Dollar General 2003 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2003 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

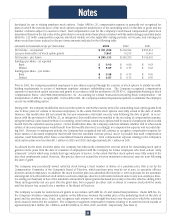

Revenue and gain recognition

The Company recognizes sales at the time the sale is made to the customer. The Company records gain contingencies when realized.

Advertising costs

Advertising costs are expensed as incurred and were $5.4 million, $7.1 million, and $6.6 million in 2003, 2002, and 2001, respec-

tively. These costs primarily related to targeted circulars supporting new stores and in-store signage.

Interest during construction

To assure that interest costs properly reflect only that portion relating to current operations, interest on borrowed funds during the

construction of property and equipment is capitalized. Interest costs capitalized were approximately $0.2 million, $0.1 million and

$1.3 million in 2003, 2002 and 2001, respectively.

Income taxes

The Company reports income taxes in accordance with SFAS No. 109, "Accounting for Income Taxes." Under SFAS No. 109, the

asset and liability method is used for computing future income tax consequences of events, which have been recognized in the

Company’s consolidated financial statements or income tax returns. Deferred income tax expense or benefit is the net change dur-

ing the year in the Company’s deferred income tax assets and liabilities.

Management estimates

The preparation of financial statements and related disclosures in conformity with accounting principles generally accepted in the

United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities

and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of

revenues and expenses during the reporting periods. Actual results could differ from those estimates.

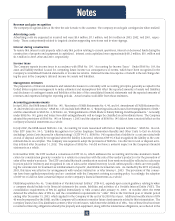

Accounting pronouncements

In April 2002, the FASB issued SFAS No. 145, "Rescission of FASB Statements No. 4, 44, and 64, Amendment of FASB Statement No.

13, and Technical Corrections." SFAS No. 145 rescinds both SFAS No. 4, "Reporting Gains and Losses from Extinguishment of Debt,"

and the amendment to SFAS No. 4, SFAS No. 64, "Extinguishments of Debt Made to Satisfy Sinking-Fund Requirements." Generally,

under SFAS No. 145, gains and losses from debt extinguishments will no longer be classified as extraordinary items. The Company

adopted the provisions of SFAS No. 145 on February 1, 2003 and the adoption of SFAS No. 145 did not have a material effect on the

Company’s financial statements as a whole.

In July 2002, the FASB issued SFAS No. 146, "Accounting for Costs Associated with Exit or Disposal Activities." SFAS No. 146 nul-

lifies EITF Issue No. 94-3, "Liability Recognition for Certain Employee Termination Benefits and Other Costs to Exit an Activity

(including Certain Costs Incurred in a Restructuring)" ("EITF 94-3"). SFAS No. 146 requires that a liability for a cost associated with

an exit or disposal activity be recognized when the liability is incurred, whereas EITF 94-3 had recognized the liability at the com-

mitment date to an exit plan. The Company was required to adopt the provisions of SFAS No. 146 effective for exit or disposal activ-

ities initiated after December 31, 2002. The adoption of SFAS No. 146 did not have a material impact on the Company’s financial

statements as a whole.

In November 2002, the EITF reached a consensus on EITF 02-16, which addresses the accounting and income statement classifi-

cation for consideration given by a vendor to a retailer in connection with the sale of the vendor’s products or for the promotion of

sales of the vendor’s products. The EITF concluded that such consideration received from vendors should be reflected as a decrease

in prices paid for inventory and recognized in cost of sales as the related inventory is sold, unless specific criteria are met qualify-

ing the consideration for treatment as reimbursement of specific, identifiable incremental costs. As clarified by the EITF in January

2003, this issue was effective for arrangements with vendors initiated on or after January 1, 2003. The provisions of this consen-

sus have been applied prospectively and are consistent with the Company’s existing accounting policy. Accordingly, the adoption

of EITF 02-16 did not have a material impact on the Company’s financial statements as a whole.

FASB Interpretation No. 46, "Consolidation of Variable Interest Entities" ("FIN 46"), expands upon current guidance relating to when

a company should include in its financial statements the assets, liabilities and activities of a Variable Interest Entity ("VIE"). The

consolidation requirements of FIN 46 applied immediately to VIEs created after January 31, 2003. In October 2003, the FASB

deferred the effective date of FIN 46, and the consolidation requirements for "older" VIEs to the first fiscal year or interim period

ending after December 15, 2003, which applied for the Company at the end of its 2003 fiscal year. Additional modifications of FIN

46 may be proposed by the FASB, and the Company will continue to monitor future developments related to this interpretation. The

Company leases four of its distribution centers ("DCs") from lessors, which meet the definition of VIEs. Two of these DCs have been

recorded as financing obligations whereby the property and equipment, along with the related lease obligations, are reflected in the

Notes

32