Dollar General 2003 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2003 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

shares at an exercise price of $12.68 per share. The option vests at a rate of 166,666 shares on the second anniversary of the grant

date and 333,334 shares on the third anniversary of the grant date. The option will terminate 10 years from the grant date.

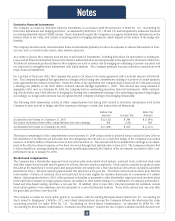

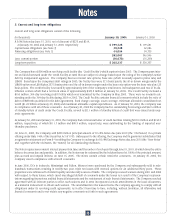

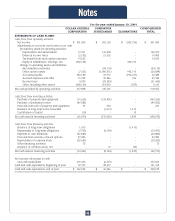

Pro forma information regarding net income and earnings per share, as disclosed in Note 1, has been determined as if the Company

had accounted for its employee stock-based compensation plans under the fair value method of SFAS No. 123. The fair value of

options granted during 2003, 2002 and 2001 was $5.45, $6.15, and $6.77, respectively. The fair value of each stock option grant

was estimated on the date of grant using the Black-Scholes option pricing model with the following assumptions:

2003 2002 2001

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Expected dividend yield 0.9% 0.8% 0.8%

Expected stock price volatility 36.9% 35.3% 35.3%

Weighted average risk-free interest rate 2.7% 3.9% 4.8%

Expected life of options (years) 3.7 6.5 6.0

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

The Black-Scholes option model was developed for use in estimating the fair value of traded options, which have no vesting restric-

tions and are fully transferable. In addition, option valuation models require the input of highly subjective assumptions including the

expected stock price volatility. Because the Company’s employee stock options have characteristics significantly different from those

of traded options, and because changes in the subjective input assumptions can materially affect the fair value estimate, in manage-

ment’s opinion, the existing models do not necessarily provide a reliable single measure of the fair value of its employee stock options.

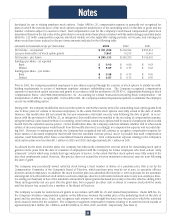

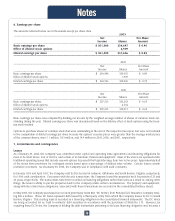

A summary of the balances and activity for all of the Company’s stock option awards for the last three fiscal years is presented below:

Shares Weighted Average

Issued Exercise Price

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Balance, February 2, 2001 22,091,128 $ 15.02

Granted 7,201,728 17.20

Exercised (1,322,511) 9.75

Canceled (1,999,583) 18.07

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Balance, February 1, 2002 25,970,762 15.65

Granted 4,146,986 15.83

Exercised (690,515) 6.90

Canceled (2,510,662) 17.35

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Balance, January 31, 2003 26,916,571 15.73

Granted 4,705,586 18.39

Exercised (4,240,438) 11.68

Canceled (2,450,429) 17.76

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Balance, January 30, 2004 24,931,290 $ 16.75

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

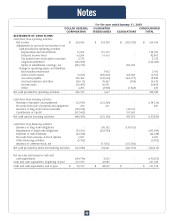

The following table summarizes information about all stock options outstanding at January 30, 2004:

Options Outstanding Options Exercisable

____________________________________________________________ ______________________________________

Weighted Average

Range of Number Remaining Weighted Average Number Weighted Average

Exercise Prices Outstanding Contractual Life Exercise Price Exercisable Exercise Price

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

$ 3.69 - $ 10.48 2,099,022 2.0 $ 6.12 1,788,169 $ 6.07

$ 10.49 - $ 17.31 11,277,069 6.8 14.80 6,619,212 14.79

$ 17.32 - $ 23.90 11,555,199 6.9 20.60 6,625,390 20.80

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

$ 3.69 - $ 23.90 24,931,290 6.4 $ 16.75 15,032,771 $ 16.40

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

At January 30, 2004, there were approximately 9.1 million shares available for grant under the Company’s stock incentive plan. At January

31, 2003 and February 1, 2002, respectively, there were approximately 17.0 million and 11.6 million exercisable options outstanding.

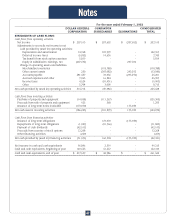

10. Capital stock

The Company has a Shareholder Rights Plan (the "Plan") under which Series B Junior Participating Preferred Stock Purchase Rights

(the "Rights") were issued for each outstanding share of common stock. The Rights were attached to all common stock outstand-

ing as of March 10, 2000, and will be attached to all additional shares of common stock issued prior to the Plan’s expiration on

February 28, 2010, or such earlier termination, if applicable. The Rights entitle the holders to purchase from the Company one one-

Notes

40