Dollar General 2003 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2003 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

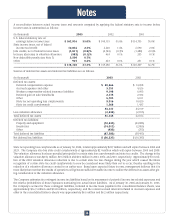

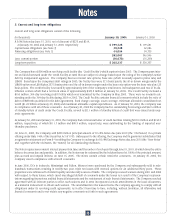

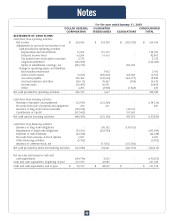

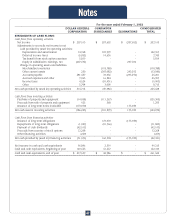

Effective January 1, 1998, the Company also established a supplemental retirement plan and a compensation deferral plan for a

select group of management and highly compensated employees. The supplemental retirement plan is a noncontributory defined

contribution plan with annual Company contributions ranging from 2% to 12% of base pay plus bonus depending upon age plus

years of service and salary level. Under the compensation deferral plan, participants may defer up to 65% of base pay and 100% of

bonus pay. Effective January 1, 2000, both the supplemental retirement plan and compensation deferral plan were amended and

restated so that such plans were combined into one master plan document. Effective January 1, 2003, the plan document was

amended to clarify certain provisions and to mirror the 401(k) plan employer contribution provisions that became effective on

January 1, 2003, as described above. An employee may be designated for participation in one or both of the plans, according to the

eligibility requirements of the plans. Compensation expense for these plans was approximately $0.5 million in 2003, $0.2 million

in 2002, and $0.1 million in 2001.

In September 2000, the supplemental retirement plan and compensation deferral plan assets were invested in Company stock and

mutual funds as designated by the plan participants and placed in a rabbi trust. The mutual funds are stated at fair market value,

which is based on quoted market prices, and are included in Other current assets. In accordance with EITF 97-14 "Accounting for

Deferred Compensation Arrangements Where Amounts Earned Are Held in a Rabbi Trust and Invested," the Company’s stock is

recorded at historical cost and classified as Common stock held in trust. Pursuant to the terms of the plan, a participant’s account

balance will be paid in cash by (a) lump sum, (b) monthly installments over a 5, 10 or 15 year period or (c) a combination of lump

sum and installments. The deferred compensation liability is recorded at the fair value of the investments held in the trust and is

included in Accrued expenses and other in the consolidated balance sheets.

During 2003, the Company established two supplemental executive retirement plans; each with one executive participant. The

Company accounts for these plans in accordance with SFAS No. 87, "Employers’ Accounting for Pensions", as amended by SFAS

No. 132, "Employers’ Disclosures about Pensions and Other Postretirement Benefits", and supplemented by SFAS No. 130,

"Reporting Comprehensive Income", but has not included additional disclosures due to their immateriality.

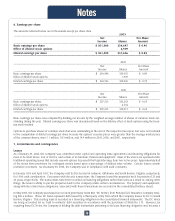

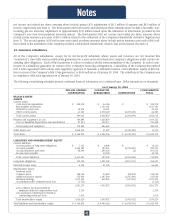

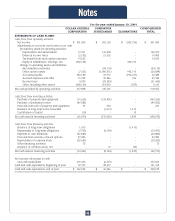

9. Stock-based compensation

The Company has established a stock incentive plan under which restricted stock, restricted stock units, stock options to purchase

common stock and other equity-based awards may be granted to executive officers, directors and key employees.

All stock options granted in 2003, 2002 and 2001 under the terms of the Company’s stock incentive plan were non-qualified stock

options issued at a price equal to the fair market value of the Company’s common stock on the date of grant. Non-qualified options

granted under these plans have expiration dates no later than 10 years following the date of grant.

Under the plan, stock option grants are made to key management employees including executive officers, as well as other employ-

ees, as prescribed by the Compensation Committee of the Board of Directors. The number of options granted is directly linked to

the employee’s job classification. Beginning in 2002, vesting provisions for options granted under the plan changed from a combi-

nation of Company performance-based vesting and time-based vesting to time-based vesting only. All options granted in 2003 and

2002 under the plan vest ratably over a four-year period, except for a grant made to the CEO in 2003 which vests at a rate of 333,333

shares on the first anniversary and 166,667 shares on the second anniversary of the grant date.

In 2003, the Company awarded a total of 50,000 shares of restricted stock to certain plan participants at a weighted average fair

value of $19.37 per share. The difference between the market price of the underlying stock and the purchase price on the date of

grant, which was set at zero for all restricted stock awards in 2003, was recorded as a reduction of shareholders’ equity as Unearned

compensation expense and is being amortized to expense on a straight-line basis over the restriction period. Under the stock

incentive plan, recipients of restricted stock are entitled to receive cash dividends and to vote their respective shares, but are pro-

hibited from selling or transferring shares prior to vesting. In addition, the maximum number of shares of restricted stock or

restricted stock units eligible for issuance under the terms of this plan has been capped at 4,000,000. At January 30, 2004, 3,918,000

shares of restricted stock or restricted stock units were available for grant under the plan.

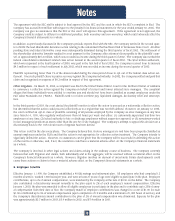

During 2003, the Company also granted stock options and restricted stock in transactions that were not made under the stock incen-

tive plan. The Company awarded 78,865 shares of restricted stock as a material inducement to employment to its CEO at a fair value

of $12.68 per share. The difference between the market price of the underlying stock and the purchase price on the date of grant,

which was set as zero for this restricted stock award, was recorded as a reduction of shareholders’ equity as Unearned compensa-

tion expense and is being amortized to expense on a straight-line basis over the restriction period of five years. The CEO is entitled

to receive cash dividends and to vote these shares, but is prohibited from selling or transferring shares prior to vesting. Also during

the first quarter of 2003, the Company awarded the CEO, as a material inducement to employment, an option to purchase 500,000

Notes

39