Dollar General 2003 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2003 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

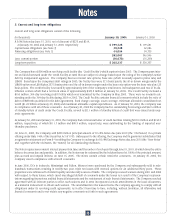

legal right of offset exists, has reflected the acquired DC Notes as a reduction of its outstanding financing obligations in its consol-

idated financial statements in accordance with the provisions of FASB Interpretation No. 39, "Offsetting of Amounts Related to

Certain Contracts – An Interpretation of APB Opinion No. 10 and FASB Statement No. 105." There was no gain or loss recognized

as a result of this transaction.

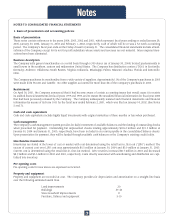

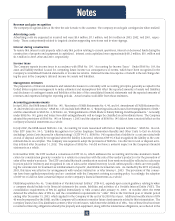

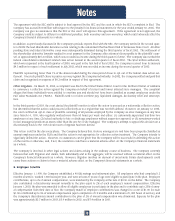

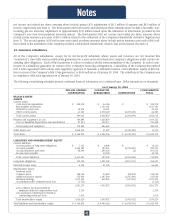

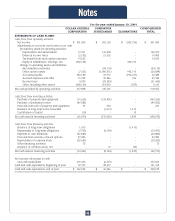

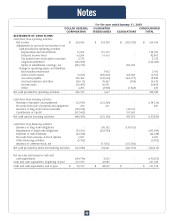

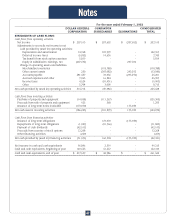

Future minimum payments as of January 30, 2004, for capital leases, financing obligations and operating leases are as follows:

Capital Financing Operating

(In thousands) leases obligations leases

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

2004 $ 18,672 $ 9,283 $ 221,838

2005 12,837 9,283 179,571

2006 6,358 9,283 134,557

2007 3,372 9,564 98,549

2008 2,142 9,510 67,683

Thereafter 714 146,822 246,786

_________ __________ ___________

Total minimum payments 44,095 193,745 $ 948,984

___________

___________

Less: imputed interest (5,867) (100,559)

_________ __________

Present value of net minimum lease payments 38,228 93,186

Less: purchased promissory notes - (49,132)

_________ __________

38,228 44,054

Less: current portion, net (15,902) (768)

_________ __________

Long-term portion $ 22,326 $ 43,286

_________ __________

_________ __________

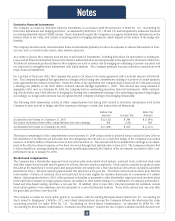

Capital leases were discounted at an effective interest rate of approximately 8.7% at January 30, 2004. The gross amount of prop-

erty and equipment recorded under capital leases and financing obligations at January 30, 2004 and January 31, 2003, was $184.4

million and $184.3 million, respectively. Accumulated depreciation on property and equipment under capital leases and financing

obligations at January 30, 2004 and January 31, 2003, was $81.8 million and $61.9 million, respectively.

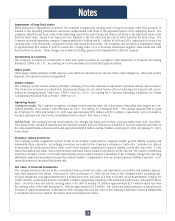

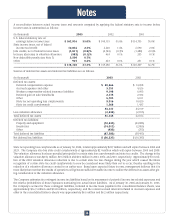

Rent expense under all operating leases was as follows:

(In thousands) 2003 2002 2001

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Minimum rentals $ 233,007 $ 200,724 $ 173,060

Contingent rentals 14,302 15,621 12,774

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

$ 247,309 $ 216,345 $ 185,834

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

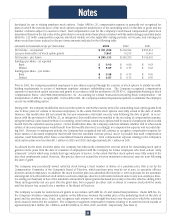

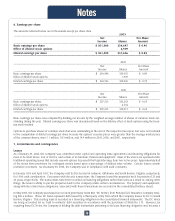

Legal proceedings

Restatement-Related Proceedings. As previously disclosed in the Company’s periodic reports filed with the Securities and

Exchange Commission (the "SEC"), the Company restated its audited financial statements for fiscal years 1999 and 1998, and cer-

tain unaudited financial information for fiscal year 2000, by means of its Form 10-K for the fiscal year ended February 2, 2001, which

was filed on January 14, 2002.

The SEC has been conducting an investigation into the circumstances giving rise to the restatement and, on January 8, 2004, the

Company received notice that the SEC staff was considering recommending that the SEC bring a civil injunctive action against the

Company for alleged violations of the federal securities laws in connection with circumstances relating to the restatement. The

Company subsequently has reached an agreement in principle with the SEC staff to settle the matter. Under the terms of the agree-

ment in principle, the Company will consent, without admitting or denying the allegations in a complaint to be filed by the SEC, to

the entry of a permanent civil injunction against future violations of the antifraud, books and records, reporting and internal con-

trol provisions of the federal securities laws and related SEC rules and will pay a $10 million non-deductible civil penalty. The

Company is not entitled to seek reimbursement from its insurers with regard to this settlement.

Notes

37