GE 2012 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2012 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

of debt to equity because cash balances may be used to reduce

debt and because this long-term debt has equity-like characteris-

tics. The usefulness of this supplemental measure may be limited,

however, as the total amount of cash and equivalents at any point

in time may be different than the amount that could practically be

applied to reduce outstanding debt, and it may not be advanta-

geous or practical to replace certain long-term debt with equity.

Despite these potential limitations, we believe that this measure,

considered along with the corresponding GAAP measure, pro-

vides investors with additional information that may be more

comparable to other financial institutions and businesses.

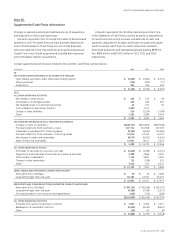

GE Capital Ending Net Investment (ENI), Excluding Cash

and Equivalents

(In billions)

December 31,

2012

January 1,

2009 (a)

GECC total assets $539.2 $661.0

Less assets of discontinued operations 1.1 25.1

Less non-interest bearing liabilities 57.6 85.4

GE Capital ENI 480.5 550.5

Less cash and equivalents 61.9 37.7

GE Capital ENI, excluding cash

and equivalents $418.6 $512.8

(a) As originally reported.

We use ENI to measure the size of our GE Capital segment. We

believe that this measure is a useful indicator of the capital (debt

or equity) required to fund a business as it adjusts for non-

interest bearing current liabilities generated in the normal course

of business that do not require a capital outlay. We also believe

that by excluding cash and equivalents, we provide a meaning-

ful measure of assets requiring capital to fund our GE Capital

segment, as a substantial amount of this cash and equivalents

resulted from debt issuances to pre-fund future debt maturi-

ties and will not be used to fund additional assets. Providing this

measure will help investors measure how we are performing

against our previously communicated goal to reduce the size of

our financial services segment.

GE Pre-Tax Earnings from Continuing Operations,

Excluding GECC Earnings from Continuing Operations

and the Corresponding Effective Tax Rates

(Dollars in millions) 2012 2011 2010

GE earnings from continuing

operations before income taxes $16,852 $19,231 $15,156

Less GECC earnings from

continuing operations 7,401 6,584 3,120

Total $ 9,451 $12,647 $12,036

GE provision for income taxes $ 2,013 $ 4,839 $ 2,024

GE effective tax rate, excluding

GECC earnings 21.3% 38.3% 16.8%

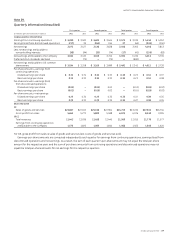

Reconciliation of U.S. Federal Statutory Income Tax Rate to

GE Effective Tax Rate, Excluding GECC Earnings

2012 2011 2010

U.S. federal statutory income

tax rate 35.0 % 35.0 % 35.0 %

Reduction in rate resulting from

Tax on global activities

including exports (7.6) (7.9) (13.5)

U.S. business credits (1.2) (2.3) (2.8)

NBCU gain — 14.9 —

All other—net (4.9) (1.4) (1.9)

(13.7) 3.3 (18.2)

GE effective tax rate, excluding

GECC earnings 21.3 % 38.3 % 16.8 %

We believe that the GE effective tax rate is best analyzed in rela-

tion to GE earnings before income taxes excluding the GECC net

earnings from continuing operations, as GE tax expense does not

include taxes on GECC earnings. Management believes that in addi-

tion to the Consolidated and GECC tax rates shown in Note 14, this

supplemental measure provides investors with useful information

as it presents the GE effective tax rate that can be used in compar-

ing the GE results to other non-financial services businesses.

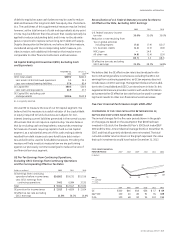

Five-Year Financial Performance Graph: 2008–2012

COMPARISON OF FIVE-YEAR CUMULATIVE RETURN AMONG GE,

S&P 500 AND DOW JONES INDUSTRIAL AVERAGE

The annual changes for the five-year period shown in the graph

on this page are based on the assumption that $100 had been

invested in GE stock, the Standard & Poor’s 500 Stock Index (S&P

500) and the Dow Jones Industrial Average (DJIA) on December 31,

2007, and that all quarterly dividends were reinvested. The total

cumulative dollar returns shown on the graph represent the value

that such investments would have had on December 31, 2012.

FIVE-YEAR FINANCIAL

PERFORMANCE

(In dollars)

GE

S&P 500

DJIA

57

56

46

46

100

69

2007 2008 2009 2010 2011 2012

GE $100 $46 $46 $56 $ 57 $ 69

S&P 500 100 63 80 92 94 109

DJIA 100 68 83 95 103 114

2007 2008 2009 2010 2011 2012

GE 2012 ANNUAL REPORT 143

supplemental information