Dollar General 2003 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2003 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Financial Risk Management

The Company is exposed to market risk primarily from adverse changes in interest rates. To minimize such risk, the Company may

periodically use financial instruments, including derivatives. As a matter of policy, the Company does not buy or sell financial

instruments for speculative or trading purposes and all financial instrument transactions must be authorized and executed pursuant

to Board of Directors approval. All financial instrument positions taken by the Company are used to reduce risk by hedging an

underlying economic exposure. Because of high correlation between the financial instrument and the underlying exposure being

hedged, fluctuations in the value of the financial instruments are generally offset by reciprocal changes in the value of the under-

lying economic exposure. The financial instruments used by the Company are straightforward instruments with liquid markets.

The Company has cash flow exposure relating to variable interest rates associated with its revolving line of credit, and may peri-

odically seek to manage this risk through the use of interest rate derivatives. The primary interest rate exposure on variable rate

obligations is based on the London Interbank Offered Rate ("LIBOR").

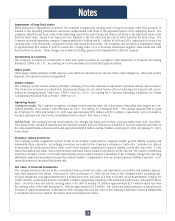

At January 30, 2004 and January 31, 2003, the fair value of the Company’s debt, excluding capital lease obligations, was estimated

at approximately $265.4 million (net of the fair value of a note receivable on the South Boston, Virginia DC of $48.9 million, as fur-

ther discussed in Note 7 to the Consolidated Financial Statements) and $287.0 million, respectively, based on the estimated market

value of the debt at those dates. Such fair value was greater than the carrying value of the debt at January 30, 2004 by approxi-

mately $21.7 million and less than the carrying value of the debt at January 31, 2003, by approximately $7.4 million.

At February 1, 2002, the Company was party to an interest rate swap agreement with a notional amount of $100 million. The

Company designated this agreement as a hedge of its floating rate commitments relating to a portion of certain synthetic lease

agreements that existed at that time. Under the terms of the agreement, the Company paid a fixed rate of 5.60% and received a

floating rate (LIBOR) on the $100 million notional amount through September 1, 2002. The fair value of the interest rate swap

agreement was $(2.6) million at February 1, 2002. The counterparty to the Company’s interest rate swap agreement was a major

financial institution. The interest rate swap agreement expired on September 1, 2002. As of January 30, 2004, the Company was

not party to any interest rate derivatives.

In 2002 and 2001, as required by SFAS No. 133, the Company recorded the fair value of the interest rate swap in the balance sheet,

with the offsetting, effective portion of the change in fair value recorded in Other comprehensive loss, a separate component of

Shareholders’ equity in the Consolidated Financial Statements. Amounts recorded in Other comprehensive loss were reclassified

into earnings, as an adjustment to interest expense, in the same period during which the hedged synthetic lease agreements affect-

ed earnings.

Based upon the Company’s variable rate borrowing levels, a 1% adverse change in interest rates would have resulted in a pre-tax

reduction of earnings and cash flows of approximately $1.7 million, including the effects of interest rate swaps, in 2002. In 2003,

the Company had no outstanding variable rate borrowings. Based upon the Company’s outstanding indebtedness at January 30,

2004 and January 31, 2003, a 1% reduction in interest rates would have resulted in an increase in the fair value of the Company’s

fixed rate debt of approximately $14.8 million and $17.6 million, respectively.

M D & A

22