GE 2012 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2012 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.82 GE 2012 ANNUAL REPORT

notes to consolidated financial statements

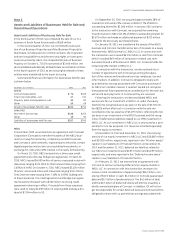

For short-duration insurance contracts, including accident

and health insurance, we report premiums as earned income

over the terms of the related agreements, generally on a pro-rata

basis. For traditional long-duration insurance contracts includ-

ing long-term care, term, whole life and annuities payable for

the life of the annuitant, we report premiums as earned income

when due.

Premiums received on investment contracts (including

annuities without significant mortality risk) are not reported as

revenues but rather as deposit liabilities. We recognize revenues

for charges and assessments on these contracts, mostly for mor-

tality, contract initiation, administration and surrender. Amounts

credited to policyholder accounts are charged to expense.

Liabilities for traditional long-duration insurance contracts

represent the present value of such benefits less the present

value of future net premiums based on mortality, morbidity, inter-

est and other assumptions at the time the policies were issued or

acquired. Liabilities for investment contracts equal the account

value, that is, the amount that accrues to the benefit of the con-

tract or policyholder including credited interest and assessments

through the financial statement date. For guaranteed investment

contracts, the liability is also adjusted as a result of fair value

hedging activity.

Liabilities for unpaid claims and estimated claim settlement

expenses represent our best estimate of the ultimate obliga-

tions for reported and incurred-but-not-reported claims and

the related estimated claim settlement expenses. Liabilities for

unpaid claims and estimated claim settlement expenses are con-

tinually reviewed and adjusted through current operations.

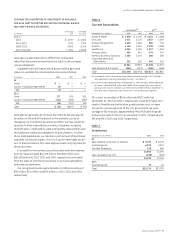

Fair Value Measurements

For financial assets and liabilities measured at fair value on

a recurring basis, fair value is the price we would receive to

sell an asset or pay to transfer a liability in an orderly transac-

tion with a market participant at the measurement date. In the

absence of active markets for the identical assets or liabilities,

such measurements involve developing assumptions based

on market observable data and, in the absence of such data,

internal information that is consistent with what market partici-

pants would use in a hypothetical transaction that occurs at the

measurement date.

Observable inputs reflect market data obtained from inde-

pendent sources, while unobservable inputs reflect our market

assumptions. Preference is given to observable inputs. These two

types of inputs create the following fair value hierarchy:

Level 1— Quoted prices for identical instruments in

active markets.

Level 2— Quoted prices for similar instruments in active markets;

quoted prices for identical or similar instruments in mar-

kets that are not active; and model-derived valuations

whose inputs are observable or whose significant value

drivers are observable.

Level 3— Significant inputs to the valuation model

are unobservable.

We maintain policies and procedures to value instruments using

the best and most relevant data available. In addition, we have

risk management teams that review valuation, including inde-

pendent price validation for certain instruments. With regards to

Level 3 valuations (including instruments valued by third parties),

we perform a variety of procedures to assess the reasonableness

of the valuations. Such reviews, which may be performed quar-

terly, monthly or weekly, include an evaluation of instruments

whose fair value change exceeds predefined thresholds (and/or

does not change) and consider the current interest rate, currency

and credit environment, as well as other published data, such

as rating agency market reports and current appraisals. These

reviews are performed within each business by the asset and

risk managers, pricing committees and valuation committees.

A detailed review of methodologies and assumptions is per-

formed by individuals independent of the business for individual

measurements with a fair value exceeding predefined thresh-

olds. This detailed review may include the use of a third-party

valuation firm.

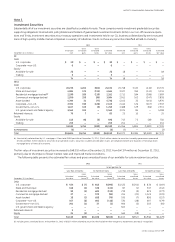

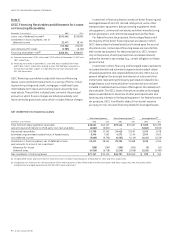

Recurring Fair Value Measurements

The following sections describe the valuation methodologies we

use to measure different financial instruments at fair value on a

recurring basis.

INVESTMENTS IN DEBT AND EQUITY SECURITIES. When available,

we use quoted market prices to determine the fair value of

investment securities, and they are included in Level 1. Level 1

securities primarily include publicly traded equity securities.

For large numbers of investment securities for which market

prices are observable for identical or similar investment securi-

ties but not readily accessible for each of those investments

individually (that is, it is difficult to obtain pricing information for

each individual investment security at the measurement date), we

obtain pricing information from an independent pricing vendor.

The pricing vendor uses various pricing models for each asset

class that are consistent with what other market participants

would use. The inputs and assumptions to the model of the pric-

ing vendor are derived from market observable sources including:

benchmark yields, reported trades, broker/dealer quotes, issuer

spreads, benchmark securities, bids, offers, and other market-

related data. Since many fixed income securities do not trade

on a daily basis, the methodology of the pricing vendor uses

available information as applicable such as benchmark curves,

benchmarking of like securities, sector groupings, and matrix

pricing. The pricing vendor considers available market observ-

able inputs in determining the evaluation for a security. Thus,

certain securities may not be priced using quoted prices, but

rather determined from market observable information. These

investments are included in Level 2 and primarily comprise our

portfolio of corporate fixed income, and government, mortgage

and asset-backed securities. In infrequent circumstances, our

pricing vendors may provide us with valuations that are based on

significant unobservable inputs, and in those circumstances we

classify the investment securities in Level 3.