Dollar General 2003 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2003 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

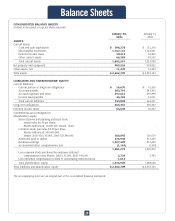

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Basis of presentation and accounting policies

Basis of presentation

These notes contain references to the years 2004, 2003, 2002 and 2001, which represent fiscal years ending or ended January 28,

2005, January 30, 2004, January 31, 2003 and February 1, 2002, respectively, each of which will be or was a 52-week accounting

period. The Company’s fiscal year ends on the Friday closest to January 31. The consolidated financial statements include all sub-

sidiaries of the Company, except for its not-for-profit subsidiary whose assets and revenues are not material. Intercompany trans-

actions have been eliminated.

Business description

The Company sells general merchandise on a retail basis through 6,700 stores (as of January 30, 2004) located predominantly in

small towns in the southern, eastern and midwestern United States. The Company has distribution centers ("DCs") in Scottsville,

Kentucky; Ardmore, Oklahoma; South Boston, Virginia; Indianola, Mississippi; Fulton, Missouri; Alachua, Florida and Zanesville,

Ohio.

The Company purchases its merchandise from a wide variety of suppliers. Approximately 11% of the Company’s purchases in 2003

were made from Procter and Gamble. No other supplier accounted for more than 4% of the Company’s purchases in 2003.

Restatement

On April 30, 2001, the Company announced that it had become aware of certain accounting issues that would cause it to restate

its audited financial statements for fiscal years 1999 and 1998, and to restate the unaudited financial information for fiscal year 2000

that had been previously released by the Company. The Company subsequently restated such financial statements and financial

information by means of its Form 10-K for the fiscal year ended February 2, 2001, which was filed on January 14, 2002. (See Notes

5 and 7).

Cash and cash equivalents

Cash and cash equivalents include highly liquid investments with original maturities of three months or less when purchased.

Cash management

The Company’s cash management system provides for daily investment of available balances and the funding of outstanding checks

when presented for payment. Outstanding but unpresented checks totaling approximately $105.2 million and $91.3 million at

January 30, 2004 and January 31, 2003, respectively, have been included in Accounts payable in the consolidated balance sheets.

Upon presentation for payment, they will be funded through available cash balances or the Company’s existing credit facility.

Merchandise inventories

Inventories are stated at the lower of cost or market with cost determined using the retail last-in, first-out ("LIFO") method. The

excess of current cost over LIFO cost was approximately $6.5 million at January 30, 2004 and $5.9 million at January 31, 2003.

Current cost is determined using the retail first-in, first-out method. LIFO reserves increased $0.7 million in 2003 and decreased

$8.9 million and $3.5 million in 2002 and 2001, respectively. Costs directly associated with warehousing and distribution are capi-

talized into inventory.

Pre-opening costs

Pre-opening costs for new stores are expensed as incurred.

Property and equipment

Property and equipment are recorded at cost. The Company provides for depreciation and amortization on a straight-line basis

over the following estimated useful lives:

Land improvements 20

Buildings 39-40

Store leasehold improvements 8

Furniture, fixtures and equipment 3-10

Notes

28