Dollar General 2003 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2003 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

It is truly an honor to address you in my first letter to shareholders,

as Chairman and CEO of Dollar General Corporation. As the first

Chairman and CEO who is not a member of the founding Turner fam-

ily, I can report to you today, almost a year after my arrival, that the

transition has gone very smoothly. I continue to be extremely excit-

ed about Dollar General's strong legacy, robust business model, loyal

customer base and talented management team. Our mission,

Serving Others, is real to us and is the perspective through which we

develop priorities to meet the needs of our customers.

As you may know, in 2003, we reorganized our senior management

team by bringing in outside talent and blending it with seasoned

Dollar General veterans. With your Board of Directors, we complet-

ed a comprehensive strategic plan and are aligned with its strategic

imperatives. As you will see in this Annual Report, we are your Team

on a Mission for 2004 and beyond.

From a retailer’s perspective, 2003 was a particularly challenging

year because of the tough economy and uncertainties created by the

war in Iraq and the continuing war on terrorism. Nonetheless, part-

ly because of the continued blurring of retail channels in the U.S. and

partly due to the resilience of our own model, we were able to post

record results for the year. To recap:

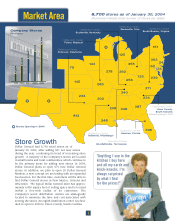

• Total net sales grew 12.6% to $6.87 billion, while same store

sales increased 4.0%.

• We opened 673 new Dollar General stores, including two Dollar

General Market stores, exceeding our goal of 650 new stores,

and grew net store selling square footage by 10%.

• Net income increased 13.6%. However, when you exclude

restatement-related items, it grew 24.1%.

• Operating profit margin, excluding restatement-related items,

improved from 7.1% of sales in 2002 to 7.6% in 2003. Including

restatement-related items, operating profit margin was 7.4% of

sales in 2003 compared to 7.5% of sales in 2002.

• We generated $320 million of cash flow before financing activ-

ities that we used to reduce debt, pay dividends and repurchase

1.5 million shares of our stock. At the end of the fiscal year,

cash on our balance sheet exceeded our outstanding borrow-

ings by $116 million, compared to the end of 2002 when our net

debt was $225 million.

• Our return on invested capital (ROIC) increased to 13.3% com-

pared to 12.9% in 2002, and, excluding restatement-related

items, ROIC increased to 13.6% in 2003 compared to 12.5% in

2002.

In fiscal 2003, Dollar General paid cash dividends to shareholders of

$46.9 million, or $0.14 per share, on an annual basis. In March

2004, your Board of Directors increased the quarterly dividend by an

additional 14.3%, to $0.04 from $0.035 per share. During the fourth

quarter of 2003, the Company also repurchased approximately 1.5

million shares of its outstanding common stock for $29.7 million.

The Company’s current share repurchase authorization for up to 12

million shares expires in March 2005.

In 2003, the Securities and Exchange Commission continued its

investigation relating to Dollar General’s January 14, 2002, restate-

ment of the 1998 and 1999 financial statements and certain unaudit-

ed financial information for fiscal year 2000. The matter appears to

be drawing to a close as the Company has reached an agreement in

principle with the staff of the SEC. We believe the proposed settle-

ment represents a fair conclusion to this matter. While we are hope-

ful that the full Commission will approve this agreement in principle,

we have no assurance that it will.

As it is for all public companies, corporate governance is a critical

issue for Dollar General. With the enactment of Sarbanes-Oxley in

2002, many of the rules have become more stringent and more

formalized. At Dollar General, your Board of Directors and your

management team take this topic very seriously and have taken

appropriate steps to ensure continued compliance. For more

information, visit the Corporate Governance section of our Web

site, www.dollargeneral.com, located under Investing.

