-U.S. installment and revolving credit 717 350 26 (1,046) 576 623

U.S. installment and revolving credit 2,008 2,666 (24) (2,906) 538 2,282

Non-U.S. auto 101 18 (4) (146) 98 67

Other 199 132 18 (257) 80 172

Total Consumer 3,571 3,277 24 (4,616) 1,368 3,624

Total $6,190 $3,891 $(98) $(6,582) $1,584 $4,985

(a) Other primarily included transfers to held-for-sale and the effects of currency exchange.

(b) Net write-offs (gross write-offs less recoveries) in certain portfolios may exceed the beginning allowance for losses as our revolving credit portfolios turn over more than

once per year or, in all portfolios, can reflect losses that are incurred subsequent to the beginning of the fiscal year due to information becoming available during the

current year, which may identify further deterioration on existing financing receivables.

(c) In 2012, we completed the sale of a portion of our Business Properties portfolio.

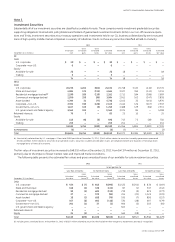

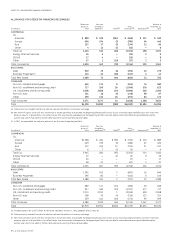

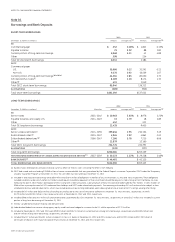

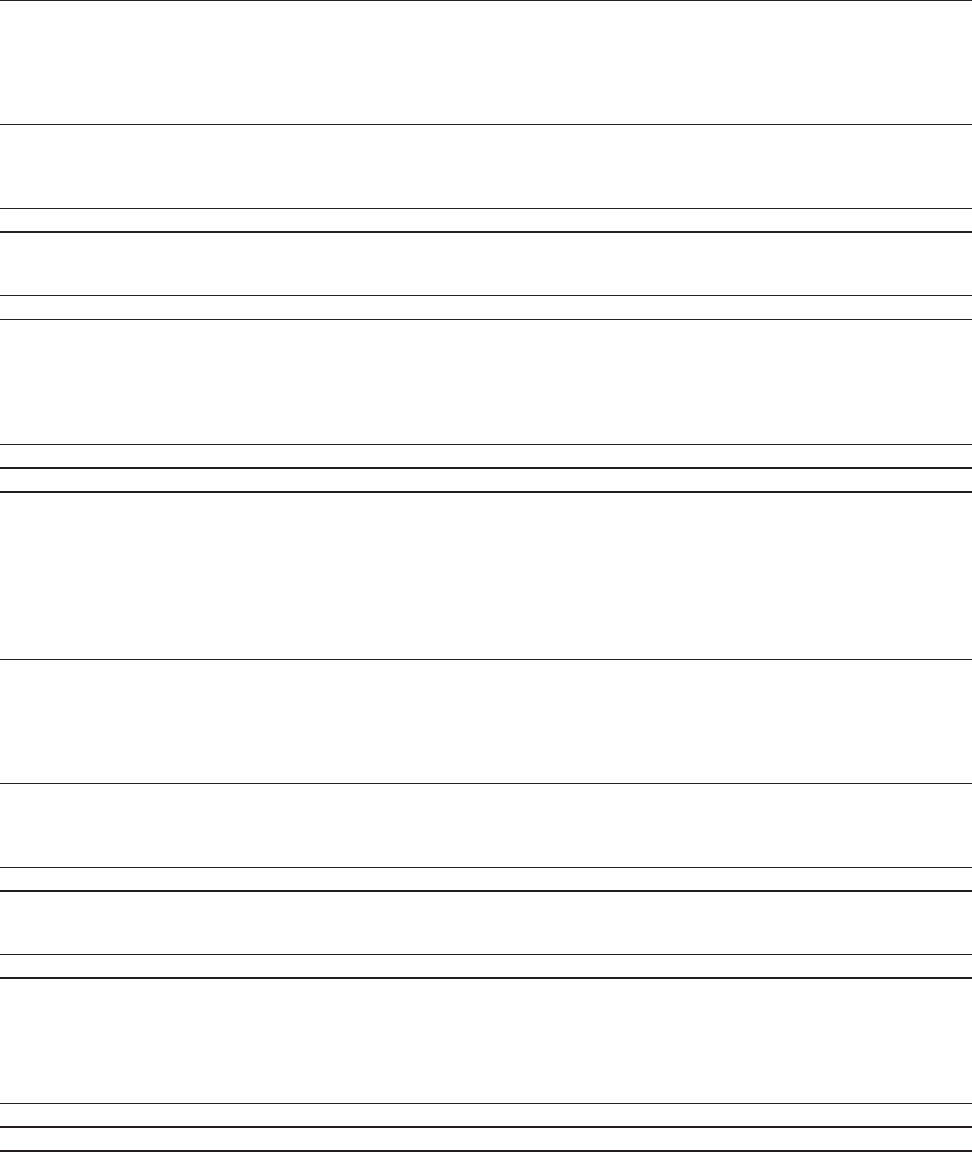

(In millions)

Balance at

January 1,

2011

Provision

charged to

operations (a) Other (b) Gross

write-offs (c) Recoveries (c)

Balance at

December 31,

2011

COMMERCIAL

CLL

Americas $1,288 $ 281 $ (96) $ (700) $ 116 $ 889

Europe 429 195 (5) (286) 67 400

Asia 222 105 13 (214) 31 157

Other 6 3 (3) (2) — 4

Total CLL 1,945 584 (91) (1,202) 214 1,450

Energy Financial Services 22 — (1) (4) 9 26

GECAS 20 — — (3) — 17

Other 5823 —(47) 337

Total Commercial 2,045 607 (92) (1,256) 226 1,530

REAL ESTATE

Debt 1,292 242 2 (603) 16 949

Business Properties 196 82 — (144) 6 140

Total Real Estate 1,488 324 2 (747) 22 1,089

CONSUMER

Non-U.S. residential mortgages 689 117 (13) (296) 49 546

Non-U.S. installment and revolving credit 937 490 (30) (1,257) 577 717

U.S. installment and revolving credit 2,333 2,241 1 (3,095) 528 2,008

Non-U.S. auto 168 30 (4) (216) 123 101

Other 259 142 (20) (272) 90 199

Total Consumer 4,386 3,020 (66) (5,136) 1,367 3,571

Total $7,919 $3,951 $(156) $(7,139) $1,615 $6,190

(a) Included a provision of $77 million at Consumer related to the July 1, 2011 adoption of ASU 2011-02.

(b) Other primarily included transfers to held-for-sale and the effects of currency exchange.

(c) Net write-offs (gross write-offs less recoveries) in certain portfolios may exceed the beginning allowance for losses as our revolving credit portfolios turn over more than

once per year or, in all portfolios, can reflect losses that are incurred subsequent to the beginning of the fiscal year due to information becoming available during the

current year, which may identify further deterioration on existing financing receivables.