Dollar General 2003 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2003 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

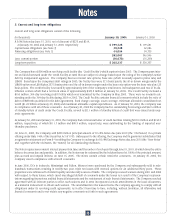

The agreement with the SEC staff is subject to final approval by the SEC and the court in which the SEC’s complaint is filed. The

Company has accrued $10 million with respect to the penalty in its financial statements for the year ended January 30, 2004. The

Company can give no assurances that the SEC or the court will approve this agreement. If the agreement is not approved, the

Company could be subject to different or additional penalties, both monetary and non-monetary, which could adversely affect the

Company’s financial statements as a whole.

In addition, as previously discussed in the Company’s periodic reports filed with the SEC, the Company settled in the second quar-

ter of 2002 the lead shareholder derivative action relating to the restatement that had been filed in Tennessee State Court. All other

pending state and federal derivative cases were subsequently dismissed during the third quarter of fiscal 2002. The settlement of

the shareholder derivative lawsuits resulted in a net payment to the Company, after attorney’s fees payable to the plaintiffs’ coun-

sel, of approximately $25.2 million, which was recorded as income during the third quarter of 2002. The Company also settled the

federal consolidated restatement-related class action lawsuit in the second quarter of fiscal 2002. The $162 million settlement,

which was expensed in the fourth quarter of 2000, was paid in the first half of fiscal 2002. The Company received from its insurers

$4.5 million in respect of such settlement in July 2002, which was recorded as income during the second quarter of 2002.

Plaintiffs representing fewer than 1% of the shares traded during the class period chose to opt out of the federal class action set-

tlement. One such plaintiff chose to pursue recovery against the Company individually. In 2002, the Company settled and paid that

claim and recognized an expense of $0.2 million in respect of that agreement.

Other Litigation. On March 14, 2002, a complaint was filed in the United States District Court for the Northern District of Alabama

to commence a collective action against the Company on behalf of current and former salaried store managers. The complaint

alleges that these individuals were entitled to overtime pay and should not have been classified as exempt employees under the

Fair Labor Standards Act ("FLSA"). Plaintiffs seek to recover overtime pay, liquidated damages, declaratory relief and attorneys’

fees.

In the third quarter of 2003, the court denied the plaintiff’s motion to allow the action to proceed as a nationwide collective action,

but determined that the action could proceed collectively as to a region that was not then defined. However, on January 12, 2004,

the court certified an opt-in class of plaintiffs consisting of all persons employed by the Company as store managers at any time

since March 14, 1999, who regularly worked more than 50 hours per week and either: (1) customarily supervised less than two

employees at one time; (2) lacked authority to hire or discharge employees without supervisor approval; or (3) sometimes worked

in non-managerial positions at stores other than the one he or she managed. The Company’s attempt to appeal this decision on a

discretionary basis to the 11th Circuit Court of Appeals has been denied.

This action is still in the discovery phase. The Company believes that its store managers are and have been properly classified as

exempt employees under the FLSA and that the action is not appropriate for collective action treatment. The Company intends to

vigorously defend the action. However, no assurances can be given that the Company will be successful in defending this action

on the merits or otherwise, and, if not, the resolution could have a material adverse effect on the Company’s financial statements

as a whole.

The Company is involved in other legal actions and claims arising in the ordinary course of business. The Company currently

believes that such litigation and claims, both individually and in the aggregate, will be resolved without a material effect on the

Company’s financial statements as a whole. However, litigation involves an element of uncertainty. Future developments could

cause these actions or claims to have a material adverse effect on the Company’s financial statements as a whole.

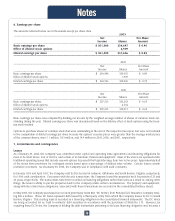

8. Employee benefits

Effective January 1, 1998, the Company established a 401(k) savings and retirement plan. All employees who had completed 12

months of service, worked 1,000 hours per year, and were at least 21 years of age were eligible to participate in the plan. Employee

contributions, up to 6% of annual compensation, were matched by the Company at the rate of $0.50 on the dollar. The Company

also contributed a discretionary amount annually to the plan equal to 2% of each employee’s annual compensation. Effective

January 1, 2003, the plan was amended to allow all eligible employees to participate in the plan and to contribute up to 25% of annu-

al compensation from their date of hire; the Company match of employee contributions was changed to a rate of $1.00 for each

$1.00 contributed up to 5% of annual compensation (upon completion of 12 months and a minimum of 1,000 hours of service); and

the Company’s discretionary annual contribution to the plan of 2% of annual compensation was eliminated. Expense for the plan

was approximately $2.7 million in 2003, $5.9 million in 2002, and $7.4 million in 2001.

Notes

38