GE 2012 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2012 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. GE 2012 ANNUAL REPORT 145

OPTION The right, not the obligation, to execute a transaction at

a designated price, generally involving equity interests, interest

rates, currencies or commodities. See “Hedge.”

OTHER COMPREHENSIVE INCOME Changes in assets and liabilities

that do not result from transactions with shareowners and are not

included in net income but are recognized in a separate component

of shareowners’ equity. Other Comprehensive Income includes

the following components:

Þ INVESTMENT SECURITIES— Unrealized gains and losses on securi-

ties classified as available-for-sale.

Þ CURRENCY TRANSLATION ADJUSTMENTS— The result of translating

into U.S. dollars those amounts denominated or measured in a

different currency.

Þ CASH FLOW HEDGES— The effective portion of the fair value of

cash flow hedges. Such hedges relate to an exposure to vari-

ability in the cash flows of recognized assets, liabilities or

forecasted transactions that are attributable to a specific risk.

Þ BENEFIT PLANS— Unamortized prior service costs and net actu-

arial losses (gains) related to pension and retiree health and

life benefits.

Þ RECLASSIFICATION ADJUSTMENTS— Amounts previously recog-

nized in Other Comprehensive Income that are included in net

income in the current period.

PRODUCT SERVICES For purposes of the financial statement display

of sales and costs of sales in our Statement of Earnings, “goods”

is required by U.S. Securities and Exchange Commission regula-

tions to include all sales of tangible products, and “services”

must include all other sales, including broadcasting and other

services activities. In our Management’s Discussion and Analysis

of Operations we refer to sales under product service agreements

and sales of both goods (such as spare parts and equipment

upgrades) and related services (such as monitoring, maintenance

and repairs) as sales of “product services,” which is an important

part of our operations.

PRODUCT SERVICES AGREEMENTS Contractual commitments, with

multiple-year terms, to provide specified services for products in

our Power & Water, Oil & Gas, Aviation and Transportation installed

base—for example, monitoring, maintenance, service and spare

parts for a gas turbine/generator set installed in a customer’s

power plant.

PRODUCTIVITY The rate of increased output for a given level of

input, with both output and input measured in constant currency.

PROGRESS COLLECTIONS Payments received on customer contracts

before the related revenue is recognized.

QUALIFIED SPECIAL PURPOSE ENTITIES (QSPEs) A type of variable

interest entity whose activities are significantly limited and entirely

specified in the legal documents that established it. There also are

significant limitations on the types of assets and derivative instru-

ments such entities may hold and the types and extent of activities

and decision-making they may engage in.

RETAINED INTEREST A portion of a transferred financial asset

retained by the transferor that provides rights to receive portions

of the cash inflows from that asset.

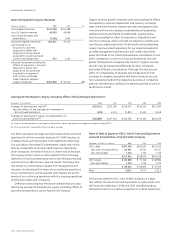

RETURN ON AVERAGE GE SHAREOWNERS’ EQUITY Earnings from

continuing operations before accounting changes divided by

average GE shareowners’ equity, excluding effects of discontin-

ued operations (on an annual basis, calculated using a five-point

average). Average GE shareowners’ equity, excluding effects of

discontinued operations, as of the end of each of the years in the

five-year period ended December 31, 2012, is described in the

Supplemental Information section.

RETURN ON AVERAGE TOTAL CAPITAL invested For GE, earnings from

continuing operations before accounting changes plus the sum of

after-tax interest and other financial charges and noncontrolling

interests, divided by the sum of the averages of total shareowners’

equity (excluding effects of discontinued operations), borrow-

ings, mandatorily redeemable preferred stock and noncontrolling

interests (on an annual basis, calculated using a five-point average).

Average total shareowners’ equity, excluding effects of discontin-

ued operations as of the end of each of the years in the five-year

period ended December 31, 2012, is described in the Supplemental

Information section.

SECURITIZATION A process whereby loans or other receivables are

packaged, underwritten and sold to investors. In a typical transac-

tion, assets are sold to a special purpose entity, which purchases

the assets with cash raised through issuance of beneficial interests

(usually debt instruments) to third-party investors. Whether or

not credit risk associated with the securitized assets is retained

by the seller depends on the structure of the securitization. See

“Monetization” and “Variable Interest Entity.”

SUBPRIME For purposes of Consumer-related discussion, subprime

includes consumer finance products like mortgage, auto, cards,

sales finance and personal loans to U.S. and global borrowers

whose credit score implies a higher probability of default based

upon GECC’s proprietary scoring models and definitions, which add

various qualitative and quantitative factors to a base credit score

such as a FICO score or global bureau score. Although FICO and

global bureau credit scores are a widely accepted rating of indi-

vidual consumer creditworthiness, the internally modeled scores

are more reflective of the behavior and default risks in the portfolio

compared to stand-alone generic bureau scores.

TURNOVER Broadly based on the number of times that working

capital is replaced during a year. Current receivables turnover is

total sales divided by the five-point average balance of GE current

receivables. Inventory turnover is total sales divided by a five-point

average balance of inventories. See “Working Capital.”

VARIABLE INTEREST ENTITY An entity that must be consolidated by

its primary beneficiary, the party that holds a controlling financial

interest. A variable interest entity has one or both of the follow-

ing characteristics: (1) its equity at risk is not sufficient to permit

the entity to finance its activities without additional subordinated

financial support from other parties, or (2) as a group, the equity

investors lack one or more of the following characteristics: (a) the

power to direct the activities that most significantly affect the eco-

nomic performance of the entity, (b) obligation to absorb expected

losses, or (c) right to receive expected residual returns.

WORKING CAPITAL Represents GE current receivables and invento-

ries, less GE accounts payable and progress collections.

glossar