Dollar General 2003 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2003 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

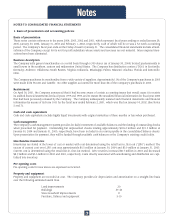

to further refine its RIM calculation, the Company intends to expand the number of departments it utilizes for its gross margin cal-

culation. The impact of this intended change on the Company’s future consolidated financial statements cannot currently be esti-

mated. Other factors that reduce potential distortion include the use of historical experience in estimating the shrink provision (see

discussion below) and the utilization of an independent statistician to assist in the LIFO sampling process and index formulation.

Also, on an ongoing basis, the Company reviews and evaluates the salability of its inventory and records adjustments, if necessary,

to reflect its inventory at the lower of cost or market.

The Company calculates its shrink provision based on actual physical inventory results during the fiscal year and an accrual for esti-

mated shrink occurring subsequent to a physical inventory through the end of the fiscal reporting period. This accrual is calculat-

ed as a percentage of sales and is determined by dividing the sum of all book-to-physical inventory adjustments recorded during

the previous twelve months by the related sales for the same period. During 2003, in an effort to improve this estimate, the

Company applied store-specific shrink rates to store-specific sales generated subsequent to a given store’s physical inventory. In

2002 and 2001, the Company applied a weighted-average shrink rate to all Company sales generated subsequent to physical inven-

tories. To the extent that subsequent physical inventories yield different results than this estimated accrual, the Company’s shrink

rate for a given reporting period will include the impact of adjusting the estimated results to the actual results.

During 2003, the Company implemented an item-level perpetual inventory system for financial reporting purposes. This new sys-

tem provides better information regarding the type of inventory that the Company owns and improves the Company’s ability to esti-

mate its shrink provision. The utilization of this improved information in the Company’s RIM calculation resulted in a non-recur-

ring inventory adjustment of approximately $7.8 million, which favorably impacted gross margin in the third quarter of 2003.

Property and Equipment. Property and equipment are recorded at cost. The Company groups its assets into relatively homoge-

neous classes and provides for depreciation on a straight-line basis over the estimated average useful life of each asset class. The

valuation and classification of these assets and the assignment of useful depreciable lives involves significant judgments and the

use of estimates. Property and equipment are reviewed for impairment periodically and whenever events or changes in circum-

stances indicate that the carrying value of an asset may not be recoverable.

Self-Insurance Liability. The Company retains a significant portion of the risk for its workers’ compensation, employee health

insurance, general liability, property loss and automobile coverage. These costs are significant primarily due to the large employ-

ee base and number of stores. Provisions are made to this insurance liability on an undiscounted basis based on actual claim data

and estimates of incurred but not reported claims developed by independent actuaries utilizing historical claim trends. If future

claim trends deviate from recent historical patterns, the Company may be required to record additional expenses or expense reduc-

tions which could be material to the Company’s future financial results.

Contingent Liabilities – Income Taxes. The Company is subject to routine income tax audits which occur periodically in the normal

course of business. The Company estimates its contingent income tax liabilities based on its assessment of potential income tax-

related exposures and the relative probabilities of those exposures translating into actual future liabilities. The probabilities are

estimated based on both historical audit experiences with various state and federal taxing authorities and the Company’s interpre-

tation of current income tax-related trends. If the Company’s income tax contingent liability estimates prove to be inaccurate, the

resulting adjustments could be material to the Company’s future financial results.

Effects of Inflation and Changing Prices

The Company believes that inflation and/or deflation had a minimal impact on its overall operations during 2003, 2002 and 2001.

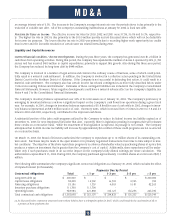

Accounting Pronouncements

In April 2002, the Financial Accounting Standards Board ("FASB") issued Statement of Financial Accounting Standards ("SFAS") No.

145, "Rescission of FASB Statements No. 4, 44, and 64, Amendment of FASB Statement No. 13, and Technical Corrections." SFAS

No. 145 rescinds both SFAS No. 4, "Reporting Gains and Losses from Extinguishment of Debt," and the amendment to SFAS No. 4,

SFAS No. 64, "Extinguishments of Debt Made to Satisfy Sinking-Fund Requirements." Generally, under SFAS No. 145, gains and

losses from debt extinguishments will no longer be classified as extraordinary items. The Company adopted the provisions of SFAS

No. 145 on February 1, 2003, and the adoption of SFAS No. 145 did not have a material effect on the Company’s financial state-

ments as a whole.

In July 2002, the FASB issued SFAS No. 146, "Accounting for Costs Associated with Exit or Disposal Activities." SFAS No. 146 nul-

lifies Emerging Issues Task Force ("EITF") Issue No. 94-3, "Liability Recognition for Certain Employee Termination Benefits and

M D & A

18