GE 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.management’s discussion and analsis

GE 2012 ANNUAL REPORT 59

respectively. GECC commercial paper maturities are funded prin-

cipally through new commercial paper issuances and at GE are

substantially repaid before quarter-end using indefinitely rein-

vested overseas cash which, as discussed above, is available for

use in the U.S. on a short-term basis without being subject to

U.S. tax.

Under the Federal Deposit Insurance Corporation’s (FDIC)

Temporary Liquidity Guarantee Program (TLGP), the FDIC guaran-

teed certain senior unsecured debt issued by GECC on or before

October 31, 2009. As of December 31, 2012, our TLGP-guaranteed

debt was fully repaid.

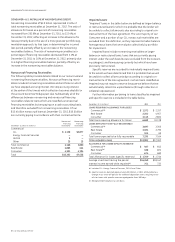

We securitize financial assets as an alternative source

of funding. During 2012, we completed $15.8 billion of non-

recourse issuances and had maturities and deconsolidations of

$14.9 billion. At December 31, 2012, consolidated non-recourse

borrowings were $30.1 billion.

We have deposit-taking capability at 12 banks outside of

the U.S. and two banks in the U.S.—GE Capital Retail Bank, a

Federal Savings Bank (FSB), and GE Capital Financial Inc., an

industrial bank (IB). The FSB and IB currently issue certificates of

deposit (CDs) in maturity terms from two months to ten years.

On January 11, 2013, the FSB acquired the deposit business of

MetLife Bank, N.A. This acquisition adds approximately $6.4 billion

in deposits and an online banking platform.

Total alternative funding at December 31, 2012 was $101 bil-

lion, mainly composed of $46 billion of bank deposits, $30 billion

of non-recourse securitization borrowings, $10 billion of fund-

ing secured by real estate, aircraft and other collateral and

$8 billion of GE Interest Plus notes. The comparable amount at

December 31, 2011 was $96 billion.

As a matter of general practice, we routinely evaluate the eco-

nomic impact of calling debt instruments where GECC has the

right to exercise a call. In determining whether to call debt, we

consider the economic benefit to GECC of calling debt, the effect

of calling debt on GECC’s liquidity profile and other factors. In

2012, we called $8.6 billion of long-term debt, of which $4.5 billion

was settled before year end.

EXCHANGE RATE AND INTEREST RATE RISKS are managed with a

variety of techniques, including match funding and selective use

of derivatives. We use derivatives to mitigate or eliminate certain

financial and market risks because we conduct business in diverse

markets around the world and local funding is not always efficient.

In addition, we use derivatives to adjust the debt we are issuing to

match the fixed or floating nature of the assets we are originating.

We apply strict policies to manage each of these risks, including

prohibitions on speculative activities. Following is an analysis of

the potential effects of changes in interest rates and currency

exchange rates using so-called “shock” tests that seek to model

the effects of shifts in rates. Such tests are inherently limited

based on the assumptions used (described further below) and

should not be viewed as a forecast; actual effects would depend

on many variables, including market factors and the composition

of the Company’s assets and liabilities at that time.

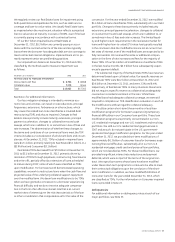

Þ It is our policy to minimize exposure to interest rate changes.

We fund our financial investments using debt or a combina-

tion of debt and hedging instruments so that the interest rates

of our borrowings match the expected interest rate profile on

our assets. To test the effectiveness of our fixed rate positions,

we assumed that, on January 1, 2013, interest rates increased

by 100 basis points across the yield curve (a “parallel shift” in

that curve) and further assumed that the increase remained

in place for 2013. We estimated, based on the year-end 2012

portfolio and holding all other assumptions constant, that our

2013 consolidated net earnings would decline by less than

$0.1 billion as a result of this parallel shift in the yield curve.

Þ It is our policy to minimize currency exposures and to con-

duct operations either within functional currencies or using

the protection of hedge strategies. We analyzed year-end

2012 consolidated currency exposures, including derivatives

designated and effective as hedges, to identify assets and

liabilities denominated in other than their relevant functional

currencies. For such assets and liabilities, we then evaluated

the effects of a 10% shift in exchange rates between those

currencies and the U.S. dollar, holding all other assumptions

constant. This analysis indicated that our 2013 consolidated

net earnings would decline by less than $0.1 billion as a result

of such a shift in exchange rates.

Debt and Derivative Instruments, Guarantees and Covenants

CREDIT RATINGS

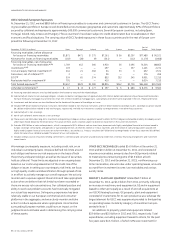

On April 3, 2012, Moody’s Investors Service (Moody’s) announced

that it had downgraded the senior unsecured debt rating of GE by

one notch from Aa2 to Aa3 and the senior unsecured debt rating

of GECC by two notches from Aa2 to A1. The ratings downgrade

did not affect GE’s and GECC’s short-term funding ratings of P-1,

which were affirmed by Moody’s. Moody’s ratings outlook for GE

and GECC is stable. We did not experience any material opera-

tional, funding or liquidity impacts from this ratings downgrade.

As of December 31, 2012, GE’s and GECC’s long-term unsecured

debt ratings from Standard and Poor’s Ratings Service (S&P) were

AA+ with a stable outlook and their short-term funding ratings

from S&P were A-1+. We are disclosing these ratings to enhance

understanding of our sources of liquidity and the effects of our

ratings on our costs of funds. Although we currently do not

expect a downgrade in the credit ratings, our ratings may be

subject to a revision or withdrawal at any time by the assigning

rating organization, and each rating should be evaluated inde-

pendently of any other rating.

Substantially all GICs were affected by the downgrade and

are more fully discussed in the Principal Debt and Derivative

Conditions section. Additionally, there were other contracts

affected by the downgrade with provisions requiring us to pro-

vide additional funding, post collateral and make other payments.

The total cash and collateral impact of these contracts was less

than $0.5 billion.

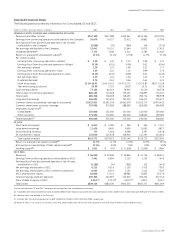

PRINCIPAL DEBT AND DERIVATIVE CONDITIONS

Certain of our derivative instruments can be terminated if speci-

fied credit ratings are not maintained and certain debt and

derivatives agreements of other consolidated entities have provi-

sions that are affected by these credit ratings.