Dollar General 2003 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2003 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

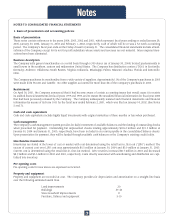

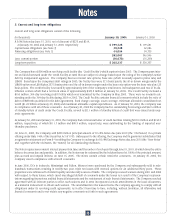

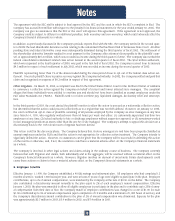

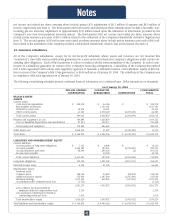

5. Current and long-term obligations

Current and long-term obligations consist of the following:

(In thousands) January 30, 2004 January 31, 2003

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

8 5/8% Notes due June 15, 2010, net of discount of $275 and $319,

at January 30, 2004 and January 31, 2003, respectively $ 199,725 $ 199,681

Capital lease obligations (see Note 7) 38,228 52,086

Financing obligations (see Note 7) 44,054 94,779

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

282,007 346,546

Less: current portion (16,670) (16,209)

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Long-term portion $ 265,337 $ 330,337

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

The Company has a $300 million revolving credit facility (the "Credit Facility") which expires in June 2005. The Company pays inter-

est on funds borrowed under the Credit Facility at rates that are subject to change based upon the rating of the Company’s senior

debt by independent agencies. The Company has two interest rate options, base rate (which is usually equal to prime rate) and

LIBOR. Based upon the Company’s debt ratings in 2003, the facility fees were 37.5 basis points, the all-in drawn margin under the

LIBOR option was LIBOR plus 237.5 basis points and the all-in drawn margin under the base rate option was the base rate plus 125

basis points. The Credit Facility is secured by approximately 400 of the Company’s retail stores, its headquarters and two of its dis-

tribution centers which had a net book value of approximately $329.8 million at January 30, 2004. The Credit Facility included a

$150 million, 364-day revolving credit facility which was terminated by the Company in May 2003. There were no amounts out-

standing under the 364-day facility during 2003 or 2002. The Credit Facility contains financial covenants which include the ratio of

debt to EBITDAR (as defined in the debt agreement), fixed charge coverage, asset coverage, minimum allowable consolidated net

worth ($1.23 billion at January 30, 2004) and maximum allowable capital expenditures. As of January 30, 2004, the Company was

in compliance with all of these covenants. As of January 30, 2004 the Company had no outstanding borrowings and $22.5 million

of standby letters of credit under the Credit Facility, as well as $2.1 million of standby letters of credit that were issued under sep-

arate agreements.

At January 30, 2004 and January 31, 2003, the Company had commercial letter of credit facilities totaling $218.0 million and $150.0

million, respectively, of which $111.7 million and $85.3 million, respectively, were outstanding for the funding of imported mer-

chandise purchases.

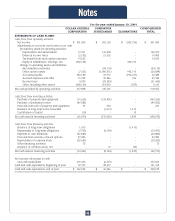

On June 21, 2000, the Company sold $200 million principal amount of 8 5/8% Notes due June 2010 (the "Old Notes") in a private

offering under Rule 144A of the Securities Act of 1933. Subsequent to the offering, the Company and its guarantor subsidiaries filed

a registration statement on Form S-4 enabling the Company to exchange its 8 5/8% Exchange Notes due June 2010 (the "New Notes"

and, together with the Old Notes, the "Notes") for all outstanding Old Notes.

The Notes require semi-annual interest payments in June and December of each year through June 15, 2010, at which time the entire

balance becomes due and payable. In addition, the Notes may be redeemed by the holders thereof at 100% of the principal amount,

plus accrued and unpaid interest, on June 15, 2005. The Notes contain certain restrictive covenants. At January 30, 2004, the

Company was in compliance with all such covenants.

In June 2000, DCs in Indianola, Mississippi and Fulton, Missouri were purchased by the Company and subsequently sold in sale-

leaseback transactions resulting in twenty-two year, triple net leases with renewal options for an additional thirty years. These

properties were refinanced to bolster liquidity and diversify sources of funds. The Company received waivers during 2001 and 2002

with respect to these leases, which cured any alleged default of covenants under the leases as a result of the Company’s represen-

tations regarding its previous audited financial statements and the restatement of such financial statements. The Company reached

agreement with all relevant parties to effect such waivers and in 2002 incorporated certain amendments in the lease documents,

as a material inducement to obtain such waivers. The amendments to the leases involve the Company agreeing to comply with all

obligations under its revolving credit agreements, as in effect from time to time, including, without limitation, all affirmative and

financial covenants and to not violate any negative covenants set forth in such agreements.

Notes

35