GE 2012 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2012 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

134 GE 2012 ANNUAL REPORT

notes to consolidated financial statements

Note 25.

Commitments and Guarantees

Commitments

In our Aviation segment, we had committed to provide financ-

ing assistance on $2,116 million of future customer acquisitions

of aircraft equipped with our engines, including commitments

made to airlines in 2012 for future sales under our GE90 and GEnx

engine campaigns. The GECAS business of GE Capital had placed

multiple-year orders for various Boeing, Airbus and other aircraft

with list prices approximating $25,735 million and secondary

orders with airlines for used aircraft of approximately $1,098 mil-

lion at December 31, 2012.

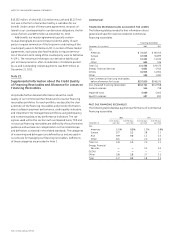

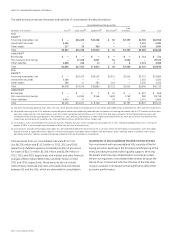

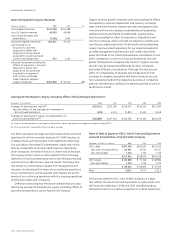

Product Warranties

We provide for estimated product warranty expenses when we

sell the related products. Because warranty estimates are fore-

casts that are based on the best available information—mostly

historical claims experience—claims costs may differ from

amounts provided. An analysis of changes in the liability for prod-

uct warranties follows.

(In millions) 2012 2011 2010

Balance at January 1 $1,507 $1,405 $1,641

Current-year provisions 611 866 491

Expenditures (723) (881) (710)

Other changes (12) 117 (17)

Balance at December 31 $1,383 $1,507 $1,405

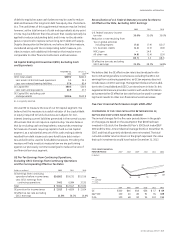

Guarantees

At December 31, 2012, we were committed under the following

guarantee arrangements beyond those provided on behalf of

VIEs. See Note 24.

Þ CREDIT SUPPORT. We have provided $3,292 million of credit sup-

port on behalf of certain customers or associated companies,

predominantly joint ventures and partnerships, using arrange-

ments such as standby letters of credit and performance

guarantees. These arrangements enable these customers

and associated companies to execute transactions or obtain

desired financing arrangements with third parties. Should the

customer or associated company fail to perform under the

terms of the transaction or financing arrangement, we would

be required to perform on their behalf. Under most such

arrangements, our guarantee is secured, usually by the asset

being purchased or financed, or possibly by certain other

assets of the customer or associated company. The length of

these credit support arrangements parallels the length of the

related financing arrangements or transactions. The liability

for such credit support was $41 million at December 31, 2012.

Þ INDEMNIFICATION AGREEMENTS. We have agreements that

require us to fund up to $140 million at December 31, 2012

under residual value guarantees on a variety of leased

equipment. Under most of our residual value guarantees,

our commitment is secured by the leased asset. The liabil-

ity for these indemnification agreements was $25 million at

December 31, 2012.

In connection with the transfer of the NBCU business to

Comcast, we have provided guarantees, on behalf of NBCU

LLC, for the acquisition of sports programming that are trig-

gered only in the event NBCU LLC fails to meet its payment

commitments. At December 31, 2012, our indemnification

under these arrangements was $7,468 million. This amount

was determined based on our current ownership share of

NBCU LLC and will change proportionately based on any

future changes to our ownership share. Comcast has agreed

to indemnify us for $383 million related to their proportionate

share of pre-existing NBCU LLC guarantees. The liability for

our NBCU LLC indemnification agreements was $151 million at

December 31, 2012.

At December 31, 2012, we also had $2,771 million of other

indemnification commitments, substantially all of which relate

to standard representations and warranties in sales of other

businesses or assets.

Þ CONTINGENT CONSIDERATION. These are agreements to provide

additional consideration to a buyer or seller in a business

combination if contractually specified conditions related

to the acquisition or disposition are achieved. Adjustments to

the proceeds from our sale of GE Money Japan are further

discussed in Note 2. All other potential payments related to

contingent consideration are insignificant.

Our guarantees are provided in the ordinary course of business.

We underwrite these guarantees considering economic, liquidity

and credit risk of the counterparty. We believe that the likelihood

is remote that any such arrangements could have a significant

adverse effect on our financial position, results of operations or

liquidity. We record liabilities for guarantees at estimated fair

value, generally the amount of the premium received, or if we do

not receive a premium, the amount based on appraisal, observed

market values or discounted cash flows. Any associated expected

recoveries from third parties are recorded as other receivables,

not netted against the liabilities.