As we move into 2004, the retailing landscape is changing very rap-

idly in America and indeed around the world. The significant growth

of big-box mass retailers over the past three decades has dramati-

cally influenced how consumers shop. A shopper today is much

more likely to shop different retail channels for different products

than a few years ago. This channel blurring benefits Dollar General

as more new customers are being introduced to our model each

year. According to ACNielsen’s Homescan® data, 66% of all

To Our Shareholders

2

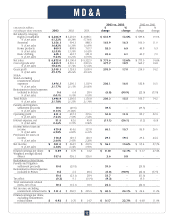

Net Sales

Fiscal years

(Dollars in millions)

as reported

excluding restatement-

related items

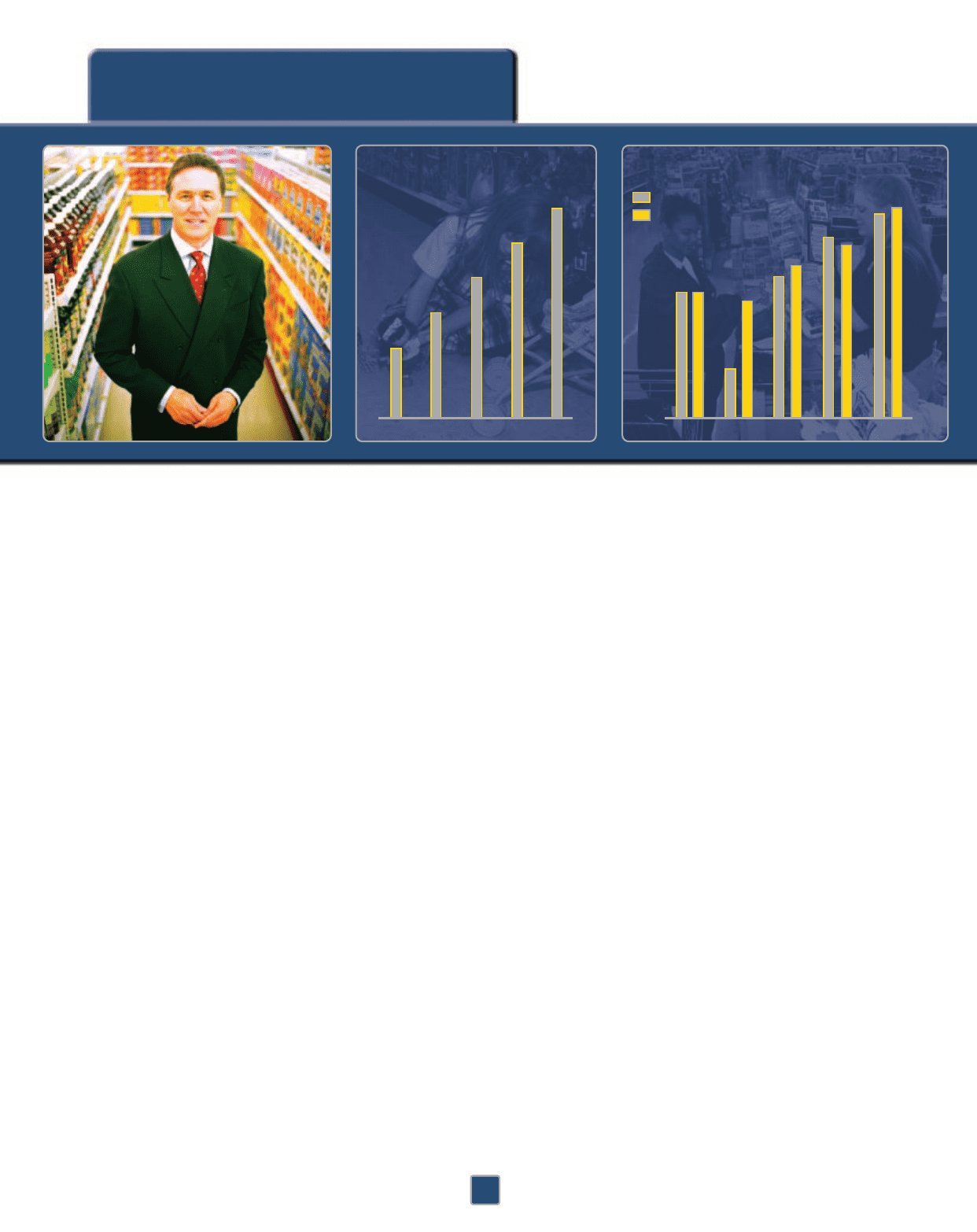

Earnings Per Share

Fiscal years

$3,888

$4,551

$5,323

$6,100

$6,872

1999 2001 2002 2003

$0.55

$0.55

$0.21

$0.62

$0.67

$0.51

$0.79

$0.75

$0.89

$0.92

1999 2000 2001 2002 2003

2000