GE 2012 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2012 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.management’s discussion and analsis

64 GE 2012 ANNUAL REPORT

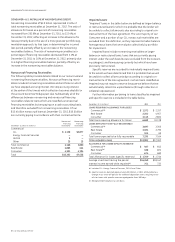

LOSSES ON FINANCING RECEIVABLES are recognized when they are

incurred, which requires us to make our best estimate of prob-

able losses inherent in the portfolio. The method for calculating

the best estimate of losses depends on the size, type and risk

characteristics of the related financing receivable. Such an esti-

mate requires consideration of historical loss experience,

adjusted for current conditions, and judgments about the prob-

able effects of relevant observable data, including present

economic conditions such as delinquency rates, financial health

of specific customers and market sectors, collateral values

(including housing price indices as applicable), and the present

and expected future levels of interest rates. The underlying

assumptions, estimates and assessments we use to provide for

losses are updated periodically to reflect our view of current

conditions and are subject to the regulatory examination process,

which can result in changes to our assumptions. Changes in such

estimates can significantly affect the allowance and provision for

losses. It is possible that we will experience credit losses that are

different from our current estimates. Write-offs in both our con-

sumer and commercial portfolios can also reflect both losses that

are incurred subsequent to the beginning of a fiscal year and

information becoming available during that fiscal year which may

identify further deterioration on exposures existing prior to the

beginning of that fiscal year, and for which reserves could not

have been previously recognized. Our risk management process

includes standards and policies for reviewing major risk expo-

sures and concentrations, and evaluates relevant data either for

individual loans or financing leases, or on a portfolio basis,

as appropriate.

Further information is provided in the Global Risk Management

section, the Financial Resources and Liquidity—Financing

Receivables section, the Asset Impairment section that follows

and in Notes 1, 6 and 23.

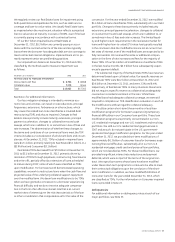

REVENUE RECOGNITION ON LONG-TERM PRODUCT SERVICES

AGREEMENTS

requires estimates of profits over the multiple-year

terms of such agreements, considering factors such as the fre-

quency and extent of future monitoring, maintenance and

overhaul events; the amount of personnel, spare parts and other

resources required to perform the services; and future billing rate

and cost changes. We routinely review estimates under product

services agreements and regularly revise them to adjust for

changes in outlook. We also regularly assess customer credit risk

inherent in the carrying amounts of receivables and contract

costs and estimated earnings, including the risk that contractual

penalties may not be sufficient to offset our accumulated invest-

ment in the event of customer termination. We gain insight into

future utilization and cost trends, as well as credit risk, through

our knowledge of the installed base of equipment and the close

interaction with our customers that comes with supplying critical

services and parts over extended periods. Revisions that affect a

product services agreement’s total estimated profitability result

in an adjustment of earnings; such adjustments increased earn-

ings by $0.4 billion in 2012, increased earnings by $0.4 billion in

2011 and decreased earnings by $0.2 billion in 2010. We provide

for probable losses when they become evident.

Further information is provided in Notes 1 and 9.

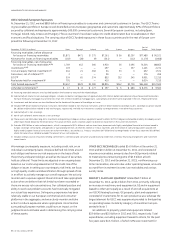

ASSET IMPAIRMENT assessment involves various estimates and

assumptions as follows:

Investments. We regularly review investment securities for

impairment using both quantitative and qualitative criteria. For

debt securities, if we do not intend to sell the security and it is not

more likely than not that we will be required to sell the security

before recovery of our amortized cost, we evaluate other qualita-

tive criteria to determine whether a credit loss exists, such as the

financial health of and specific prospects for the issuer, including

whether the issuer is in compliance with the terms and cov-

enants of the security. Quantitative criteria include determining

whether there has been an adverse change in expected future

cash flows. For equity securities, our criteria include the length of

time and magnitude of the amount that each security is in an

unrealized loss position. Our other-than-temporary impairment

reviews involve our finance, risk and asset management func-

tions as well as the portfolio management and research

capabilities of our internal and third-party asset managers. See

Note 1, which discusses the determination of fair value of invest-

ment securities.

Further information about actual and potential impairment

losses is provided in the Financial Resources and Liquidity—

Investment Securities section and in Notes 1, 3 and 9.

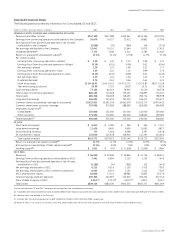

Long-Lived Assets. We review long-lived assets for impairment

whenever events or changes in circumstances indicate that the

related carrying amounts may not be recoverable. Determining

whether an impairment has occurred typically requires various

estimates and assumptions, including determining which undis-

counted cash flows are directly related to the potentially impaired

asset, the useful life over which cash flows will occur, their

amount, and the asset’s residual value, if any. In turn, measure-

ment of an impairment loss requires a determination of fair value,

which is based on the best information available. We derive the

required undiscounted cash flow estimates from our historical

experience and our internal business plans. To determine fair

value, we use quoted market prices when available, our internal

cash flow estimates discounted at an appropriate interest rate

and independent appraisals, as appropriate.

Our operating lease portfolio of commercial aircraft is a sig-

nificant concentration of assets in GE Capital, and is particularly

subject to market fluctuations. Therefore, we test recoverability

of each aircraft in our operating lease portfolio at least annually.

Additionally, we perform quarterly evaluations in circumstances

such as when aircraft are re-leased, current lease terms have

changed or a specific lessee’s credit standing changes. We con-

sider market conditions, such as global demand for commercial

aircraft. Estimates of future rentals and residual values are based

on historical experience and information received routinely

from independent appraisers. Estimated cash flows from future

leases are reduced for expected downtime between leases and

for estimated technical costs required to prepare aircraft to be

redeployed. Fair value used to measure impairment is based on