Dollar General 2003 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2003 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

an average interest rate of 6.3%. The increase in the Company’s average interest rate over the periods above is due primarily to the

reduction of variable rate debt. All of the Company’s outstanding indebtedness at January 30, 2004 is fixed rate debt.

Provision for Taxes on Income. The effective income tax rates for 2003, 2002 and 2001 were 37.3%, 36.1% and 36.7%, respective-

ly. The higher tax rate in 2003 is due primarily to the $10.0 million penalty accrual discussed above which will not be deductible

for income tax purposes. The lower effective tax rate in 2002 was primarily due to recording higher work opportunity tax credits

than in 2001 and the favorable resolution of certain state tax related items during 2002.

Liquidity and Capital Resources

Current Financial Condition / Recent Developments. During the past three years, the Company has generated over $1.2 billion in

cash flows from operating activities. During that period, the Company has expanded the number of stores it operates by 34%, (1,700

stores) and has incurred $409 million in capital expenditures, primarily to support this growth. Also during this three-year period,

the Company has reduced its long-term debt by $448 million.

The Company is involved in a number of legal actions and claims in the ordinary course of business, some of which could poten-

tially result in a material cash settlement. In addition, the Company is involved in a collective action pending in the United States

District Court for the Northern District of Alabama. If the Company is not successful in defending that action, it could result in a

material cash settlement. The Company also has certain income tax-related contingencies as more fully described below under

"Critical Accounting Policies and Estimates". Estimates of these contingent liabilities are included in the Company’s Consolidated

Financial Statements. However, future negative developments could have a material adverse effect on the Company’s liquidity. See

Notes 4 and 7 to the Consolidated Financial Statements.

The Company’s inventory balance represented over 43% of its total assets as of January 30, 2004. The Company’s proficiency in

managing its inventory balances can have a significant impact on the Company’s cash flows from operations during a given fiscal

year. For example, in 2001, changes in inventory balances represented a $118.8 million use of cash while in 2002, changes in inven-

tory balances represented an $8.0 million source of cash. Inventory turns, which increased from 3.5 times in 2001 to 3.8 and 4.0

times in 2002 and 2003, respectively, contributed to the improved cash flows.

A substantial portion of the jobs credit programs utilized by the Company to reduce its federal income tax liability expired as of

December 31, 2003 for new employees hired after that date. Currently, there is legislation pending in Congress that will reinstate

these credits on a retroactive basis. While the enactment of this legislation is expected, its passage is not certain. The Company

anticipates that its 2004 income tax liability will increase by approximately $2.6 million if these credit programs are not re-enacted

on a retroactive basis.

On March 13, 2003, the Board of Directors authorized the Company to repurchase up to 12 million shares of its outstanding com-

mon stock. Purchases may be made in the open market or in privately negotiated transactions from time to time subject to mar-

ket conditions. The objective of the share repurchase program is to enhance shareholder value by purchasing shares at a price that

produces a return on investment that is greater than the Company's cost of capital. Additionally, share repurchases will be under-

taken only if such purchases result in an accretive impact on the Company's fully diluted earnings per share calculation. This

authorization expires March 13, 2005. During 2003, the Company purchased approximately 1.5 million shares at a total cost of $29.7

million.

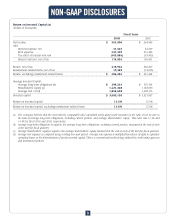

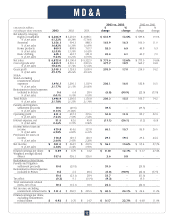

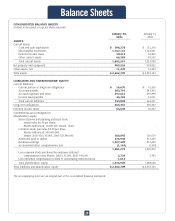

The following table summarizes the Company’s significant contractual obligations as of January 30, 2004, which excludes the effect

of imputed interest (in thousands):

Payments Due by Period

Contractual obligations Total < 1 yr 1-3 yrs 3-5 yrs > 5 yrs

––––––––––––––––– –––––––––––––––––– –––––––––––––––––– –––––––––––––––––– ––––––––––––––––––

Long-term debt (a) $ 200,000 $ - $ - $ - $ 200,000

Capital lease obligations 38,228 15,902 16,703 4,923 700

Financing obligations 93,186 1,739 4,003 5,181 82,263

Inventory purchase obligations 111,700 111,700 - - -

Operating leases 948,984 221,838 314,127 166,233 246,786

––––––––––––––––– –––––––––––––––––– –––––––––––––––––– –––––––––––––––––– ––––––––––––––––––

Total contractual cash obligations $ 1,392,098 $ 351,179 $ 334,833 $ 176,337 $ 529,749

–––––––––––––––––--------------------------------------------------------------------------------------------------------------------

–––––––––––––––––--------------------------------------------------------------------------------------------------------------------

(a) As discussed below, represents unsecured notes whose holders have a redemption option in 2005, which could result in the acceleration of all or

a portion of these payments due.

M D & A

15