Dollar General 2003 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2003 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

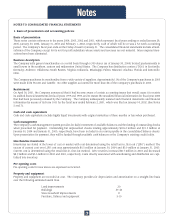

Derivative financial instruments

The Company accounts for derivative financial instruments in accordance with the provisions of SFAS No. 133, "Accounting for

Derivative Instruments and Hedging Activities", as amended by SFAS Nos. 137, 138 and 149 and interpreted by numerous Financial

Accounting Standards Board ("FASB") Issues. These statements require the Company to recognize all derivative instruments on the

balance sheet at fair value, and contain accounting rules for hedging instruments, which depend on the nature of the hedge rela-

tionship.

The Company has historically used derivative financial instruments primarily to reduce its exposure to adverse fluctuations in inter-

est rates and, to a much lesser extent, other market exposures.

As a matter of policy, the Company does not buy or sell financial instruments, including derivatives, for speculative or trading pur-

poses and all financial instrument transactions must be authorized and executed pursuant to the approval of the Board of Directors.

All financial instrument positions taken by the Company are used to reduce risk by hedging an underlying economic exposure and

are structured as straightforward instruments with liquid markets. The Company primarily executes derivative transactions with

major financial institutions.

For a portion of fiscal year 2002, the Company was party to an interest rate swap agreement with a notional amount of $100 mil-

lion. The Company designated this agreement as a hedge of the floating rate commitments relating to a portion of certain synthetic

lease agreements that existed at that time. Under the terms of the agreement, the Company paid a fixed rate of 5.60% and received

a floating rate (LIBOR) on the $100 million notional amount through September 1, 2002. This interest rate swap matured in

September 2002, and, as of January 30, 2004, the Company had no outstanding derivative financial instruments. While outstand-

ing, this derivative was 100% effective in hedging the floating rate commitments relating to the underlying exposure being hedged.

Accordingly, no hedge ineffectiveness was recognized by the Company relating to this hedging relationship.

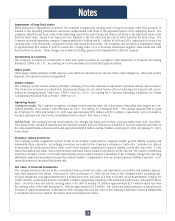

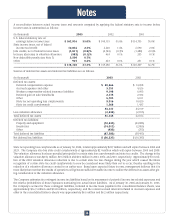

The following table summarizes activity in Other comprehensive loss during 2003 related to derivative transactions used by the

Company in prior periods to hedge cash flow exposures relating to certain debt transactions (in thousands):

Before-Tax After-Tax

Amount Income Tax Amount

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Accumulated net losses as of January 31, 2003 $ (2,133) $ 784 $ (1,349)

Net losses reclassified from Other comprehensive loss into earnings 308 (120) 188

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Accumulated net losses as of January 30, 2004 $ (1,825) $ 664 $ (1,161)

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

The balance remaining in Other comprehensive loss at January 30, 2004 relates solely to deferred losses realized in June 2000 on

the settlement of an interest rate derivative that was designated and effective as a cash flow hedge of the Company’s forecasted

issuance of its $200 million of fixed rate notes in June 2000 (see Note 5). This amount will be reclassified into earnings as an adjust-

ment to the effective interest expense on the fixed rate notes through their maturity date in June 2010. The Company estimates that

it will reclassify into earnings during the next twelve months approximately $0.2 million of the net amount recorded in Other com-

prehensive loss as of January 30, 2004.

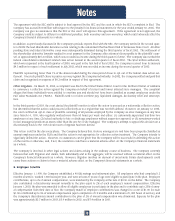

Stock-based compensation

The Company has a shareholder-approved stock incentive plan under which stock options, restricted stock, restricted stock units

and other equity-based awards may be granted to officers, directors and key employees. Stock options currently are granted under

this plan at the market price on the grant date and generally vest ratably over a four-year period, with certain exceptions as further

described in Note 9. All stock options granted under this plan have a ten-year life. The terms of this stock incentive plan limit the

total number of shares of restricted stock and restricted stock units eligible for issuance thereunder to a maximum of 4 million

shares. Options granted prior to 2002, either pursuant to this plan or pursuant to other shareholder-approved stock incentive plans

from which the Company no longer grants awards, are subject to time-based vesting or a combination of Company performance-

based and time-based vesting, and have a ten-year life. In addition, prior to June 2003, the plan provided for automatic annual

stock option grants to non-employee directors pursuant to a non-discretionary formula. Those stock options vest one year after

the grant date and have a ten-year life.

The Company accounts for stock option grants in accordance with Accounting Principles Board Opinion No. 25, "Accounting for

Stock Issued to Employees" ("APB No. 25"), and related interpretations because the Company believes the alternative fair value

accounting provided for under SFAS No. 123, "Accounting for Stock-Based Compensation," as amended by SFAS No. 148,

"Accounting for Stock-Based Compensation – Transition and Disclosure," requires the use of option valuation models that were not

Notes

30